VAT Services

Your consultant

RAVAD ZAKHR EDIN

Senior Business Consultant

On 1 January 2018, the UAE introduced Value Added Tax. VAT is a general consumption tax that applies to all transactions with goods and services, unless a transaction is exempted or taxed at a zero rate. The standard VAT rate in the UAE is 5%.

The general idea behind the VAT is that consumers of goods and services have to bear an additional cost, which is collected from them by sellers at the time of purchase, and then handed by the sellers over to the government when they file their VAT returns. For a business, VAT means that:

- It must charge the amount of VAT on all taxable goods and services it offers;

- It has the right to reclaim any VAT that is has paid, in its own turn, for the goods and services purchased from other businesses;

- It must keep track of all transactions subject to VAT and regularly update the government on them to prove its VAT due was calculated correctly.

WHO MUST BE REGISTERED FOR VAT IN THE UAE

There is no obligation for a UAE company to be registered for VAT unless its sales turnover within the country exceeds the registration threshold, which is set at AED 375.000 (~ USD 100.000). This makes the UAE VAT requirements inapplicable to all companies with a lower sales turnover, as well as to offshore companies which do not have the right to operate within the UAE.

More particularly, your company in the UAE must apply for VAT registration in any of the following cases:

- you have a valid reason to believe that the taxable turnover in the next 30 days will exceed the registration threshold. This may apply, for example, when your company has made a deal under which payments large enough are expected;

- at the end of the month, the taxable turnover for the previous 12 months actually exceeded the registration threshold;

- your UAE company receives services to be included in the return using the reverse charge method, and the amount exceeds the registration threshold.

There is also a case when you do not have to, but may have your company registered for VAT, should you wish to do so:

- when the total volume of all your taxable transactions exceeds the amount of AED 187.500 (~ USD 50.000).

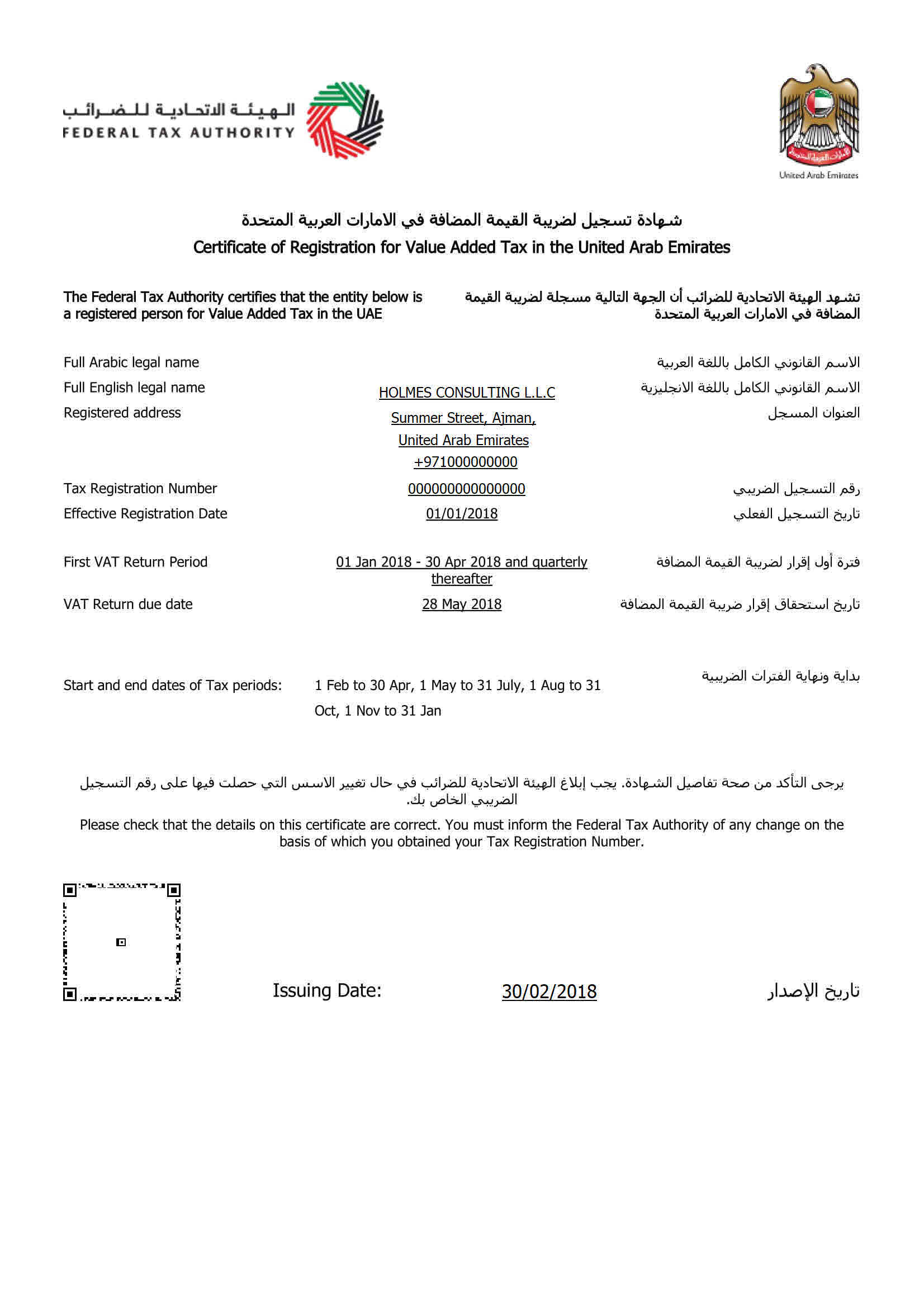

HOW TO GET REGISTERED FOR VAT IN THE UAE

An application to be registered with the UAE Federal Tax Authority and be given a VAT Tax Reference Number (TRN) can be submitted online, provided you give the details of your company, its transactions, and bank account. Once the application is received by the FTA, it normally takes 20 business days for it to be officially approved, and for registration to take place.

A detailed guide to VAT registration may be found here: https://u.ae/en/information-and-services/finance-and-investment/taxation/valueaddedtaxvat

OBLIGATIONS OF A UAE VAT-REGISTERED BUSINESS

Once your company is registered for VAT and has obtained a TRN, it has two basic responsibilities before the UAE government:

- to file a quarterly VAT return with the FTA. It can be done electronically, via the website of the Authority. If the annual turnover exceeds AED 150.000.000 (~ USD 40.830.900), you must file your return monthly. Into your VAT return, you must enter such details as the volumes of standard rated supplies of your business in each of the seven Emirates, the value of deposits received and supplies made to your staff, the value of your exempt and zero-rated supplies, and other data required to ascertain your VAT due;

- to pay the amount of your VAT at the end of each tax period, which you can do via the e-Dirham payment gateway. Bank cards and transfers are accepted. The deadline for payment is 28 days.

A detailed guide to VAT returns and payments may be found here: https://tax.gov.ae/en/

HANDS-ON GUIDANCE IN UAE TAXES

VAT may appear a simple matter to deal with, but it would be only a fraction of your UAE company’s tax obligations. Taxation is an important aspect of running your business in the UAE, and it is crucial that all requirements of the Emirati tax law are taken into consideration as applied to your particular business structure. Whether you are planning to set up a new UAE company or already run one, we highly recommend that you obtain personalized advice as to your taxes in the UAE. Our experienced Tax Benefit International team has an in-depth understanding both of the local tax law and the needs of international business, and will help you to find your way around the tax and administrative requirements in the UAE.

OUR BASIC FEES

We offer a comprehensive package of VAT registration and VAT return services. Should your company no more qualify for VAT, we will also be able to assist you with deregistration of your company as a VAT payer.

- VAT registration – AED 2.975 (USD 810)

- Preparation and submission of your VAT returns – AED 660 (USD 180) / hour

- VAT deregistration – AED 2.975 (USD 810)

- Tax advice on VAT and other matters – AED 660 (USD 180)/ hour