Company Incorporation in Hungary

Your consultant

Alina Marinich

Senior Business Consultant

Hungary, located in Central Europe, is a highly attractive jurisdiction for business due to its financial stability, one of the lowest corporate tax rates in Europe, and a streamlined process for company incorporation in Hungary. The most popular business structure in the country is the private limited company, known as KFT (Korlatolt Felelossegu Tarsasag).

Key Specifics of Starting a Business in Hungary

- Hungary is not listed in any black lists or lists of offshore jurisdictions;

- Fast company registration process;

- One of lowest corporate tax rates in Europe – 9%;

- Obtainment of European Union VAT number immediately after the registration of the company;

- Wide range of Double Taxation Agreements (DTAs).

Hungary Company Incorporation Period

Company incorporation in Hungary including bank account opening usually takes up to 2 weeks.

Hungary Business Registration Process

Step–by–step guidance:

STEP 1 – Preparation procedure

You need to choose the name of a new company.

You need to decide on the structure of the company: director(s), member(s), attorney(s).

It is also necessary to specify the amount of the share capital and distribution of shares between the members.

Name Availability Check

We request several company names to be checked with the Registry for their availability (at least 2 names). Such names:

- must be in Roman letters;

- should not contain the following words: “Hungarian”, “Budapest”, “national”, “state”, etc.;

- must end with a suffix denoting the type of entity (for example, Kft.).

Registered Address

Registered office is mandatory. Registers of members, minutes, accounting records, other company’s documents should be kept at the registered address.

Requirements to Directors

A minimum of 1 director is required.

The director could be a natural person or legal entity. The director could be the resident of any country. Directors must be at least 18 years of age and must not be bankrupt or convicted for any malpractices.

Requirements to Company Secretary

No secretary is required.

Requirements to Members

A minimum of 1 member is required.

There is no residency requirement for members. Director and member can be the same or different person(s). The member must be at least 18 years of age and can belong to any nationality.

The member can be a person or a company (i. e. individual or corporate).

Members meetings can be held anywhere in the world.

Requirements to Share Capital

The minimum share capital for KFT company in Hungary is HUF 3.000.000 (~ EUR 7.150).

Share capital must be paid up. 100% of share capital can be paid after the registration of the company. No share transfer or distribution of the dividends could be done unless the agreement capital is fully paid.

Bearer shares and shares without par value are not allowed.

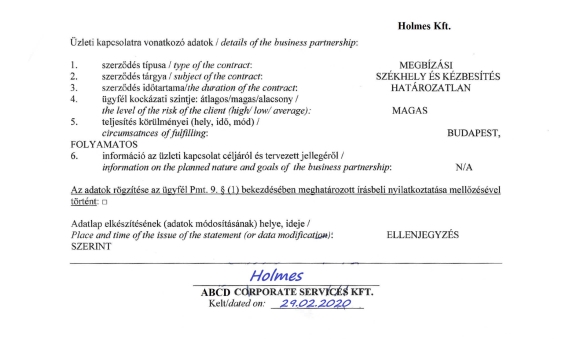

STEP 2 – Compliance Procedures

You need to provide documents for directors / members / beneficial owners / attorneys as well as detailed information about activity and geography of business of the future company.

Proof of identity:

- Scanned copy of valid passport

- Scanned copy of ID card

- Scanned copy of driving license

Proof of address (proof of residence):

- Recent utility bill (not older than last 3 months)

- Recent bank statement (not older than last 3 months)

- Other equivalent document which contains the address (for example, any ID document confirming the current residential address if this document is not used as proof of identity)

STEP 3 – Payment of Invoice

After receiving the invoice payment, we launch the company’s incorporation process (you may find our fees below – at the point “Fees”).

STEP 4 – Document Preparation for Registration

All the documents could be signed in the presence of a Hungarian lawyer (this can be arranged via video-call in Skype, Zoom, MS Teams, etc.). Then the originals of signed documents should be sent to Hungary. After the receiving of the originals of signed documents, the Hungarian lawyer will certify them and proceed with registration of the company at the Company’s Court.

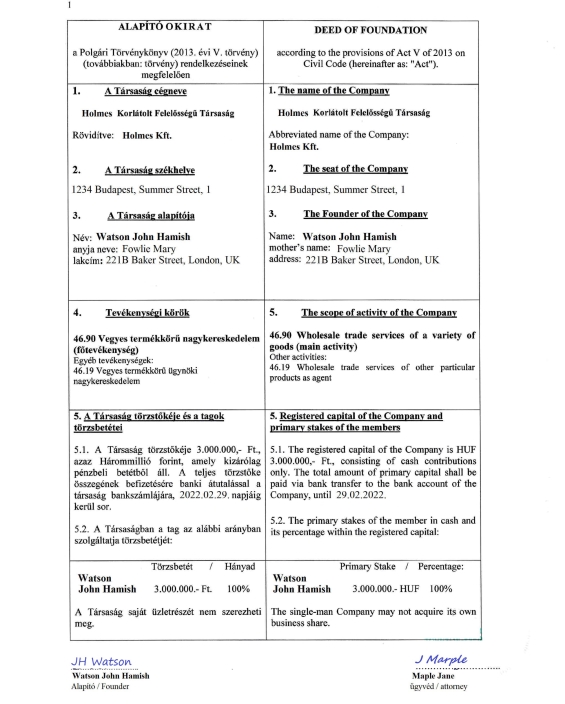

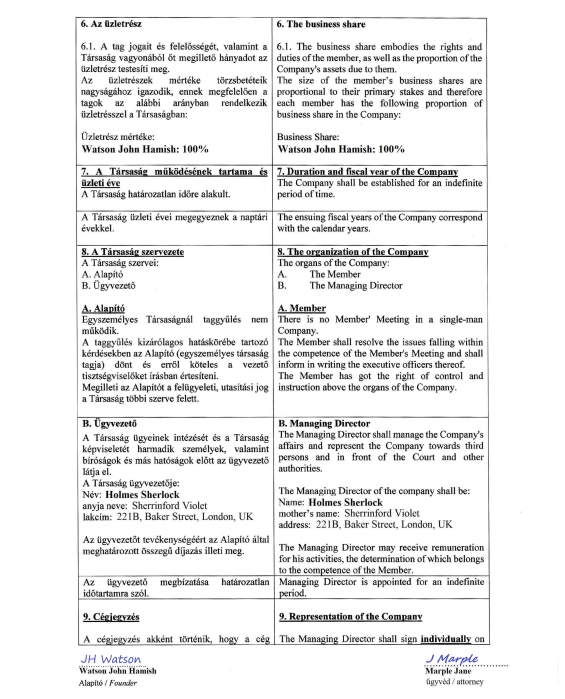

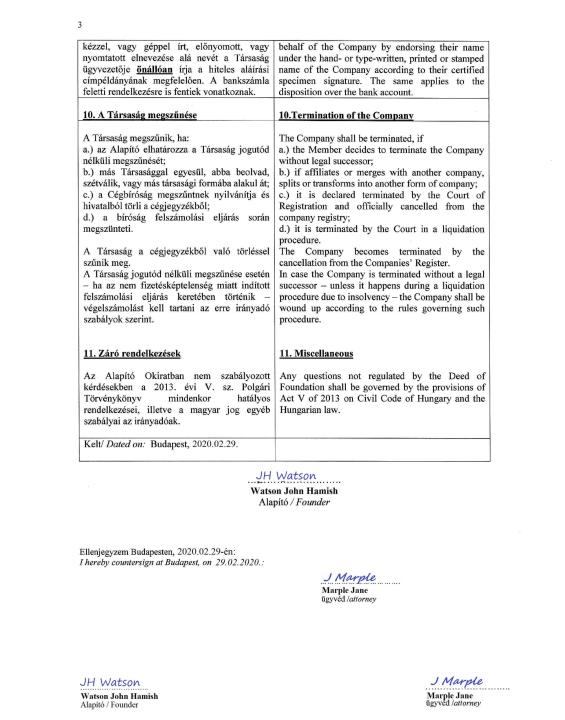

The list of the documents that should be signed and sent to Hungary:

- Articles of Association – should be signed by the member;

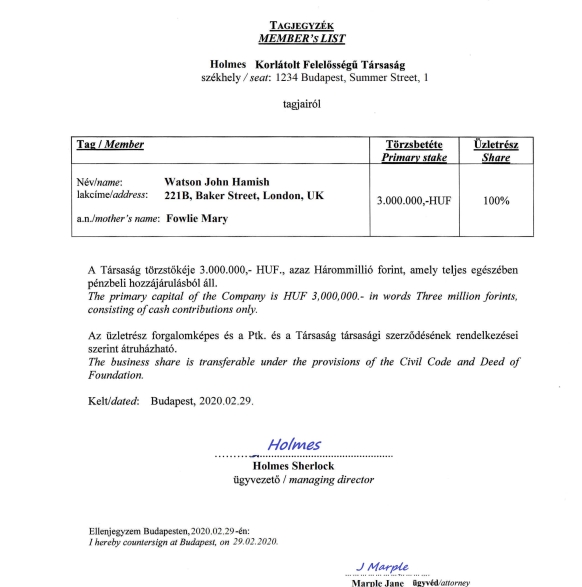

- Register of members – should be signed by the director;

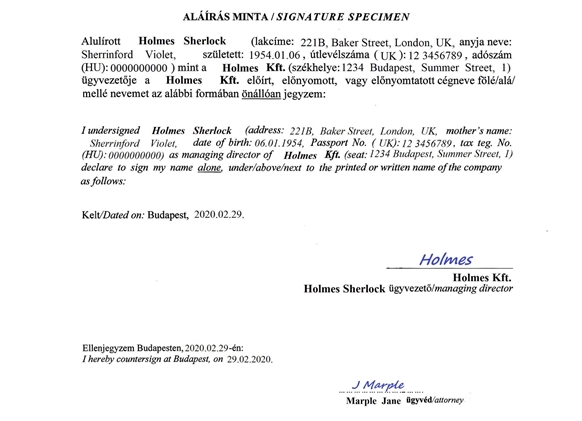

- Specimen signature card – should be signed by the director;

- Lease agreement – should be signed by the director.

Submission of Registration Application

The registration of the company in Registry takes 1 – 2 business days (after receiving the payment and the documents stated above as well as the documents and information stated at the point “Compliance procedure”).

The company must be represented by a lawyer during the registration process. The lawyer will submit the documents to the Company’s Court. After the registration at the Company’s Court the company needs to be registered with Tax Authorities and with the Hungarian Social Security Office.

Opening a Bank Account

It is mandatory for Hungarian company to open a bank account with Hungarian bank within 15 days after the completion of the registration. This account will be used to pay taxes, government levy, etc.

The information about the bank account could be found at the Companies Register which is opened to public access.

If the Hungarian company opens bank account with a foreign bank it should declare this information to Tax Authorities.

Bank accounts in Hungary could be opened only by the director of the company. And we strongly recommend to hire a local professional director.

The whole registration process usually takes up to 15 working days.

STEP 5 – Client KYC Document Collection

We collect the hard copies of certified KYC documents which we initially requested in scanned copies (the list of these documents you may find at the point “Compliance procedure”).

STEP 6 – Drafting and Delivery of Constitutive Documents

CORPORATE PACKAGE IS BEING DISPATCHED TO YOUR LOCATION

Basic set of corporate document:

- Articles of Association;

- Certificate of Incorporation;

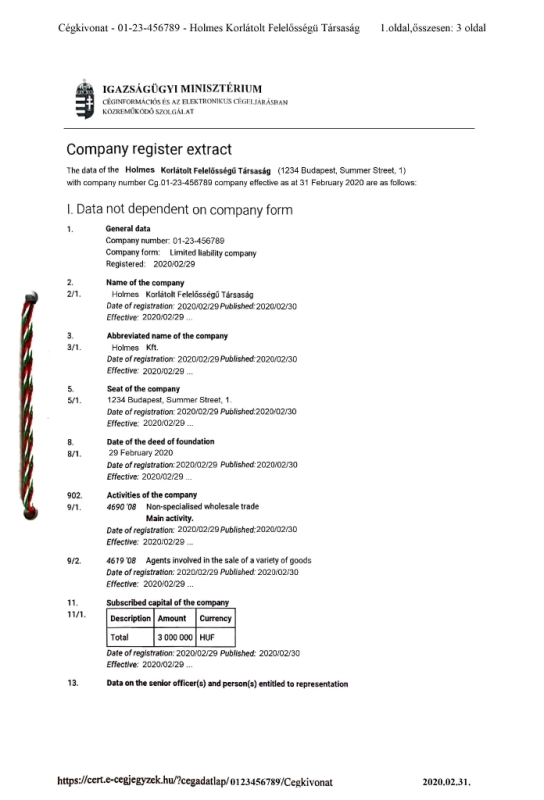

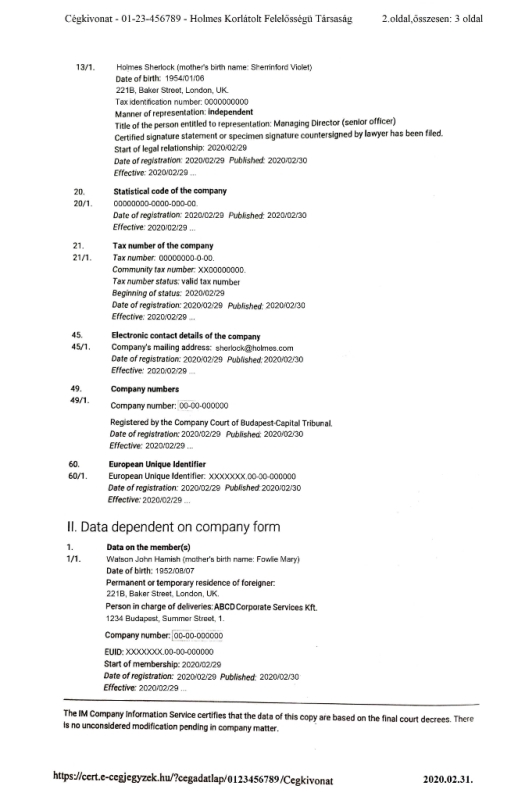

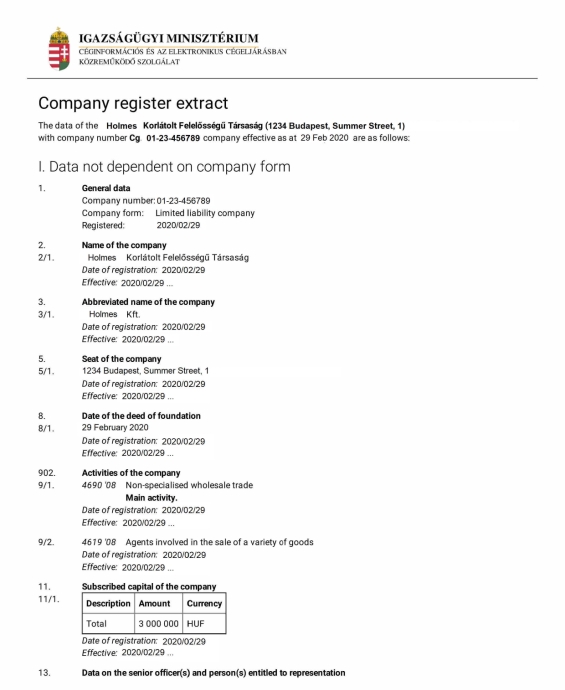

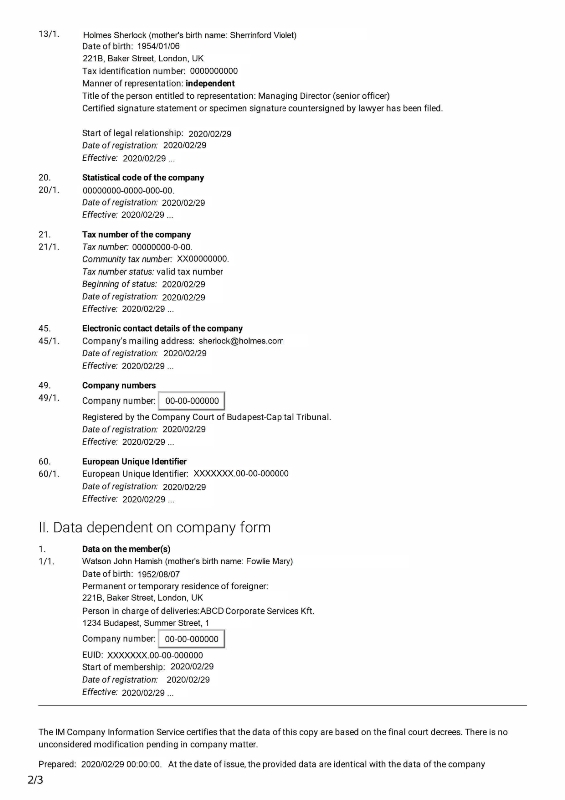

- Extract from Business Registry.

Public Disclosure of Company Information

Third parties can request the following information on Hungarian companies:

- corporate registration number,

- registered seat,

- address of branch (if any),

- date of registration,

- principal business activities,

- amount of subscribed capital,

- details of auditor (if any),

- statistical and tax numbers,

- name and address of bank in Hungary and account number,

- members, managers and executive officers data (physical person – name, address and mother’s maiden name; legal entity – company’s name, registered seat, registration number, name and location of Court of Registration, etc.).

All documents filed to the Registry including Deed of foundation or Articles of association are available to public inspection.

Company Ongoing Maintenance

Annual Renewal Process

Each company should be renewed on the annual basis (starting from the second year) before the date of each anniversary of its incorporation. In Hungary the company is also required to file annual tax return.

Preparation of Audited Financial Statements and Tax Returns

Every limited company must complete and lodge the Profits Tax Return together with the supporting documents, which are its audited financial statements, tax computation with supporting schedules showing the amount of assessable profits (or adjusted loss), and other documents and information as required within the prescribed time frame.

Audit by Hungary auditors is required when:

- annual turnover is exceeded HUF 300.000.000 (~ EUR 720.000); or

- 50 or more employees.

Invoice Processing

All the invoices should be issued electronically using specialised software approved by the Hungarian Tax Authorities.

Tax Compliance

Hungary offers flat corporate tax rate – 9%. It is one of the lowest tax rates in Europe and in the world.

Municipal tax is up to 2%.

Our Hungary Service Fees

| Services | Fees (EUR) |

| Company incorporation with one member and standard Articles of Association (including registered address for the first year without postal services, preparation and provision of the company’s original founding documents and seal) | 5.200 |

Payment of the authorized capital:

|

3.900 |

| Local bank account opening | from 1.640 |

| Office lease (organization of lease, selection, preparation of a lease contract) | 1.650 + monthly rent (depending on the size and location of the office) |

| Local professional director | from 5.500 |

| Preparation and submission of financial accounts, and conduct of an audit | 100 – 400 per hour of work |

| Courier delivery | 250 |

| Compliance fee

Payable in the cases of:

|

350 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (director / member / beneficial owner) or legal entity (director / member) if such legal entity is administered by ITA + 200 for each additional legal entity (director / member) if such legal entity is not administered by ITA 450 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |