Audit and Accounting Services in Hong Kong

Your consultant

Alina Marinich

Senior Business Consultant

With many years of experience in providing accounting services in Hong Kong and a team of highly skilled employees, we are able to tackle any professional challenges, delivering maximum value to our customers.

Since self-accounting takes a lot of time, and it is expensive to maintain a full-time accountant, we can offer you both one-time services and full professional accounting support for your company.

Qualified personnel who are ready to take care of the bookkeeping and tax accounting of your foreign company, as well as cooperation with independent auditors and with the tax authorities of other states at your disposal.

General Hong Kong accounting information for companies

Every Hong Kong Special Administrative Region of the People’s Republic of China (hereinafter referred to as Hong Kong) company must keep accounting records that are sufficient to show and explain the company’s transactions and to disclose with reasonable accuracy, at any time, the company’s financial position and financial performance.

The accounting records must contain daily entries of all sums of money received and expended by the company, and the matters in respect of which the receipt and expenditure takes place and a record of the company’s assets and liabilities.

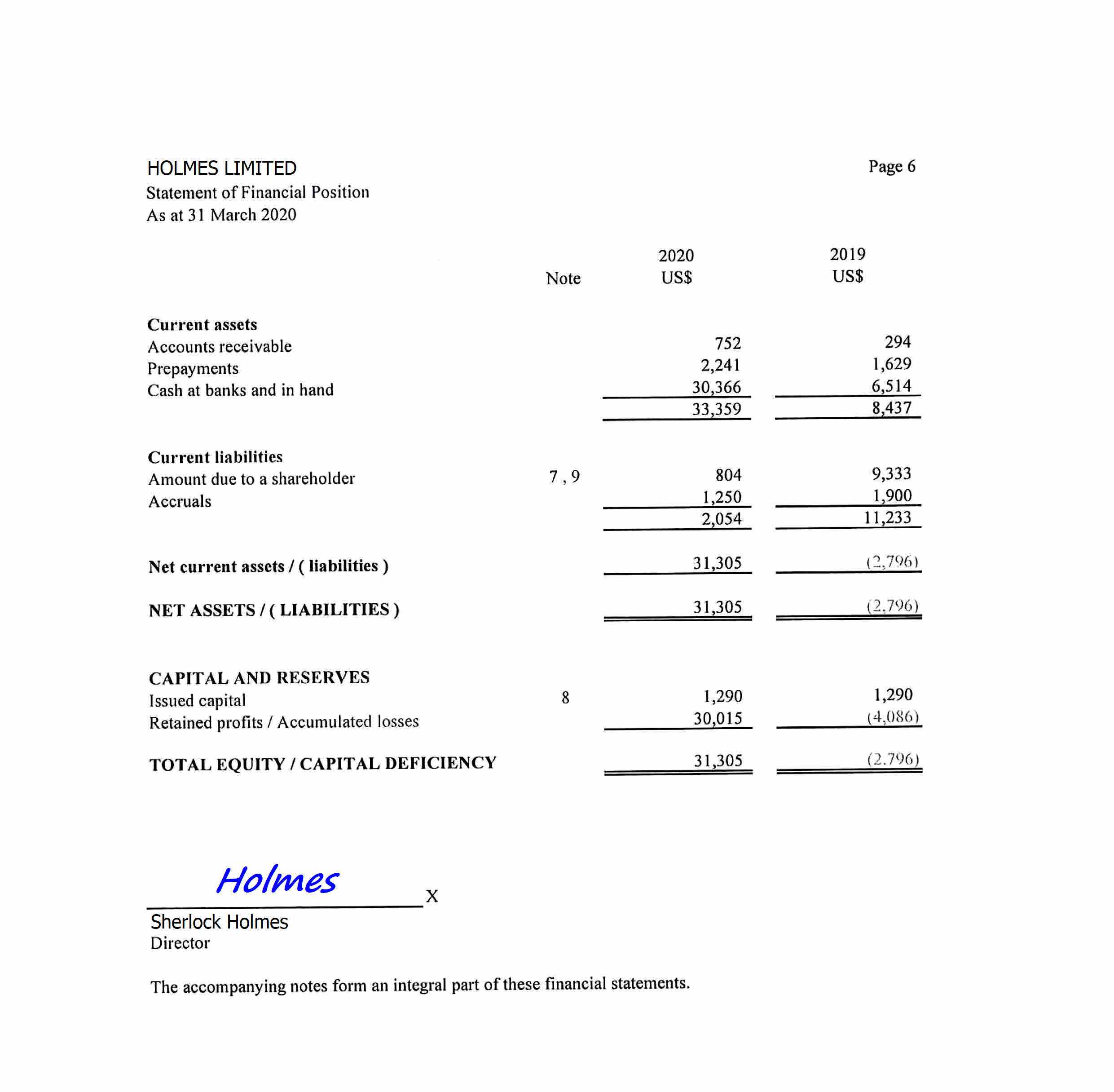

The annual financial statements for a financial year must give a true and fair view of the financial position of the company as at the end of the financial year.

There is no obligation to submit financial statements to the Companies Registry, therefore, the only body to which the reports are submitted is the Inland Revenue Department.

In accordance with the current corporate and tax legislation, all companies registered in Hong Kong are required to submit the following documents annually to the Hong Kong Inland Revenue Department:

- Financial statements certified by a local accredited auditor;

- Profits Tax Return;

- Employee’s Return;

- Resolution on the Annual General Meeting of Shareholders.

According to Companies Ordinance (Cap. 622), the accounts of all companies are subject to audit.

The exceptions are “dormant” companies.

In accordance with the Companies Ordinance (Cap. 622), companies classified as ‘dormant’ have the right to submit only Profits Tax Return to Inland Revenue Department.

A company is considered ‘dormant’ if it has had no ‘significant accounting transactions’ during the accounting period. Company may be ‘dormant’ if it’s not doing business (‘trading’) and doesn’t have any other income.

It is not necessary to prepare the audited financial statements of a dormant company until the activity begins.

The first financial period of a Hong Kong company can last from 12 to 18 months from the date of incorporation, while the company sets its own specific reporting end date. All subsequent financial periods last 12 months. The choice of the end date of the reporting financial period is very important, because it affects the deadline for filing a tax return to the Inland Revenue Department.

We recommend to consult with your auditor before choosing the end date of the first reporting period.

We provide the following accounting services in Hong Kong:

- Inspection of the provided documents for completeness and compliance with the company’s business activities;

- formation of a set of supporting documents to be provided to auditor; for the company’s archive;

- preliminary assessment of the financial result and forecast of the amount of liabilities for corporate tax, if any;

- preparation of accounts, formation of profit and loss statement and balance sheet in accordance with HKFRS for SME and IAS/IFRS and corporate legislation (Companies Ordinance (Cap. 622));

- preparation and submission of accounting statements based on the provided supporting documents;

- by additional client’s request:

- keeping accounting records of the company with the provision of interim financial results on a monthly, quarterly or semi-annual basis.

Сonsolidated financial statements

Each Hong Kong company which has subsidiaries shall consolidate its financial statements with the financial statements of its subsidiaries.

Subsidiaries are considered to be companies with more than 50% ownership in them. There are cases when a subsidiary is considered to be a company with a 50% ownership interest in it or less than 50% if it is controlled by the company. The Company controls the subsidiary if the following conditions are met:

- the company is able to manage the financial and operational policies of the subsidiary;

- the company has the ability to remove or appoint the majority of the members of the board of directors of the subsidiary;

- the company has a majority of votes at the meetings of the board of directors of the subsidiary.

As an exception, a company does not need to prepare consolidated financial statements if any of its parent companies prepares consolidated financial statements.

We also provide services for the preparation of consolidated financial statements for a group of companies, if this is required in accordance with the standards of The Companies Ordinance (Cap. 622)) or in accordance with your request.

When preparing consolidated financial statements, if necessary, you can also use our services to audit the operations of subsidiaries registered in other jurisdictions.

Reporting deadlines

Since the financial statements are filed together with the profits tax returns, the due dates depend on the date of issue of the tax returns.

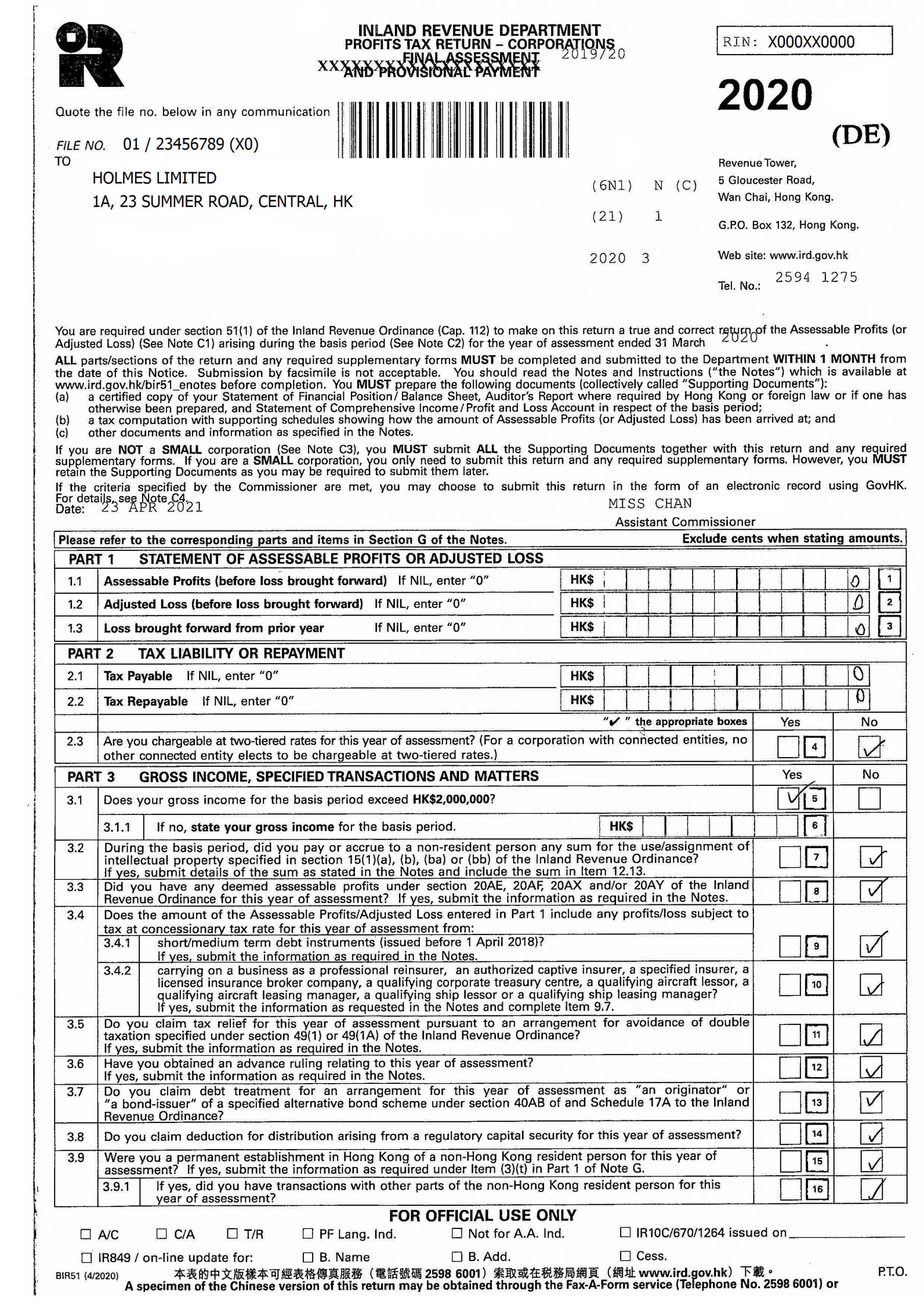

The company must submit its first profits tax return to the Inland Revenue Department within three months from the date of issuing the form. The company receives this form from the Inland Revenue Department 18 months after the date of incorporation of the company.

All subsequent profits tax returns must be submitted annually by the company to the Inland Revenue Department within one month from the date of issue of the form together with the audited financial statements.

The profits tax returns are filled out on the basis of financial statements, and even if the tax and financial year of the company do not coincide, the figures are not adjusted.

Depending on the end date of the reporting financial period, the company is granted a deferral on filing a profits tax return and audited financial statements.

The following deferral schedule is usually set:

| Accounting Date | Due Date |

| 1 April – 30 November | 1 May |

| 1 December – 31 December | 15 August |

| 1 January – 31 March | 15 November |

The overdue filing of Profits Tax Return and the Financial Statements is subject to a late filing fee.

You are advised to refer to your Hong Kong accounting and taxation consultant in order for him to orient you on individual deadlines of your company for filing due date of the Profits Tax Return.

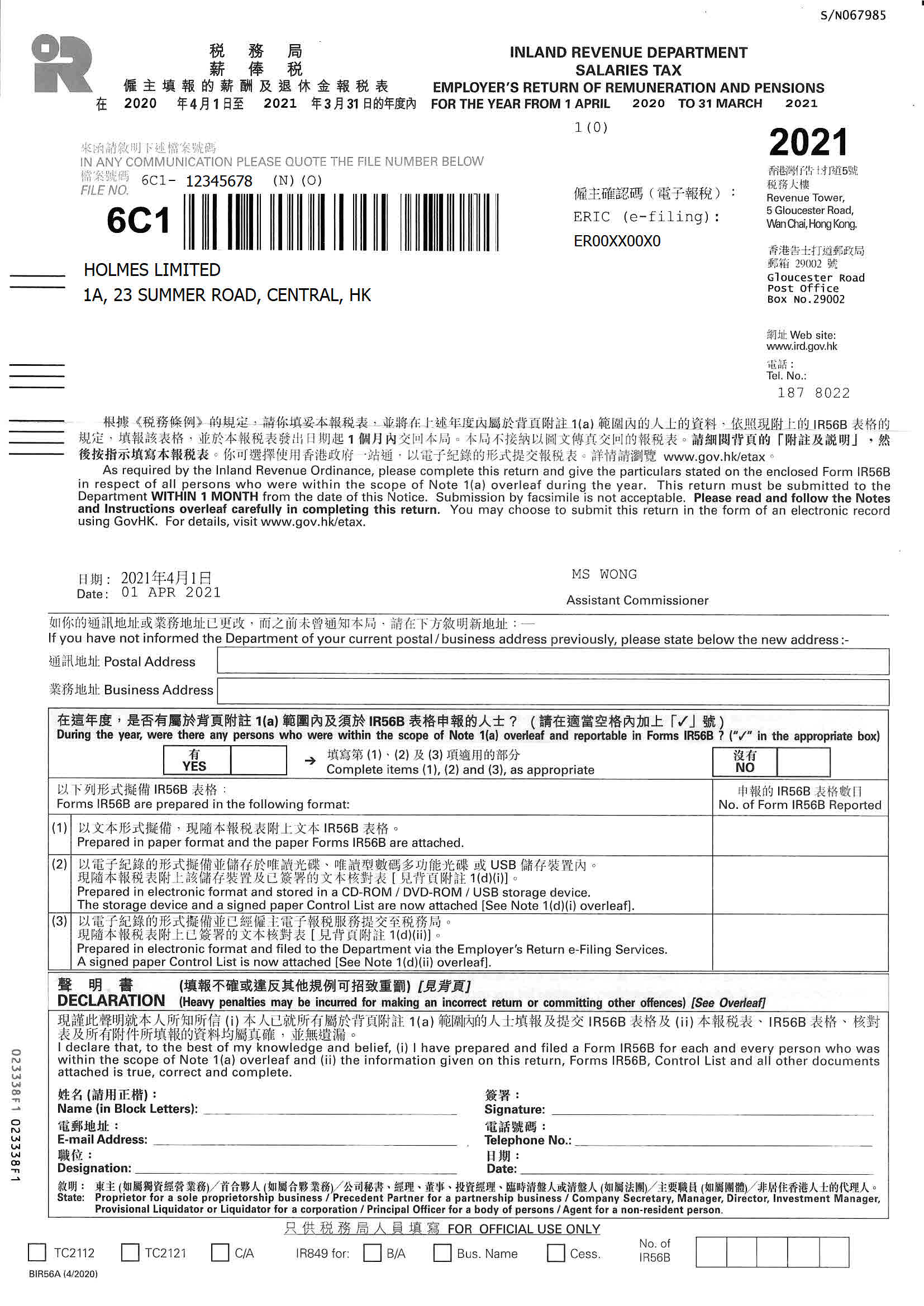

Employer’s returns

The Company’s Employer’s Return is submitted by all Hong Kong companies and reflects the presence or absence of employees in the company for the period from April 1 to March 31.

The Employer’s Return must be submitted within 1 month from the date of issue by the Inland Revenue Department of the form to be filled out.

Hong Kong tax reporting

In addition to annual financial statements a company must submit profits tax returns to the Inland Revenue Department.

As a general rule, companies that do not operate in Hong Kong and do not derive income from Hong Kong are not subject to taxation in Hong Kong. From time to time, the Inland Revenue Department checks the fact of the absence of activities in Hong Kong by sending a request to the company’s address, in which it requires information regarding activities for a particular reporting period.

In order to determine whether a company can be considered to be operating outside Hong Kong, the Inland Revenue Department, as a rule, wants to receive confirmation that:

- the company does not have a functioning office or representative office in Hong Kong;

- Hong Kong cannot be considered a place of making business decisions, contacts and negotiations with counterparties, concluding contracts, or a place of mutual settlements;

- the company does not have assets or property in Hong Kong from which the company derives income;

- as well as other information that confirms the absence of activity in Hong Kong.

For all companies operating in Hong Kong, the income tax rate is 16.5%.

The tax return must be certified (and actually prepared) by the company’s auditor.

The tax period is the same for all Hong Kong companies, regardless of the date of their incorporation. The profits tax return is submitted annually to the Hong Kong Inland Revenue Department for the period from April 1 to March 31.

Our Hong Kong tax accountants are ready to assist you in the preparation of calculations of the estimated profit for the current year as well as the assessment of tax liabilities for corporation tax and other taxes.

Our best Hong Kong services

We provide a full range of services related to the preparation of accounting and tax reports, audit and submission of audited statements to the public authorities of Hong Kong, as well as accounting, tax and administrative support of the existing offices of our clients’ companies in Hong Kong.

Having our own presence in Hong Kong since 2013, we have acquired a unique practice of direct cooperation on the issues of our clients’ companies with government institutions, such as Companies Registry, Inland Revenue Department, Customs and Excise Department and others.

Get advice before getting started

Since Hong Kong does not belong to offshore jurisdictions, and a Hong Kong company is obliged to submit reports and in some cases pay taxes on a regular basis in accordance with the procedure established by law, before starting the registration of a Hong Kong company, we recommend that you get advice from lawyers and auditors regarding the subsequent administration of the company.

Standard Hong Kong fees for our services

| SERVICES | FEE (USD)[1] |

| Yearly accounting services | |

| Preparation and submission of a Nil Profits Tax Return | 990 |

| Preparation and submission of Dormant Company Audited Report (for companies that did not operate in the reporting period) | 1.800 |

| Preparation and submission of reports for a company that has started operating | 100-400 per hour |

| Additional services | |

| Preparation and submission of a Nil Employer’s Return | 365 |

| Preparation and submission of Employer’s Return (1 employee) | 500 |

| Preparation and submission of Employer’s Return (2-3 employees) | 600 |

| Consultations, communication with auditors and government agencies | 100-400 per hour |

[1] The price is shown without VAT. UAE VAT rate – 5%.