Advisory, Accounting and Audit Services in Seychelles

Your consultant

Alina Marinich

Senior Business Consultant

With many years of experience in serving diverse organizations, our audit and accounting firm in Seychelles leverages the expertise of its team to efficiently handle any professional tasks, ensuring maximum benefit for our clients.

Since self-accounting takes a lot of time, and it is expensive to maintain a full-time accountant, we can offer you both one-time services and full professional accounting support for your company.

Qualified personnel who are ready to take care of the bookkeeping and tax accounting of your foreign company, as well as cooperation with independent auditors and with the tax authorities of other states at your disposal.

Accounting essentials for companies in Seychelles

The most popular form of business in Seychelles for foreign entrepreneurs is an International Business Company (IBC).

Every International Business Company registered in Seychelles must keep reliable accounting records that are sufficient to show and explain the company‘s transactions, enable the financial position of the company to be determined with reasonable accuracy at any time and allow for accounts of the company to be prepared.

Based on this definition, each company is required to keep the following documents:

- Copies of official bank statements for all bank accounts of the company;

- Contracts under which the activity was conducted;

- Invoices, acts, set-offs;

- Statutory documents of subsidiaries and associated enterprises;

- Contracts for the purchase of shares/interests in subsidiaries and associates;

- Copies of financial statements of subsidiaries and associates;

- Promissory notes and other financial obligations;

- Brokerage statements on securities;

- Copies of accounting books;

- Other documents reflecting the company’s activities.

Accounting records and financial summary may be kept at the company’s registered office in electronic form, but the company is obliged to notify the registered agent in writing of the physical address where the original accounting records are stored.

The Seychelles accounting records shall be preserved by the company for at least 7 years from the date of completion of the transactions or operations to which they each relate.

The financial year of the company corresponds to the calendar year, however can be changed by making the appropriate decision of the director.

Directors of Seychelles companies are personally responsible for keeping accounting records, as well as for the fact that they give a true and fair view of the company‘s financial position and explain its transactions. Failure to comply with the requirements for keeping accounting records established by law is a violation and may result in fines or prosecution.

Please contact our consultant regarding volume of accounting records keeping.

Types of Seychelles International Business Companies

To determine the volume of accounting information that shall be kept, the legislation provides for the following types of companies:

- Large companies

- Holding companies

“Large company” means a company whose annual turnover threshold is more than SCR 50.000.000 (~ USD 3.500.000).

“Holding company” means company with no trade or business operations of its own, but holding interests in other companies or assets.

In the case of a company which is a holding company and not a large company, the company shall, where its accounting records are kept outside Seychelles, lodge, not less than on a biannual basis, the accounting records at the company’s registered office in Seychelles, provided that any accounting records, whether outside Seychelles or not, shall be presented to the Seychelles authorities on request.

In the case of other type of company, it shall prepare an annual financial summary to be kept at its registered office in Seychelles within 6 months from the end of the company’s financial year and where its accounting records are kept outside Seychelles, lodge, not less than on a biannual basis, the accounting records at the company’s registered office in Seychelles, provided that any accounting records, whether outside Seychelles or not, shall be presented to the Seychelles authorities on request.

International Business Companies registered in Seychelles are not required to submit annual audited financial statements to the government authorities. However, you may need to prepare audited financial statements in various cases:

- for the purposes of compliance with the CFC legislation;

- for opening a bank account or for updating company data in your bank;

- for business estimation (for example, for sales purposes);

- for internal purposes of management and business owners.

Seychelles companies operating in the territory of Seychelles are required to prepare and submit financial statements with an independent auditor’s opinion to government authorities. Failure to submit financial statements entails the imposition of a penalty on the company.

You are advised to refer to our experts so that they will guide you on individual reporting requirements for your company.

Critical filing dates

By December 31 of each year, each Seychelles Company is required to provide an Annual Return to the registered agent in the form of a statement that the company maintains accounting records in accordance with the law, and such accounting records can be accessed through its registered agent.

Corporate tax documentation

If the company does not operate in the territory of Seychelles, then it is not obliged to register with the local tax authority and receive a taxpayer number, just as it is not obliged to pay any income taxes.

Seychelles companies operating in the territory of Seychelles are required to prepare and submit an annual tax return to the tax authorities.

The tax year in Seychelles lasts from January 1 to December 31. The Business Tax rate is 25% on the first SCR 1.000.000 (~ USD 76.000) of taxable income and 33% on the remainder. An annual payment must be made (if a tax liability arose) together with the business tax return lodgement.

The deadline for submission and payment is until March 31 the following applicable year.

We are ready to assist you in the preparation of calculations of the estimated profit for the current year as well as the assessment of tax liabilities for Business Tax and other taxes.

Choose our services

Since regardless of the company type it is required to provide accounting records, we are ready to offer our Seychelles accounting services.

We provide a full range of services related to the preparation of accounting reports and audit.

Having our own presence in the Seychelles since 2017, we have acquired a unique practice of direct cooperation on the issues of our clients’ companies with government institutions and auditors.

Consultate with specialist before starting

Despite the fact that the Seychelles refers to offshore jurisdictions, amendments to the legislation of 2021 oblige Seychelles International Business Companies to keep accounting records and in some cases to prepare an annual financial summary. Thus before starting the registration of a Seychelles company, we recommend that you get advice from lawyers and auditors regarding the subsequent administration of the company.

Fees for our services

| SERVICES | PRICE[1] |

|

Yearly accounting services |

|

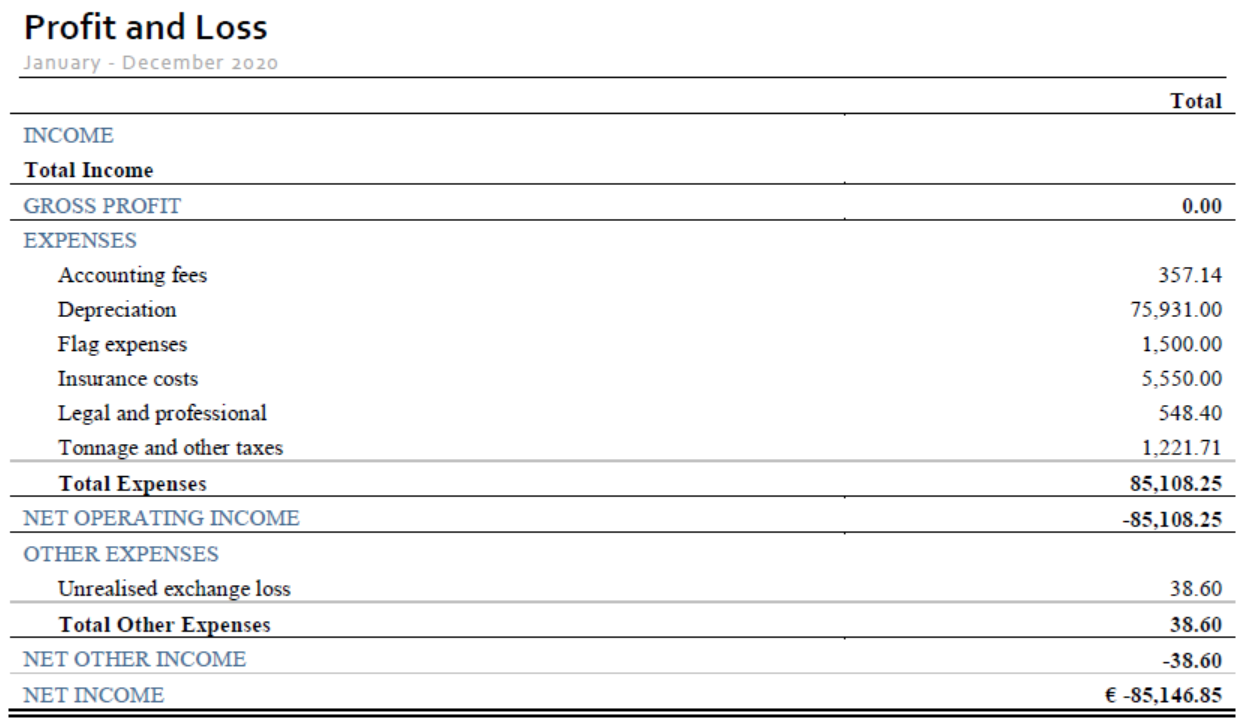

| Preparation of Dormant Accounts (for companies that did not operate in the reporting period) |

2.700 USD |

| Preparation and submission of reports for a company that has started operating | 100-350 USD per hour |

|

Additional services |

|

| Audit report in accordance with GAAP Seychelles | 3.500 USD |

| Audit report in accordance with IFRS | 1.500 USD |

| Consultations, communication with auditors and government agencies | 100-350 USD per hour of work |

[1] The price is shown without VAT. UAE VAT rate – 5%.