مستشارو الضرائب في دبي — استشارات ضريبة الشركات وضريبة القيمة المضافة

تقديمات متوافقة مع الهيئة الاتحادية للضرائب، التحكم في مخاطر الغرامات، رسوم شفافة.

تسجيل في هيئة تنظيم الاتصالات والحكومة الرقمية، حساب، تقديم، دفاع — أوراق عمل جاهزة للتدقيق، ردود في غضون يوم واحد.

يمكن لمستشار ضريبي مؤهل في دبي مساعدتك على التنقل في المشهد القانوني والضريبي المعقد لضمان عمل عملك بسلاسة وامتثال.

النطاق التعاقدي، اتفاقية عدم إفصاح، اتفاقية مستوى الخدمة للردود. نقدم الإقرارات في الوقت المحدد عند اكتمال البيانات؛ نصحح أخطائنا على حسابنا. اطلب اتفاقية مستوى الخدمة الخاصة بنا.

يتم تقديم إقرارات ضريبة الشركات/ضريبة القيمة المضافة خلال 5-10 أيام من اكتمال البيانات. يتم التقديم عبر نظام إماراتاكس، وبعد الموافقة يتم إرفاق الإيصالات وأوراق العمل والتسويات.

مكالمة سريعة، تدقيق مصغر، قائمة تدقيق. رسوم ثابتة للنطاق القياسي؛ بالساعة للمهام المخصصة/التدقيق/إشعارات الهيئة الاتحادية للضرائب. احصل على قائمة التدقيق؛ احجز تقييمًا أوليًا لمدة 15 دقيقة.

الرد الأول خلال يوم عمل واحد. قنوات مشفرة، اتفاقية عدم إفصال افتراضية، وصول قائم على الأدوار. أرسل المستندات بأمان؛ وقّع اتفاقية عدم إفصاح الآن.

في دبي

معالجة البيانات تحت اتفاقية عدم إفصاح/عقد. نقل مشفر، وصول بأقل صلاحيات، سجلات لمدة 12 شهرًا. مجلد آمن عند الطلب. اطلب شروط اتفاقية عدم إفصال.

هذا ما نقدمه من خدمات مخصصة، ننسق مباشرة مع السلطات المختصة للإشراف على كل مرحلة مع السرية والكفاءة والدقة.

املأ النموذج للاتصال باختصاصينا واكتشف كيف تقدم آي تي يه لاستشارات الأعمال حلولاً موثوقة وسلسة لجميع احتياجاتك من الوثائق العابرة للحدود والاستشارات الضريبية بكل ثقة.

خدماتنا الاستشارية الضريبية في الإمارات

التسجيل، حساب الأساس، إعداد/تقديم الإقرار، إرشادات المنطقة الحرة/البر الرئيسي، التذكيرات، الرد على استفسارات الهيئة الاتحادية للضرائب. — أوراق عمل جاهزة للتدقيق. انظر باقة ضريبة الشركات.

تسجيل/شطب ضريبة القيمة المضافة، الإقرارات الربعية، استرداد الضريبة، الفحص الصحي، الإفصاحات الطوعية، المشورة المستمرة. اطلب تسجيل ضريبة القيمة المضافة.

التسجيل في ضريبة الاستهلاك للمنتجين/المستوردين، حساب/تقديم الإقرارات، تسوية المخزون، ربط البضائع بقوائم/علامات السلع الخاضعة للضريبة وفق قواعد اتفاقيات التجارة الحرة. التحقق من أهلية السلع للإعفاء.

تنسيق اتفاقية الازدواج الضريبي/ مشروع مكافحة التهرب الضريبي، سياسة/توثيق التسعير التحويلي، التسعير بين الشركات الشقيقة، إعداد الملف الرئيسي/الملف المحلي، تقييم المخاطر. طلب تحديد نطاق التسعير التحويلي أو فهرس الملف المحلي.

تشخيص سريع، التحضير ما قبل التدقيق، تصحيح الأخطاء، إفصاحات طوعية، خطة عمل تصحيحية مع الملاك/المواعيد النهائية. احجز فحصًا ما قبل التدقيق؛ احصل على نموذج خطة

غير متأكد؟ اترك طلبًا — سنقوم بتدقيق مصغر ونقترح النطاق الصحيح.

الباقات والتسعير

للمشاريع الصغيرة والمتوسطة.

التسجيل + تقديم إقرار واحد لضريبة الشركات/ضريبة القيمة المضافة. حجم أعمال ≤ X درهم إماراتي عدد المعاملات ≤ Y معاملة/ربع سنة الدعم عبر البريد الإلكتروني مكالمة استشارية واحدة (سؤال وجواب) مشمولة التحقق من الأهلية؛ راجع الخدمات المشمولة.

لأغراض التوسع.

تقديم الإقرارات الضريبية الدورية لضريبة القيمة المضافة، والاستشارات الضريبية، والتسويات الفصلية، وخدمة حجز ساعات العمل للاستفسارات/إشعارات الهيئة الاتحادية للضرائب. مقارنة مع العروض المبدئية؛ واستفسر عن أسعار حجز ساعات العمل.

للمجموعات/الشركات القابضة.

مجموعات ضريبية، توثيق تحديد الأسعار التحويلية، الجاهزية لتدقيق الهيئة الاتحادية للضرائب، فريق مخصص، تقويم حوكمة عبر الكيانات. ارسم خريطة مجموعتك؛ اطلب التقويم.

ما العوامل المؤثرة على التكلفة؟

حجم الأعمال، حجم المعاملات، حصة الصفرية/المعفاة، حالة المنطقة الحرة، جودة البيانات، تعقيد التدقيق/تحديد الأسعار التحويلية تحدد النطاق والسعر. احصل على عرض مخصص — شارك المقاييس.

كيف تختار مستشار الضرائب المناسب في دبي

تحقق من حالة تسجيل رقم ضريبة القيمة المضافة/ الهيئة الاتحادية للضرائب؛ تأكد من أن الاعتماد يناسب نطاقك. اطلب الإثبات ومالك الحالة المحدد. قابل مستشارينا في دبي. تحقق من تسجيل رقم ضريبة القيمة المضافة.

اطلب 1-2 حالة مجهولة الهوية في قطاعك (التجزئة، التكنولوجيا، الخدمات اللوجستية). الأنماط تفوق الشعارات. انظر حالات القطاع؛ اطلب دليل القطاع.

وضح التسعير: الباقة بالساعة، اتفاقية مستوى الخدمة، المدرجات/الإضافات. اسأل عن كيفية تقدير واعتماد طلبات التغيير. راجع بيان العمل؛ افهم الإضافات.

اتفاقية عدم إفصاح، تخزين آمن، وصول قائم على الأدوار، نسخ احتياطية، مراجعة منشئ/مدقق. ضوابط مناسبة للتقديمات المنظمة. انظر سياسة البيانات؛ قابل المدقق الخاص بك.

متاح بالإنجليزية/الروسية/العربية. تحديثات الحالة عبر البريد الإلكتروني أو واتس آب على فترات متفق عليها. حدد الفترة؛ اختر القناة في الاجتماع الافتتاحي.

تقاويم الضرائب، قوالب جاهزة للهيئة الاتحادية للضرائب، إجراءات التسوية تمنع تفويت المواعيد النهائية. انظر التقويم؛ اطلب حزم القوالب.

محاسب داخلي مقابل مستشار ضريبي خارجي

| محاسب | مستشار ضريبي خارجي | |

| خبرة الهيئة الاتحادية للضرائب | محدود بتجربة 1-2 أشخاص — خطر النقاط العمياء على تغييرات القواعد. | مجمع من الاختصاصيين ذوي خبرة في حالات الهيئة الاتحادية للضرائب النادرة. قابل الفريق؛ اطلب أمثلة. |

| المرونة والمقياس | من الصعب التوسع بسرعة أثناء عمليات التدقيق أو فترات الذروة. اسأل عن دعم الذروة. | زيادة أو تقليل الساعات مع تغير عبء العمل. استكشف خيارات بنك الوقت. |

| تكلفة الملكية | الرواتب الثابتة، المزايا، النفقات العامة للإجازات تتراكم. قارن التكلفة الإجمالية. | الدفع لكل نتيجة أو بالساعة تحت اتفاقية مستوى الخدمة مع حدود النطاق. احصل على كشف الأسعار. |

| المخاطر والمسؤوليات | المساءلة الشخصية؛ التصعيد الداخلي أصعب. أضف دور المراجع. | مسؤولية تعاقدية مع تأمين تعويضات مهنية. راجع الشروط. |

النموذج المختلط هو الأفضل: فريقك يحتفظ بالسجلات الأولية؛ مستشارونا يتعاملون مع ضريبة الشركات/ضريبة القيمة المضافة وفحوصات ما قبل الهيئة الاتحادية للضرائب. العملاء الذين يستخدمون النموذج المختلط يبلغون عن أخطاء أقل. صمم نموذجًا مختلطًا؛ حدد الأدوار.

هل الخدمة مناسبة لعملك؟

أنت تحتاجنا إذا تجاوزت عتبة ضريبة القيمة المضافة، أطلقت كيانًا في المنطقة الحرة، واجهت ضريبة الشركات على مستوى المجموعة، تاجرت بسلع خاضعة للانتقائية، تتوقع مراجعة من الهيئة الاتحادية للضرائب، أو تدير دخلًا مختلطًا من المنطقة الحرة المؤهلة. المحفزات: حجم أعمال ≥ 375 ألف درهم إماراتي، إمدادات عابرة للحدود، إشعار تدقيق، فجوات في توثيق تحديد الأسعار التحويلية. احصل على قائمة المحفزات؛ احجز تقييمًا.

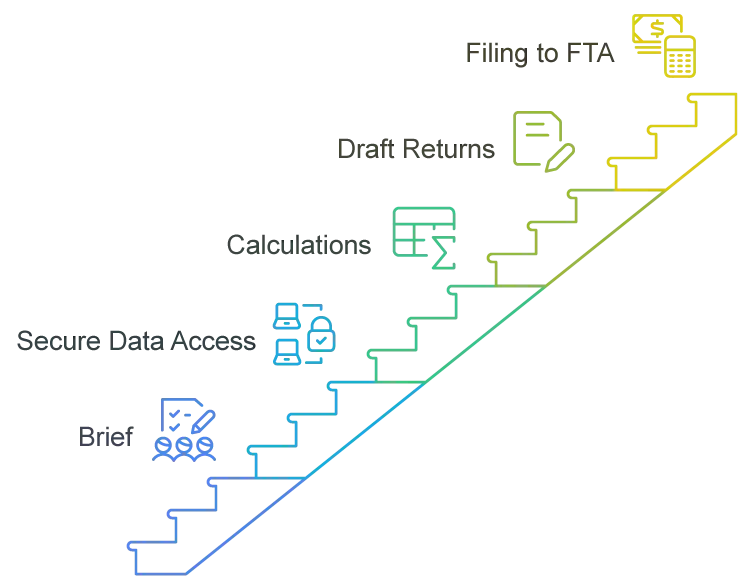

نموذج العمل، المواعيد النهائية والمستندات

1) إحاطة قبل يوم او يومين.

2) الوصول الآمن للبيانات.

3) الحسابات.

4) مسودات الإقرارات.

5) التقديم إلى الهيئة الاتحادية للضرائب.

ضريبة القيمة المضافة ربع سنوية؛ ضريبة الشركات سنوية. المستندات عبر قناة مشفرة؛ الموقع المفوض منك يوافق. نصحح النتائج مع الإيصالات/أوراق العمل. الجدول الزمني: التسجيل 5-10 أيام، أول تقديم 5-10 أيام من البيانات الكاملة. انظر الجدول الزمني.

نظرة سريعة على ضرائب مجلس التعاون الخليجي: مقارنة سريعة

| نوع الضريبة | الإمارات العربية المتحدة | المملكة العربية السعودية | البحرين | سلطنة عمان | قطر | الكويت |

|---|---|---|---|---|---|---|

| الضريبة على الشركات | مع عتبات/إعفاءات — تحقق. 9% | معدل عام (خط أساس السعودية). 20% | عدا النفط والغاز (البحرين). 0% | قياسي (عُمان/الكويت). 15% | قياسي (خط أساس قطر). 10% | قياسي (الكويت) — تحقق من التحديثات. 15% |

| ضريبة القيمة المضافة | 5% - 0% معفاة (قانون ضريبة القيمة المضافة للإمارات). | 15% قياسي | 10% قياسي | 5% قياسي | 0% حتى اليوم | 5% قياسي – أكد البلد. |

| ضريبة الاستقطاع | 0% في معظم الحالات (الإمارات العربية المتحدة). راجع المعاهدات. | 5-20% حسب النوع (المملكة العربية السعودية). تصنيف المدفوعات. | 0% قياسي | 10% قياسي | 5-7% بحسب النوع | 5% قياسي |

| ضريبة الإنتاج | 50-100% حسب السلع | نطاق. 50-100% | نطاق. 50-100% | 100% على بعض السلع. | نطاق. 50-100% | 100% على بعض السلع. |

تحقق دائمًا من المعدلات الحالية، تفضيلات المعاهدات، استثناءات القطاع قبل القرارات — القواعد تتغير، وتطبق أنظمة خاصة. اطلب ورقة المعدلات الحالية؛ اطلب فحص معاهدة.

القطاعات التي نخدمها

التكنولوجيا / البرمجيات كخدمة

الاشتراكات، الخدمات الإلكترونية العابرة للحدود، قواعد مكان التوريد. راجع قواعد البرمجيات كخدمة.

التجزئة / التجارة الإلكترونية

الأسواق، معالجة المرتجعات، ضوابط المخزون للحفاظ على صحة ضريبة القيمة المضافة. راجع القواعد.

الخدمات اللوجستية / الاستيراد

التفاعل مع الجمارك، الانتقائية، إدارة المخزون المعفى عبر الحدود. راجع الضوابط.

العقارات

الإيجار مقابل البيع، سيناريوهات 0%/معفاة، توقيت التوريد لصفقات العقارات. راجع القواعد.

التصنيع

المدخلات، التكاليف، الإعفاءات، ضوابط غير مباشرة عبر دورة الإنتاج. راجع الضوابط.

التكنولوجيا المالية / المدفوعات

التراخيص، الرسوم، اختبارات الإعفاء الضريبي على الخدمات المالية. راجع معايير الإعفاء.

كيف نعمل

- 1

التشخيص. جمع المدخلات، الوصول إلى الدفاتر، رسم خريطة النطاق/المخاطر، تخطيط المخرجات مع التواريخ/الملاك. ابدأ التشخيص.

- 2

التنفيذ. حساب الأساس، مسودات الإقرارات/الإفصاحات، الاتفاق على المواقف، التقديم إلى الهيئة الاتحادية للضرائب عبر نظام إماراتاكس، أرشفة الوثائق الجاهزة للتدقيق. انظر حزمة التقديم.

- 3

الدعم. تتبع المواعيد النهائية، الرد على استفسارات الهيئة الاتحادية للضرائب، إجراء التسويات، تحسين العملية بانتظام تحت اتفاقية مستوى الخدمة. انظر اتفاقية مستوى الخدمة.

الأسئلة الشائعة: أسئلة خدمات الاستشارات الضريبية، مجابة

تنطبق مزايا المنطقة الحرة المؤهلة على الدخل المؤهل. العمليات المختلطة تخاطر بفقدان الإعفاء. قد يظل التسجيل/التقديم السنوي مطلوبًا.

تستغرق عملية التسجيل في ضريبة القيمة المضافة عادةً من 5 إلى 10 أيام عمل بعد إكمال المستندات. أول تقديم هو ربع سنوي، اعتمادًا على العتبة.

باقة أو بالساعة — بناءً على حجم الأعمال، المعاملات، حصة الصفرية/المعفاة، المنطقة الحرة، التعقيد. انظر معايير التسعير.

تدقيق سريع لضريبة القيمة المضافة لتصحيح الأخطاء قبل مراجعة الهيئة الاتحادية للضرائب، تقليل مخاطر الغرامات، تمكين الإفصاحات الطوعية. اطلب فحصًا صحيًا.

نعم — اتفاقية عدم إفصاح/عقد، تشفير، وصول محدود، سجلات نشاط مع الاحتفاظ. اطلب مقتطفات من السياسة.

نعم — 60–90 دقيقة مع توصيات كتابية بعد ذلك، أسئلة وأجوبة متابعة عبر البريد الإلكتروني. نعم — 60–90 دقيقة مع توصيات كتابية بعد ذلك، أسئلة وأجوبة متابعة عبر البريد الإلكتروني.