Offshore Company Registration in UK

Your consultant

Alina Marinich

Senior Business Consultant

Great Britain is a jurisdiction that needs no introduction, consistently ranking at the top of global ratings for economics, finance, business, freedom, and social life. Many entrepreneurs closely follow the country’s performance and choose the UK for its strong reputation. UK company registration offers businesses the opportunity to operate in one of the world’s most respected and dynamic environments, benefiting from its stability and international prestige:

- fast-track incorporation of a company with no need to travel – a company can be incorporated within one working day;

- a flexible common law system, which is an important factor when making shareholders agreements and developing complex mechanisms for company management by directors and shareholders;

- a big range of digital services on the Companies House website.

Unlike most of the neighboring countries, the UK surprises with the low level of duties that forms the inexpensive cost of the company itself.

In addition, the UK is not an offshore jurisdiction and is not blacklisted by the OECD or the FATF.

We represent two famous types of companies: LTD and LLP in England.

UK Company Strucutre Requirements

Limited Liability Company

- At least 1 director who is individual, no restrictions on citizenship or country of domicile.

- At least 1 shareholder who can be either an individual or a legal entity, a resident or citizen of / domiciled in any country. A shareholder can be the same person as the director.

- No requirement to appoint a secretary.

- No minimum capital requirement in a company. A company usually issues 1.000 shares of GBP 1 each. No requirement for the par value of shares either. Bearer shares, as well as shares with no par value, are not permitted. If necessary, it is possible to issue different classes of shares, which is very convenient for introducing investors to the company or creating share option schemes for the management.

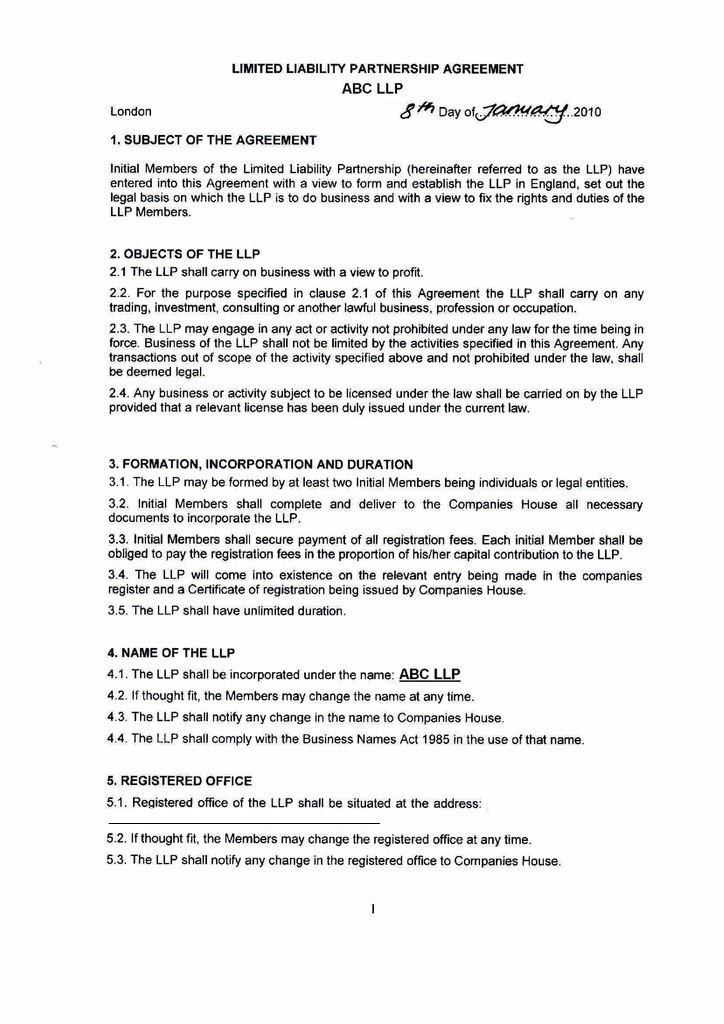

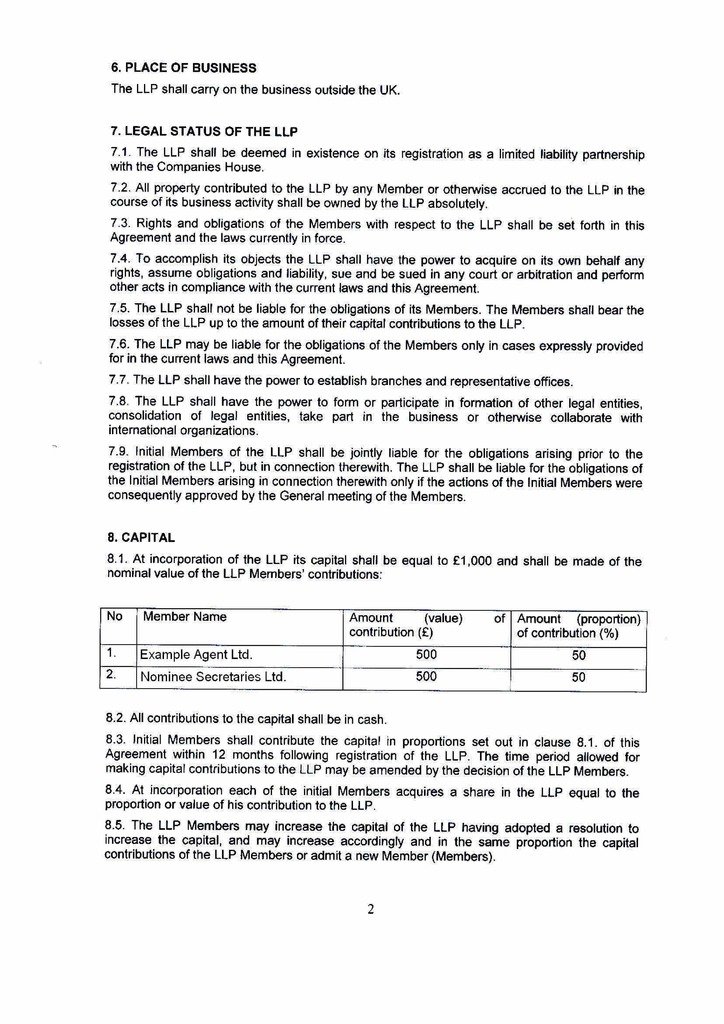

Limited Liability Partnership

- At least 2 members who can be both individuals and legal entities. No requirements as to their residence.

- One of the members or another person can be appointed as LLP manager, to simplify the management procedure.

- No minimum capital requirement in an LLP; the constitutive documents will show the members’ contribution which is made by them upon incorporation.

UK Company Incorporation Period

Incorporation of a new UK company takes about 2 – 3 weeks from the date of filing with Companies House, including the time required to prepare an apostilled set. Also the same day service for company incorporation is available for a premium fee.

UK Business Registration Process

The registration procedure has no special features. However, it should be noted that there is a full-fledged open register that reflects absolutely all information about the company, including directors, shareholders, members and all controlling persons.

A step-by-step guidance will follow here:

STEP 1 – Company Name Verification

We request 2–3 names to be checked with the Registry in order of priority. The names check usually takes up to 24 hours. The name must meet the following requirements:

- it must not be identical or similar to the name of any existing company;

- it must end with a suffix denoting the type of entity (“Limited” / “Ltd” or “LLP”).

STEP 2 – Regulatory Due Diligence

The Anti-Money Laundering and Counter-Terrorist Financing Act requires corporate service providers to identify the beneficial owners of the company, the source of their funds and the nature of activities for which they will use the company. However frightening it may sound, this compliance check is quite simple and requires a client to provide the above information in free form, as well as proof of identity and of residential address for all the individuals in the company’s structure. Also, for each company, we sign an agreement with the beneficial owner for administration of the company and provision of audit services, as well as have a client information form filled in, solely for our files.

STEP 3 – Payment Processing

STEP 4 – Compilation of Incorporation Documents,

having the documents signed by the directors and shareholders.

Documents prepared for LTD:

- Application to register a company (form IN01)

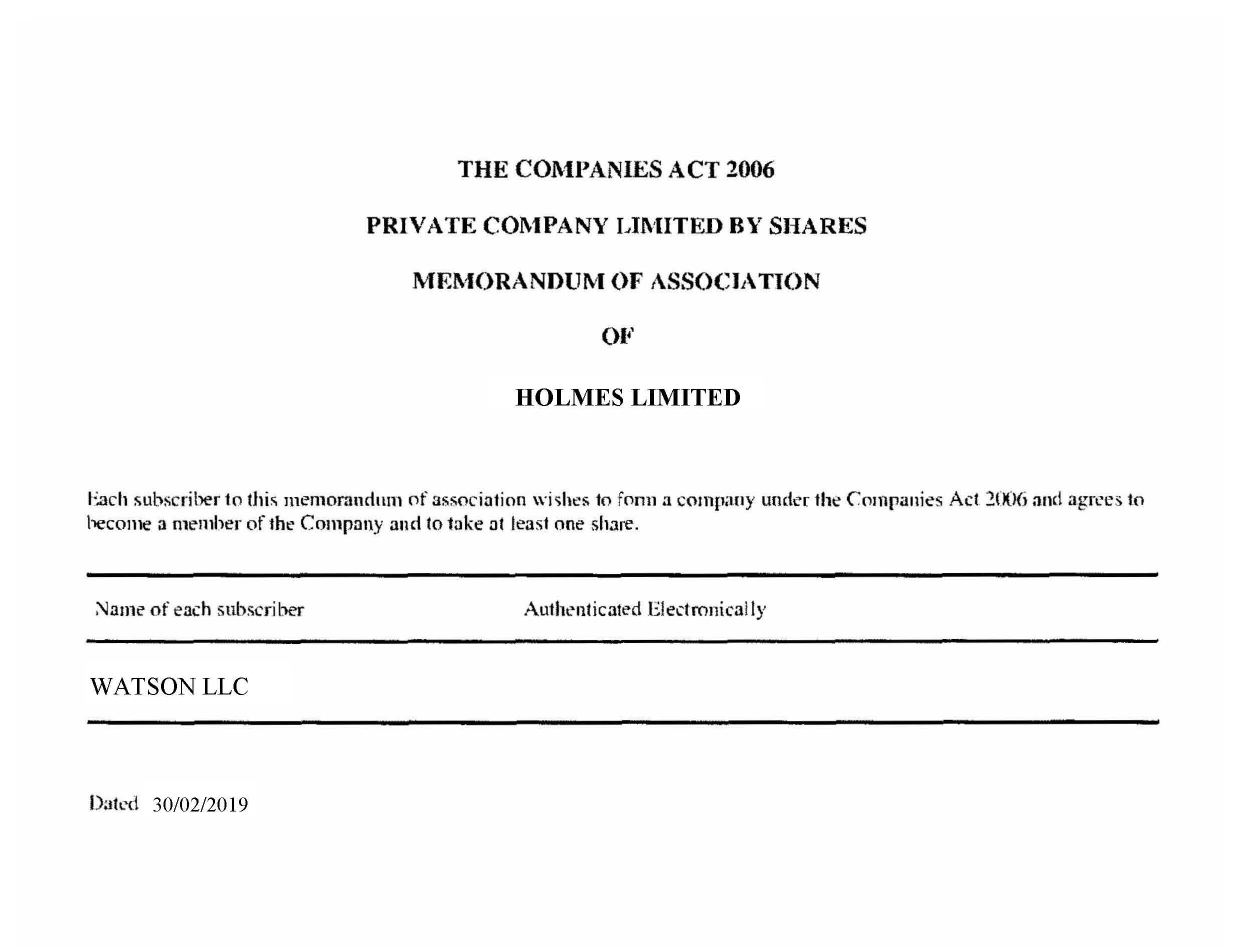

- Memorandum of Association

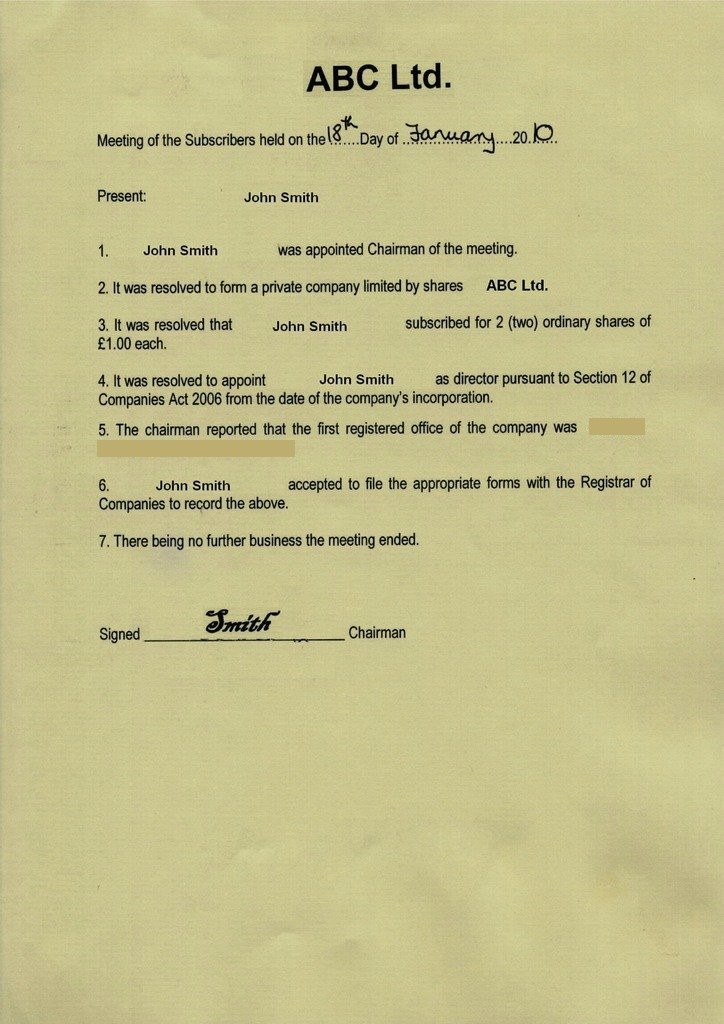

- Minutes of the Meeting of the Subscribers (appointing the first director and issuing the initial shares)

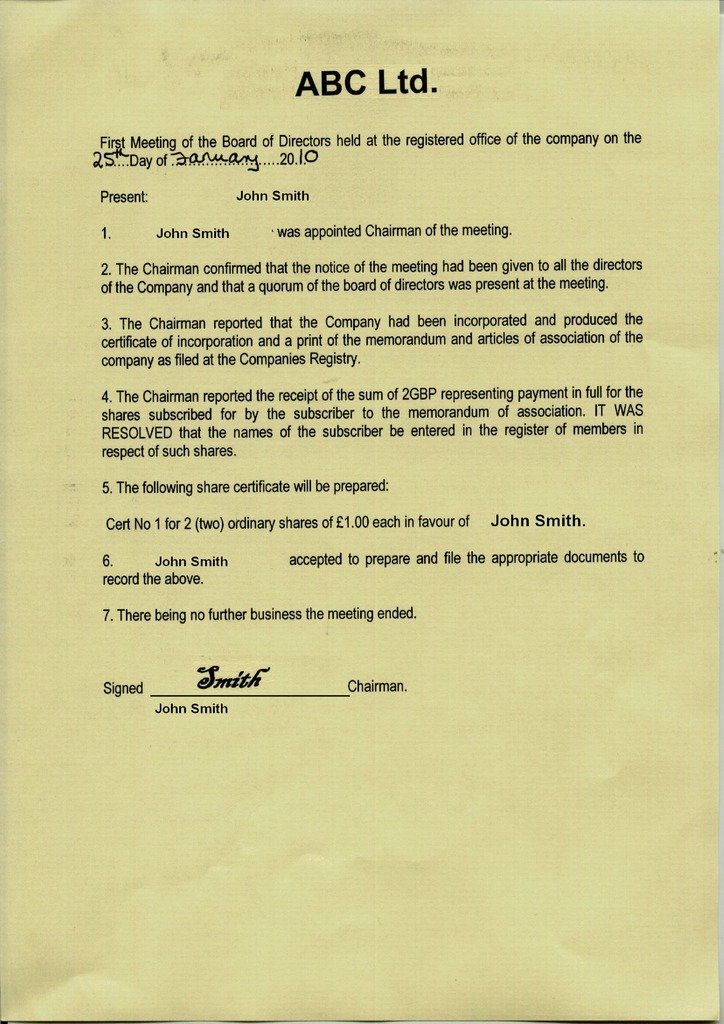

- Minutes of the First Meeting of the Board of Directors.

These documents are required to launch the incorporation.

In addition to the documents listed above, there are:

- Share Certificate

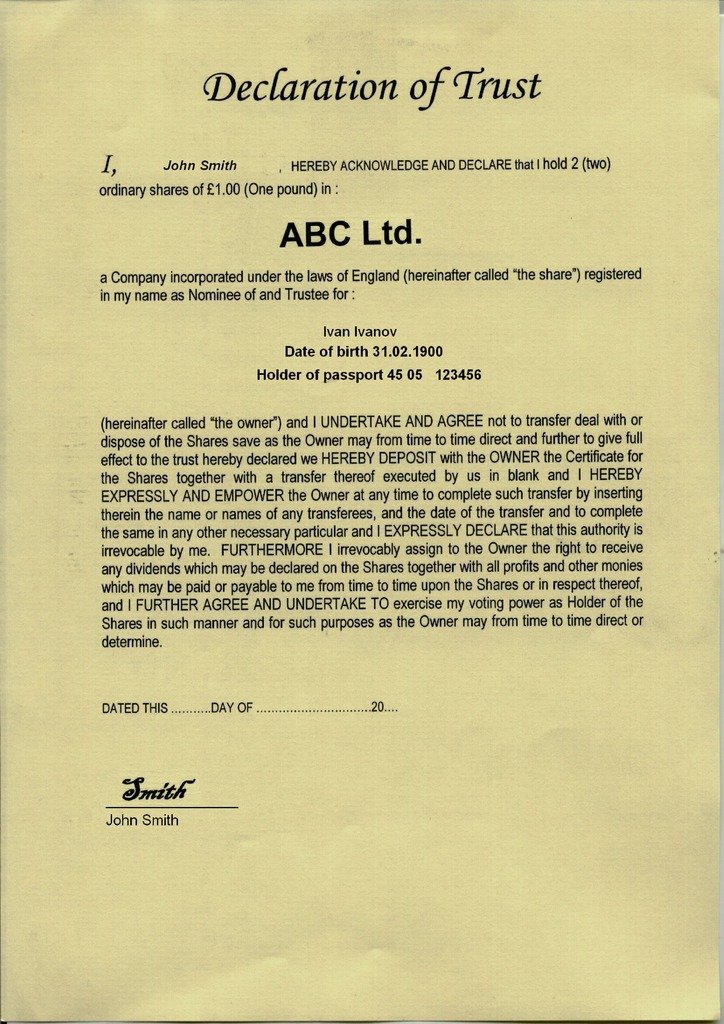

- Declaration of Trust (if the company has a nominee shareholder)

- Consent letter of the director to his appointment

- PSC documents: Notice, Confirmation / Declaration

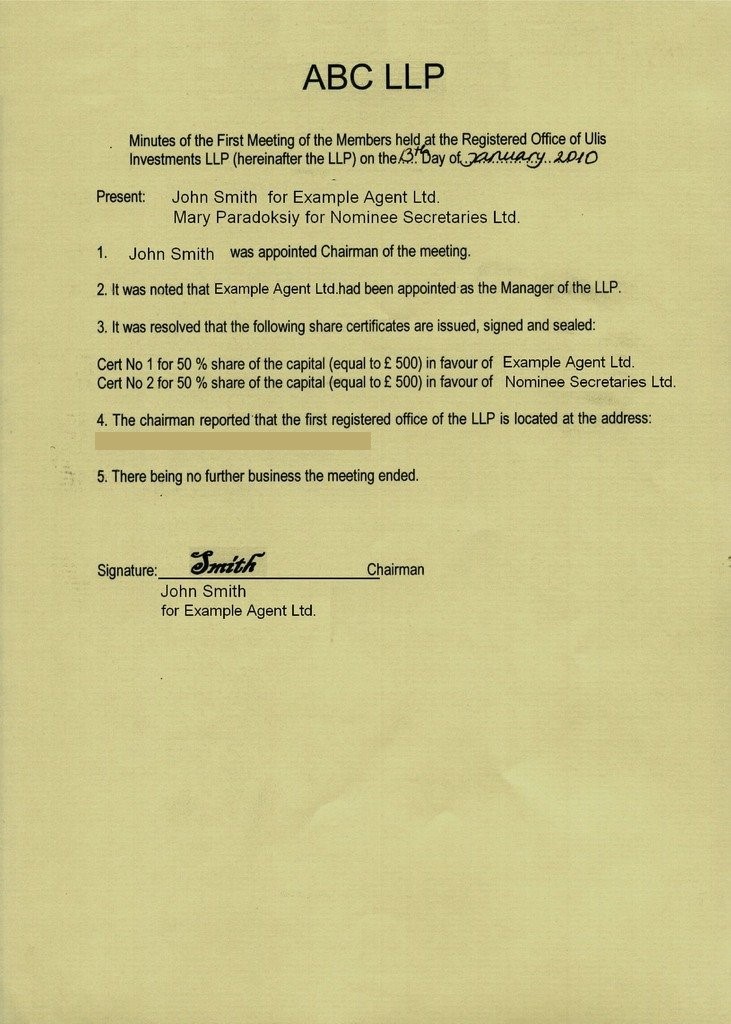

Document prepared for LLP:

Signing of Form LLIN01 by the managing member is sufficient for incorporation purposes. Later on the following documents are prepared and signed by the members:

- LLP Agreement

- Minutes of the Organisational Meeting

- Minutes of the First Meeting of the Members

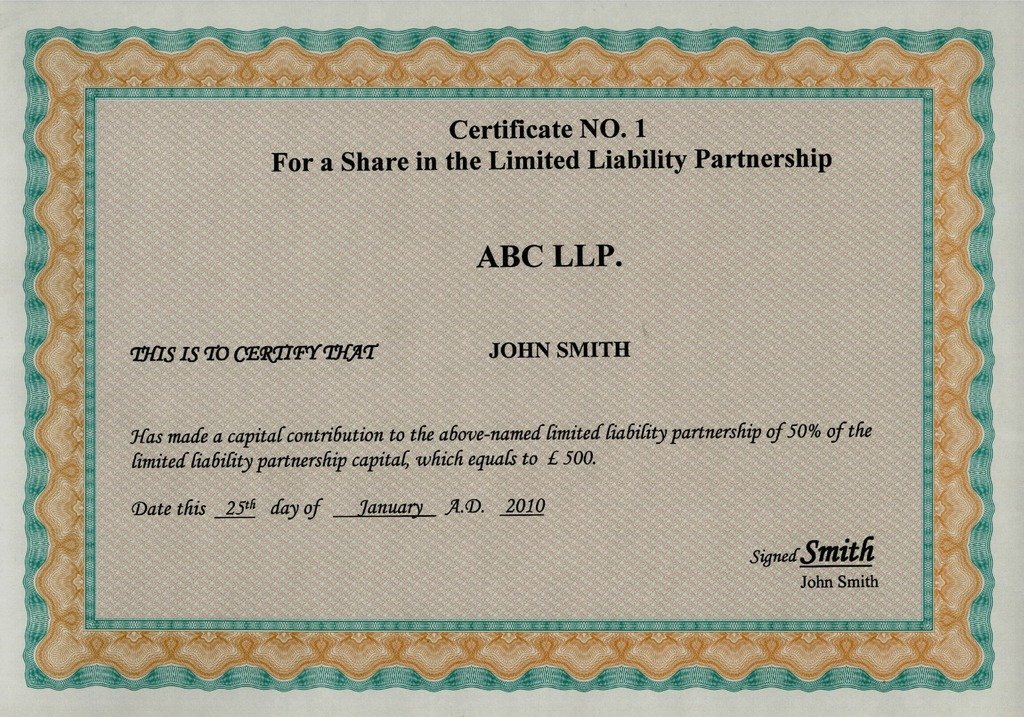

- “Share” Certificate

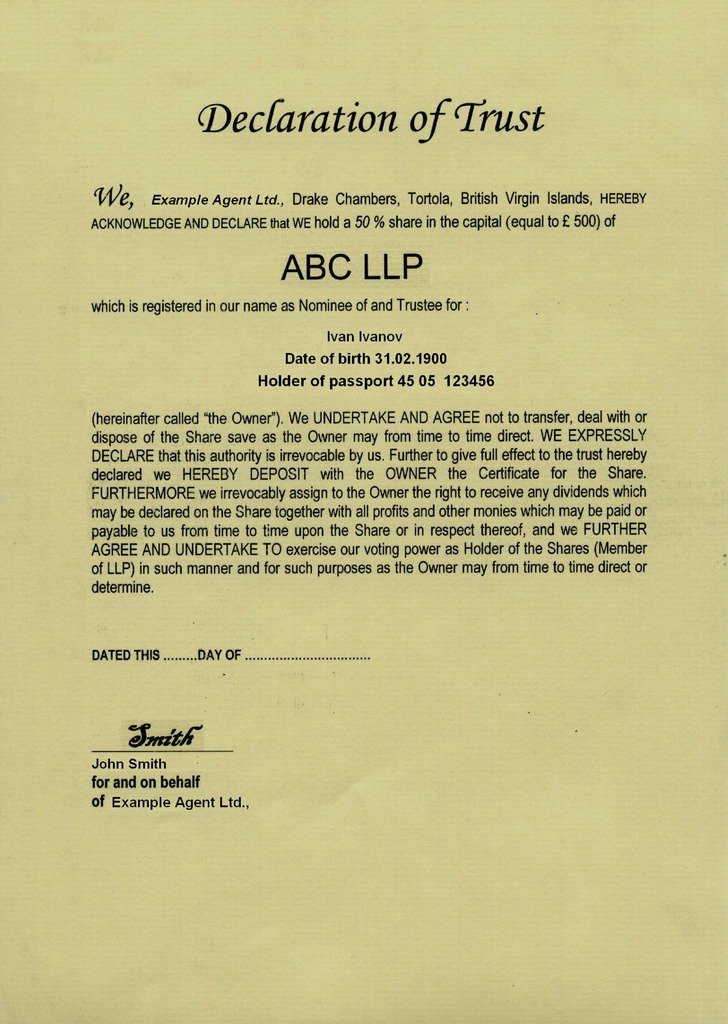

- Declaration of Trust (if the LLP has a nominee member)

- PSC documents: Notice, Confirmation / Declaration

STEP 5 – Submission of Incorporation Application

STEP 6 – Preparation and Delivery of Founding Documents

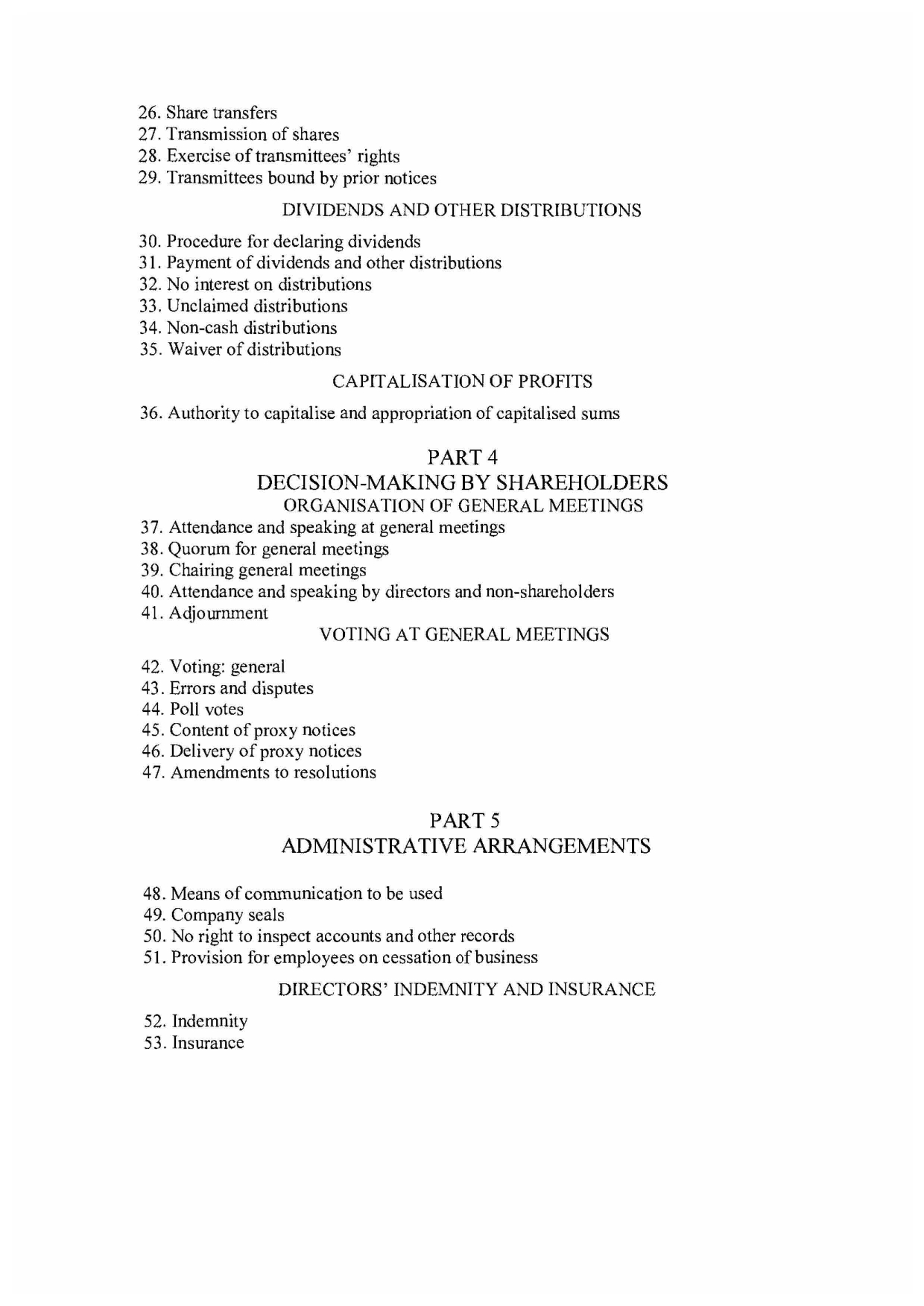

Upon incorporation, the original constitutive documents, including minutes, share certificates and declarations of trust (if applicable), as well as an apostilled set of copies of the following documents, are delivered:

For LTD:

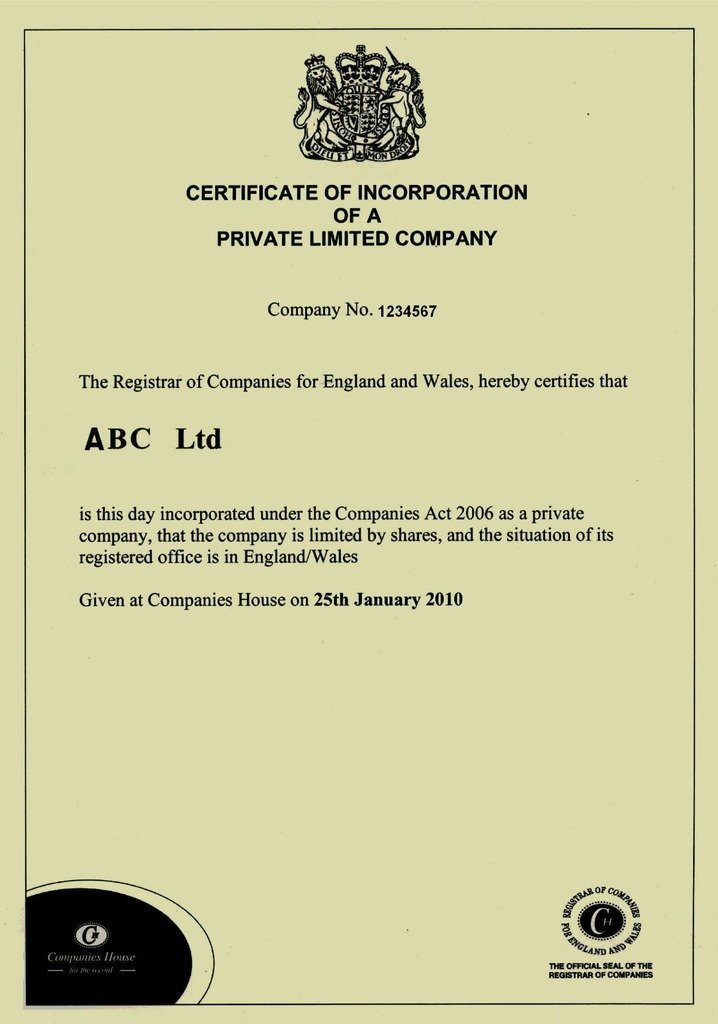

- Certificate of Incorporation

- Minutes of the Meeting of the Subscribers

- Minutes of the First Meeting of the Board of Directors

- Memorandum of Association

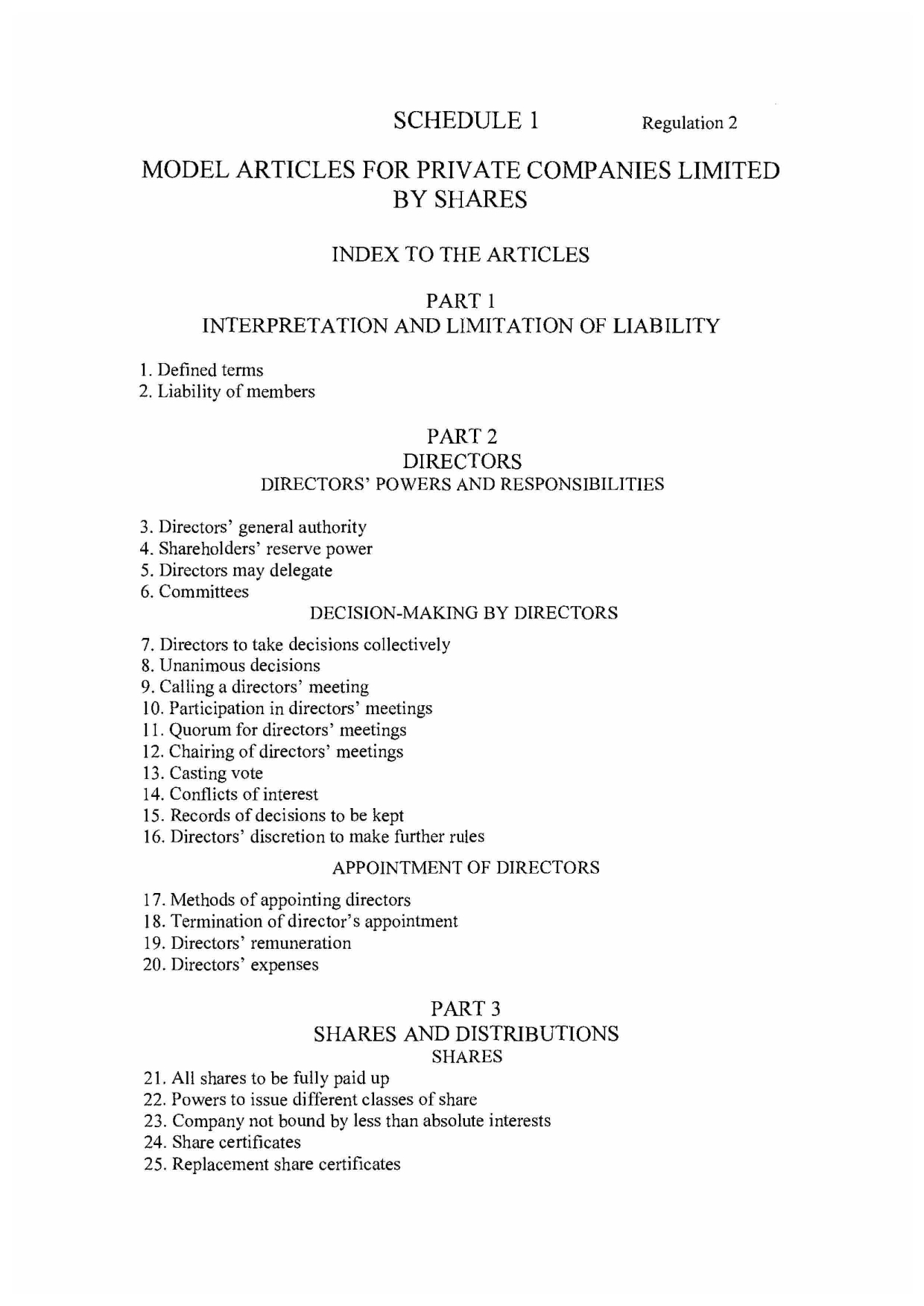

- Articles of Association

For LLP:

- Certificate of Incorporation

- Minutes of the Organisational Meeting

- Minutes of the First Meeting of the Members

- LLP Agreement

The client also receives the company seal.

Register Transparency and Disclosure

The information about directors and shareholders / members is registered by a company on first incorporation at Companies House and then submitted annually in the Confirmation Statement, so it is on the public record and available for inspection by everyone.

Effective from April 2016, all companies and partnerships registered in UK must collect information about persons with significant control, keep a PSC register and make it available at Companies House.

A person with significant control is an individual who meets at least one of the following conditions:

- holds more than 25% of the company’s shares;

- holds more than 25% of the voting rights in the company;

- has the right to appoint or remove a majority of the company’s board of directors;

- has the right to exercise significant influence or control over the company;

- Where a trust or a firm would satisfy one of the first 4 conditions if it were an individual, any individual holding the right to exercise or actually exercising significant influence or control over that trust or a firm.

The information contained in the PSC Register is open to the public inspection.

Ongoing Corporate Administration

Yearly Renewal Requirements

Each company should be renewed on the annually basis (starting from the second year). The date of renewal is the same as the date of the company’s registration.

Each UK company is also required to file annual return which on 30 June 2016 was replaced by the annual Confirmation Statement.

Submission of Annual Company Filings

Each UK company shall file a Confirmation Statement to the Companies House on an annual basis. The Confirmation Statement provides a summary of up to date company information, including:

- Name of the company;

- Registration number;

- Date of the annual return;

- Main activity of the company;

- Type of the company, e.g. private or public;

- Registered office address;

- Address where the UK company keeps its corporate documents, if it is not the registered office, and names of the documents kept;

- Details of the company’s secretary (individual or legal entity), if any;

- Details of all directors of the company (individuals or legal entities).

If the Confirmation Statement is not filed, the Registrar may assume that the UK company is not doing business anymore and may strike it down from the register. A penalty may be imposed for late filing of the Confirmation Statement.

Taxation of LTDs

Corporation tax

The ordinary corporation tax rate is 19%. Profits from the sale of 10% of shares or more in a company are usually tax-exempt. The exemption does not apply to the sale of companies acquired in the previous year and of dormant companies.

Capital gains tax

Capital gains are taxed at the ordinary corporation tax rate of 19%. Gains over this amount and up to GBP 37.500 are taxed at the rate of 10%. Gains beyond this threshold are taxed at the rate of 20%.

VAT

The standard VAT rate is 20%. A reduced VAT rate of 5% applies to some types of goods and services.

Stamp duty

The purchase / sale of shares may be subject to stamp duty at the rate of 0,5% (in some cases, 1,5%). On acquisition of non-residential property, stamp duty is charged at the rate of 5%. Stamp duty on acquisition of residential property is 15% (if the purchaser is an individual, and the property is the only residential property, then stamp duty is levied at progressive rates up to 12%). From 1 April 2021, an additional 2% is charged if the purchaser of residential property is a non-resident. Stamp duty is also due on property rents. Special rules apply in Scotland and Wales.

Taxation of LLPs

UK partnerships are transparent for tax purposes. This means that profits are taxed not at the level of the partnership itself, but in the hands of its members in the relevant proportions.

Preparation of Audited Accounts

All UK companies shall prepare annual financial statements reflecting their financial standing and results of their business activity for the year. That requirement is applicable to Limited Companies and Limited Liability Partnerships.

For limited liability companies (LTD) and limited liability partnerships (LLP) the deadline for submission of financial statements is 9 months from the accounting reference date (for the first financial statements – no later than 21 months from the date of registration of the company / partnership). Accounting Reference Date (ARD) is the last day of the month in which the anniversary of the company’s incorporation falls.

The first financial year, as in many jurisdictions, may be extended up to 18 months. It is also possible to change the financial year end date. Such change is permitted once in 5 years.

If a UK company does not qualify for an audit exemption, its financial statements must undergo an independent review, and an auditor’s report must be attached. Utilizing professional audit in London ensures this process complies fully with statutory requirements and maintains the accuracy and integrity of the company’s financial reporting.

In order to qualify for an audit exemption, the UK company should be a dormant company or a small company within the financial year. To be considered a small company, the company should meet two of the following criteria:

- The annual turnover shall not exceed GBP 10.200.000;

- The value of assets shall not exceed GBP 5.100.000;

- The number of employees shall not be more than 50.

Filing of Yearly Tax Declarations

The laws of the United Kingdom provide for many forms of reporting that should be filled in and filed by companies and partnerships. Some of them are listed below:

- CT600 – a tax return that limited liability companies (Limited Company / LTD) should file within 12 months after the financial year-end date. However, the filing deadline may be different for the first year;

- SA400 – a form required for registration of a Limited Liability Partnership / LLP with the UK’s tax authority (HMRC), so that the partnership could further file the SA800 form;

- SA800 – a tax return that should be filed by limited liability partnerships. The tax period is unified for all partnerships and runs from the 5th of April till the 4th of April of the following year. There are two filing deadlines: 31st of October if filed in hard copy; and the 31st of January if filed in electronic format.

There are also separate reporting forms for members of partnerships.

Service Pricing and Fees

| Services | Fees (USD) |

| Total cost of incorporation of LTD (including a registered address and a local secretary services for the first year, compliance fee, preparation and provision of the corporate documents, and the company’s seal) |

1.800

|

| Total cost of incorporation of LLP (including a registered address and a local secretary services for the first year, compliance fee, preparation and provision of the corporate documents, and the company’s seal) |

1.980 |

| Annual renewal (starting from the second year), including provision of a registered address and a local secretary, but excluding compliance fee | 870

|

| Certificate of Good Standing | 220 (without apostille)

860 (with apostille) |

| Certificate of Incumbency | 220 (without apostille)

860 (with apostille) |

| Duplicate of the Certificate of Incorporation | 195 |

| Certified Copy of M&AA by Companies House | 270 |

| Apostille of any document (under statutory declaration) | 640 |

| Urgent apostille of a document | 870 |

| Preparation and submission of dormant accounts (for dormant companies) | 770 |

| Preparation and submission of financial accounts (for active companies), as well as conducting of an audit | 100 – 400 per hour of work |

| Courier delivery | 250 |

| Compliance fee

Payable in the cases of:

|

350 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (director / shareholder / beneficial owner) or legal entity (director / shareholder) if such legal entity is administered by ITA + 200 for each additional legal entity (director / shareholder) if such legal entity is not administered by ITA 450 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |