Accounting and Audit Services in Romania

Your consultant

Alina Marinich

Senior Business Consultant

With many years of experience in servicing various organizations and the expertise of our Romanian accountants, we are able to solve any professional tasks while delivering maximum benefit to our customers.

Since self-accounting takes a lot of time, and it is expensive to maintain a full-time accountant, we can offer you both one-time services and full professional accounting support for your company.

Qualified personnel who are ready to take care of the bookkeeping and tax accounting services in Romania, as well as cooperation with independent auditors and with the tax authorities of other states at your disposal.

Essential accounting information for Romanian companies

As The Accounting Law 82/1991 (revised) says, companies registered in Romania must keep accounting records that provide an accurate and complete picture of the company’s state of affairs, being the major instrument of knowledge, management and control.

The accounts shall be kept in the Romanian language and in the national currency, RON.

As a EU Member State, Romania is subject to accounting, auditing and financial reporting requirements set out in EU Rules and Directives as implemented into national laws and regulations.

In particular, Romanian companies should prepare their financial statements in accordance with IFRS.

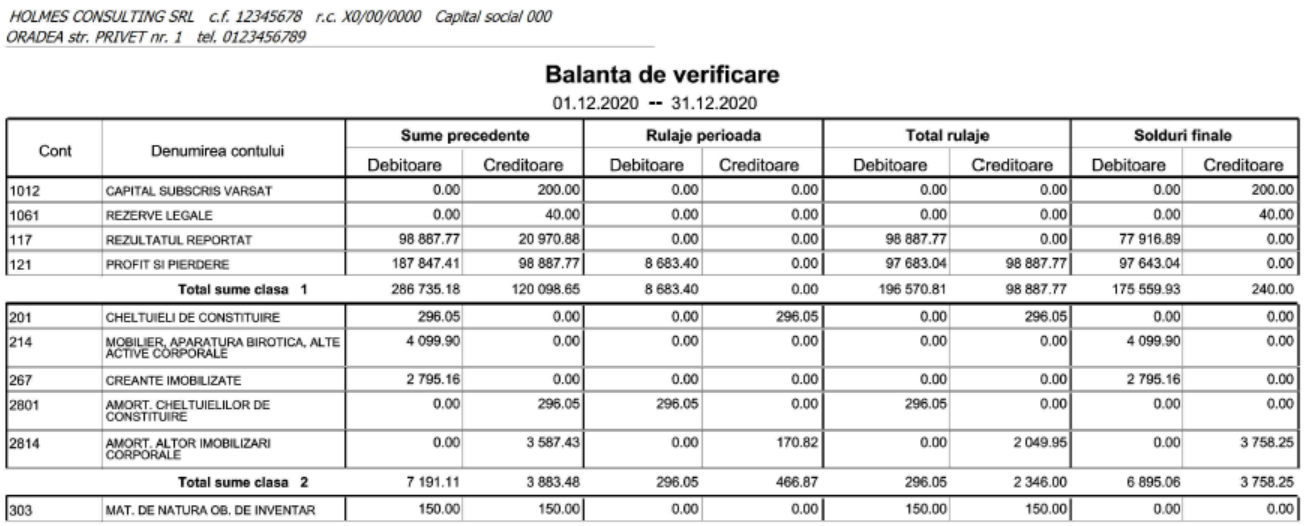

All Romanian companies shall prepare annual accounts; however the trial balance shall be drawn up on a monthly basis, in order to check the accurate recording of the asset transactions in the books. Thus accounting services are paid on a monthly basis.

The annual accounts shall include:

- the balance sheet,

- the profit and loss account or the budget account in the case of public institutions,

- appendices

- and the management report.

However, microenterprises are not required to make explanatory notes to the annual financial statements, they prepare a simplified balance sheet and a profit and loss statement.

Microenterprises are organizations that do not exceed the limits of at least two of the following three criteria at the reporting date:

- Turnover – RON 3.000.000 (~ EUR 600.000)

- Total Assets – RON 1.500.000 (~ EUR 300.000)

- The average number of employees during the financial year – 10

Romanian companies that exceed the limits of at least two of the following three criteria for two consecutive years at the reporting date are subject to audit:

- Turnover – RON 32.000.000 (~ EUR 6.500.000)

- Total Assets – RON 16.000.000 (~ EUR 3.250.000)

- The average number of employees during the financial year – 50

Please connect our Romanian consultants on the necessity of an audit and the volume of financial statements.

We provide the following accounting services:

- Inspection of the provided documents for completeness and compliance with the company’s business activities;

- formation of a set of supporting documents to be provided to auditor; for the company’s archive;

- preliminary assessment of the financial result and forecast of the amount of liabilities for corporate tax, VAT, etc.;

- preparation of accounts, formation of profit and loss statement and balance sheet in accordance with IFRS and corporate legislation;

- preparation and submission of accounting statements based on the provided supporting documents;

- by additional client’s request:

- keeping accounting records of the company with the provision of interim financial results on a monthly, quarterly or semi-annual basis.

Group financial reporting

The parent Romanian company prepares annual consolidated financial statements starting from the first financial year in which at least two of the three criteria below were exceeded for the group of companies at the reporting date:

- Turnover – RON 210.000.000 (~ EUR 42.500.000)

- Total Assets – RON 105.000.000 (~ EUR 21.250.000)

- The average number of employees during the financial year – 250

Also, annual consolidated financial statements are subject to audit.

We also provide services for the preparation of consolidated financial statements for a group of companies, if this is required in accordance with the Order no. 1 802 of December 29, 2014 or in accordance with your request.

When preparing consolidated financial statements, if necessary, you can also use our services to audit the operations of subsidiaries registered in other jurisdictions.

Key submission timelines

All Romanian companies shall submit one copy of the annual accounts no later than April 15 of the following year to the General Directorate of Public Finance and Financial Control.

The overdue filing of a company’s accounts is subject to a late filing fee.

You are advised to refer to our consultant in order for him to orient you on individual deadlines of your company for filing due date of the company’s accounts.

Tax filing and compliance

In addition to annual accounts a company that is a tax resident of Romania is taxed on income received or derived from all taxable sources in Romania and abroad.

The standard income tax rate is 16%.

Romania offers the most attractive tax regime in the EU for small businesses.

An entity is considered small if the company’s income for previous years is no more than EUR 1.000.000. The income tax rate in this case will be:

- 1% if the company employs at least one full-time employee;

- 3% if the company does not have full-time employees.

Usually the tax year corresponds to the calendar year.

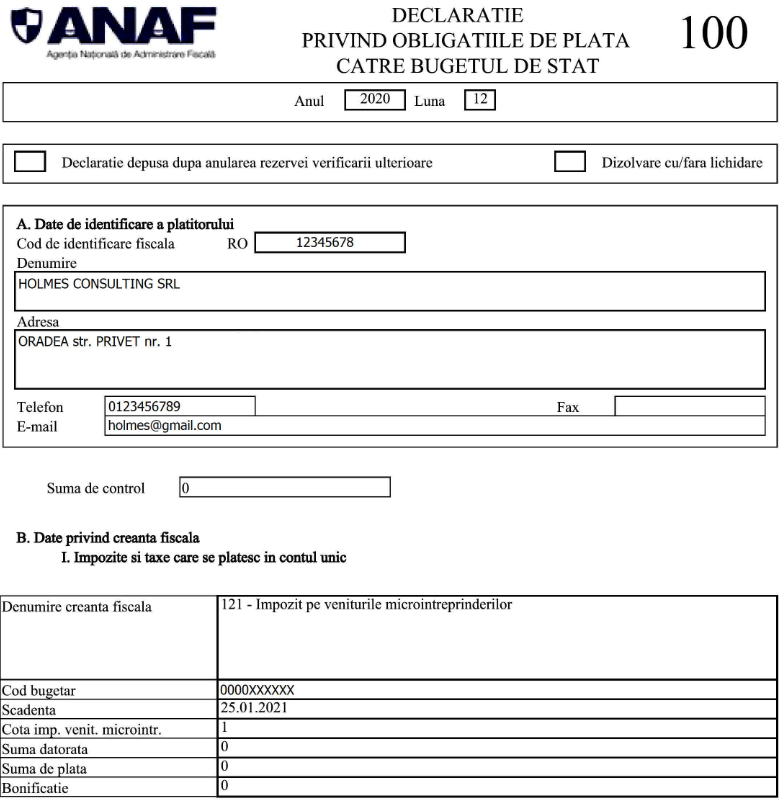

For income tax, quarterly tax returns and an annual return are filed, usually before March 25 of the year following the reporting year

Income tax is paid before the 25th day of the month following the reporting quarter, the annual payment is made before the 25th day of the third month following the reporting quarter.

We are ready to assist you in the preparation of calculations of the estimated profit for the current year as well as the assessment of tax liabilities for corporation tax and other taxes.

To determine the tax burden of the company, we recommend consult with a tax consultant

VAT submission reports

It is also necessary to take into account vat-related issues. In most EU countries, including Romania, VAT registration obligations do not arise as long as the sales turnover in the country is below the registration threshold, which is RON 300.000 (~ EUR 60.500). At the same time, initiative registration is possible.

The VAT rate in Romania is 19%.

If your Romanian Company no longer needs to be registered for VAT due to a change in the direction of activity, or due to the termination of activity, or for any other reason, we also provide services for de-registering the company with VAT in accordance with the current Romanian corporate and tax legislation.

What we offer

We provide a comprehensive range of accounting services in Romania, leveraging the expertise of Romanian accountants and Romania auditors. Our offerings include audit services, preparation of accounting and tax reports, submission of accounts to public authorities, and accounting supervision services in Romania. Additionally, we offer tax and administrative support for the offices of our clients’ companies in Romania, ensuring compliance and efficiency in all financial operations.

Having our own presence in Romania since 2018, we have acquired a unique practice of direct cooperation on the issues of our clients’ companies with government institutions.

Get consultation before start

Since Romania does not belong to offshore jurisdictions, and a Romanian company is obliged to submit reports and pay taxes on a regular basis in accordance with the procedure established by law, before starting the registration of a Romanian company, we recommend that you get advice from lawyers and auditors regarding the subsequent administration of the company.

Standard fees for our Romania services

| SERVICES | PRICE[1] |

| Monthly accounting services | |

| Preparation and submission of the VIES declaration

Preparation of a trial balance |

from 200 EUR

from 250 EUR |

| Quarterly accounting services | |

| Preparation and submission of VAT declaration | 150-400 USD per hour |

| Yearly accounting services | |

| Preparation and submission of an annual report | from 1.200 EUR |

| Statutory audit | 150-400 USD per hour |

| Additional services | |

| VAT registration | 1.200 EUR |

| VAT de-registration | 1.200 EUR |

| Consultations, communication with auditors and government agencies | 150-400 USD per hour |

[1] The price is shown without VAT. UAE VAT rate – 5%.