Registration of a BVI Company – Company Setup in the British Virgin Islands

Your consultant

Alina Marinich

Senior Business Consultant

GENERAL INFO

The BVI is one of the most famous offshore zones as up today. Small amount of government fees, fast reaction of the Registry, confidential policy, non-tax regime and absence of obligations to submit financial statements of the company to governmental bodies are the reasons why this jurisdiction is recognized as a very convenient solution for registration of the company.

The country is placed in the Caribbean, having more than 50 small and main islands. This is a wonderful archipelago with a population of 30.000, British overseas territory.

Under the BVI Business Companies Act several types of companies can be registered. The most frequently registered type of company is company limited by shares as its incorporation and further administration meets all needs of modern business. You can find below the steps of registration process of the company limited by shares and its further administration.

Key specifics

- Offshore company is completely tax exempt

- Small amount of government fees

- Confidentiality

- No requirements as to the residency of company’s officers

- No requirements as to the minimum amount of share capital

- No obligation to submit financial statements or accounts of the company to governmental bodies

INCORPORATION PERIOD

On average, it takes 5 working days to incorporate a BVI company after all necessary documents are provided and the proposed names are checked with the Registrar.

REGISTRATION PROCESS

The procedure is simple and fast. A detailed description and step-by-step instruction will guide you at full.

STEP 1

Name check

We request several names to be checked with the Registry (Registry of Corporate Affairs).

The name shall have one of the following suffixes, indicating the type of the company: “Limited”, “Corporation”,”Incorporated”, “Societe Anonyme”,”Sociedad Anonima”, “Gesellschaft mit beschrankter Haftung” or the abbreviations “Ltd”, “Corp”, “Inc” , “S.A.”, “GmbH”, “Unlimited” or “Unltd”.

The names check usually takes up to 24 hours.

Structure of the company

You should choose whether you will use nominee service (nominee director and / or shareholder) or not and, if not, advise us of the identity and number of future director (s) and shareholder(s).

Under BVI legislation the company limited by shares shall have at least 1 director, who can be resident of any country. Legal entity can be a director of the BVI company, too.

Shareholder and beneficial owner. There are also no requirements as to the residency of shareholders and beneficial owners. A shareholder can be a physical or legal entity of any residence. There shall be at least 1 shareholder and 1 beneficiary accordingly. One person can be a director, a shareholder and a beneficial owner of the company at the same time.

Confidentiality

Information about the director of the company shall be filed to the Registry of Corporate Affairs (which is one of FSC’s divisions; Financial Services Commission / FSС is the regulator of the BVI companies’ activities) within 21 days of the date of registration of the company. The register of directors is not available for public inspection. However, since 1 January 2023 the Registry shall make available, upon request, a list of current company’s directors contained in a company’s register of directors filed with the Registry (only the names of directors are available and further details remain confidential; former directors’ names are not available).

So, the registers of directors and beneficial owners of the company are not public ones and, as a general rule, are disclosed only to the registered agent and BVI governmental bodies. The information about the shareholders is not public either and is disclosed only to the registered agent. It is not filed to governmental bodies.

Information about the beneficial owner of the company is to be filed to the Beneficial Ownership Secure Search System (BOSSS). BOSSS is the platform regulated by the International Tax Authority whereby registered agents file the information. The information is closed to the general public.

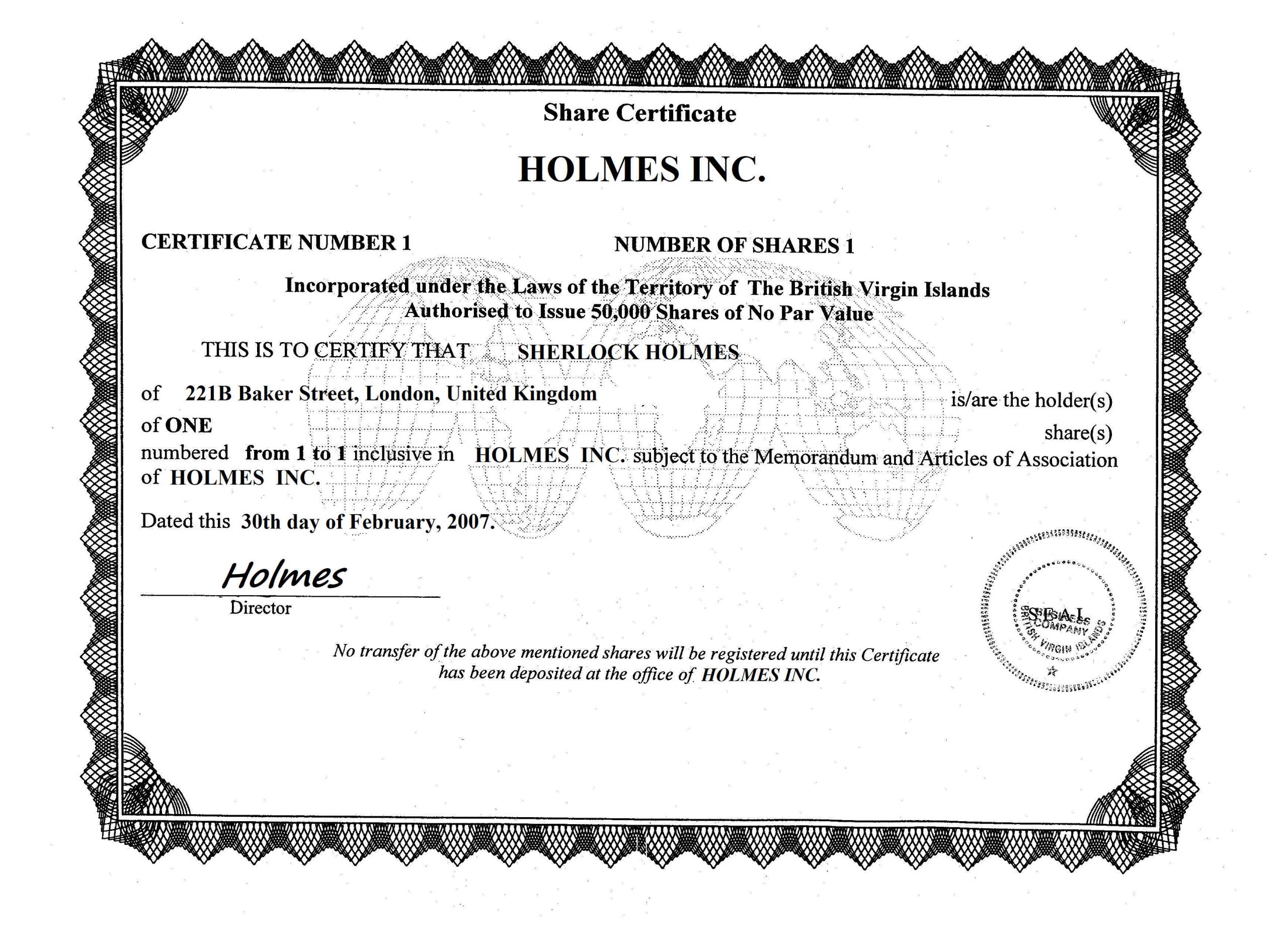

Share capital

There are no specific requirements for the minimum authorized share capital and its payment deadlines. Standard authorized share capital amounts to 50 000 shares of no par value or with a par value of USD 1 each.

Bearer shares are prohibited nowadays for BVI companies (bearer shares cannot be issued and the existing bearer shares are required to be redeemed or converted to registered shares).

The BVI legislation provides for the requirements of the issued and paid share capital: at least 1 share is to be issued and paid. The period during which the issued capital shall be paid is to be stated in the Memorandum or Articles of Association of the company.

It is necessary to draw your attention to the fact that if the amount of authorized share capital is more than 50 000 shares, government fees for the company’s incorporation and renewal will be higher.

STEP 2

Compliance procedure

We will kindly request data about the prospective company and documents for each member of the company’s structure.

Please find below the information to be provided about the company at this stage:

- Description of planned activity of the company in the very detail if possible;

- Geography of planned activity, regions where the company will run its business.

Kindly provide the following documents for each officer in the company’s structure:

1. For individuals (firstly you can send us the documents in scanned copies and later certified copies thereof; please find the requirements for certification of the documents in Step 4)

1) Document proving the identity of the person (official document with natural person’s photography and signature)

Variants of documents:

- Passport

- ID card

- Driving license

2) Document proving permanent residence address

Variants of documents:

- Passport with the registration mark (if this document is not used as proof of identity)

- Utility bill – supply of water, electricity, gas – not older than last 3 months

- Tax receipt – not older than last 3 months

- Bank statement indicating residence address – not older than last 3 months

2. For legal entity

- Corporate documents and documents proving the identity and residence address of all officers in the structure of the company. Please contact the ITA Business consultant for detailed information.

Kindly note that upon the examination of the above mentioned documents by our compliance department, the provision of additional documents may be needed, depending on the business legal structure, company’s activity and risk rating.

Invoice payment

Once the structure and the activity of the company is confirmed, we will send you the invoice to be paid for the registration of the company. The information about fees you may find below at point “Fees”.

STEP 3

Applying for the registration

Once the payment is received we will arrange for registering the company. Upon receiving the approval from the Registry we will prepare the set of corporate documents and arrange for apostille of the set.

First apostilled set of corporate documents includes the following documents:

1) Certificate of Incorporation;

2) Memorandum and Articles of Association;

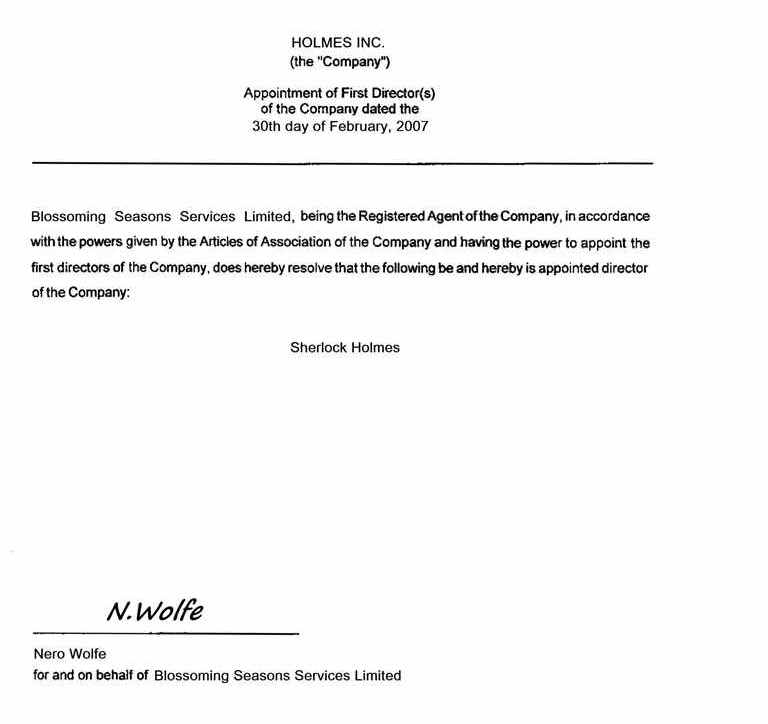

3) Appointment of First Director.

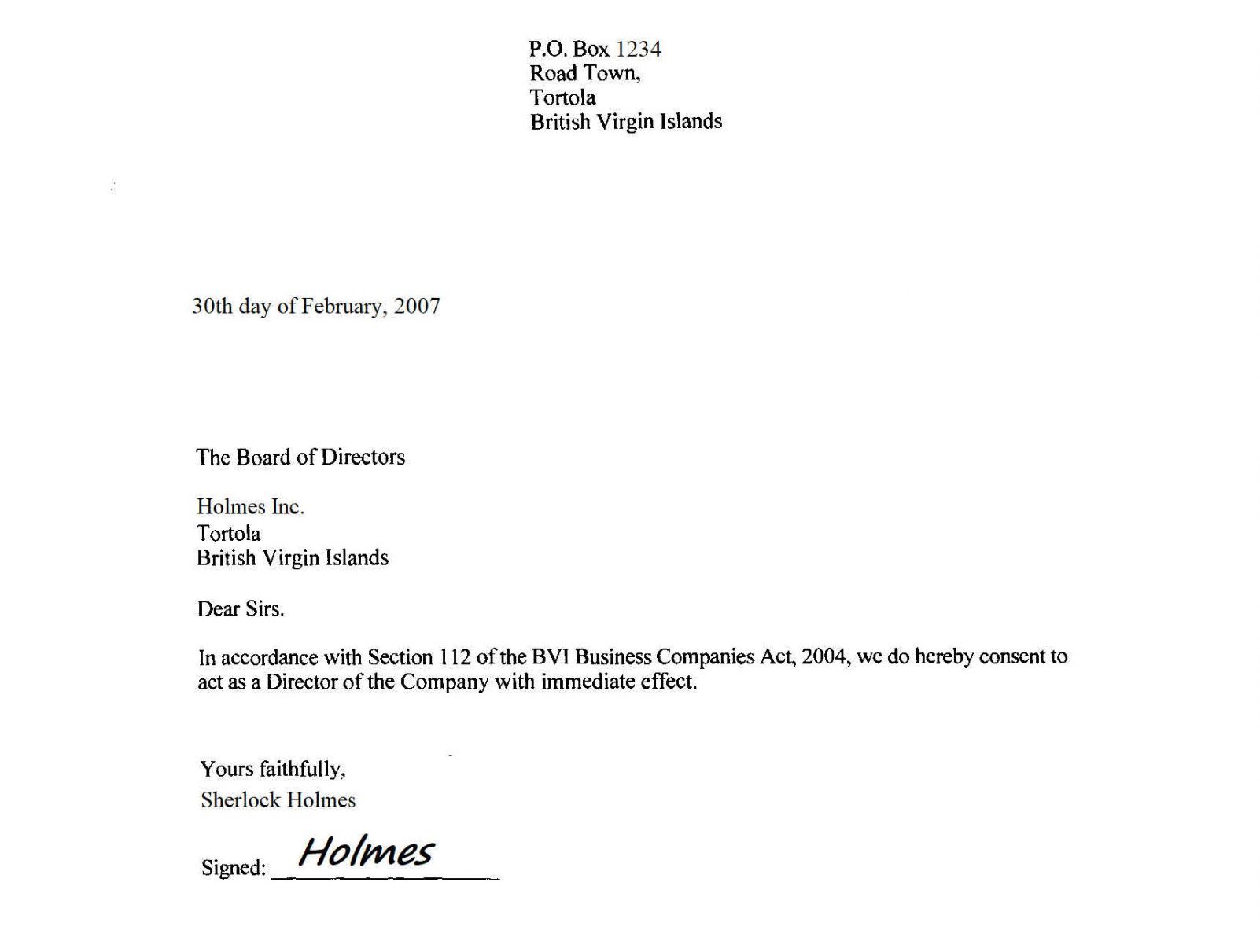

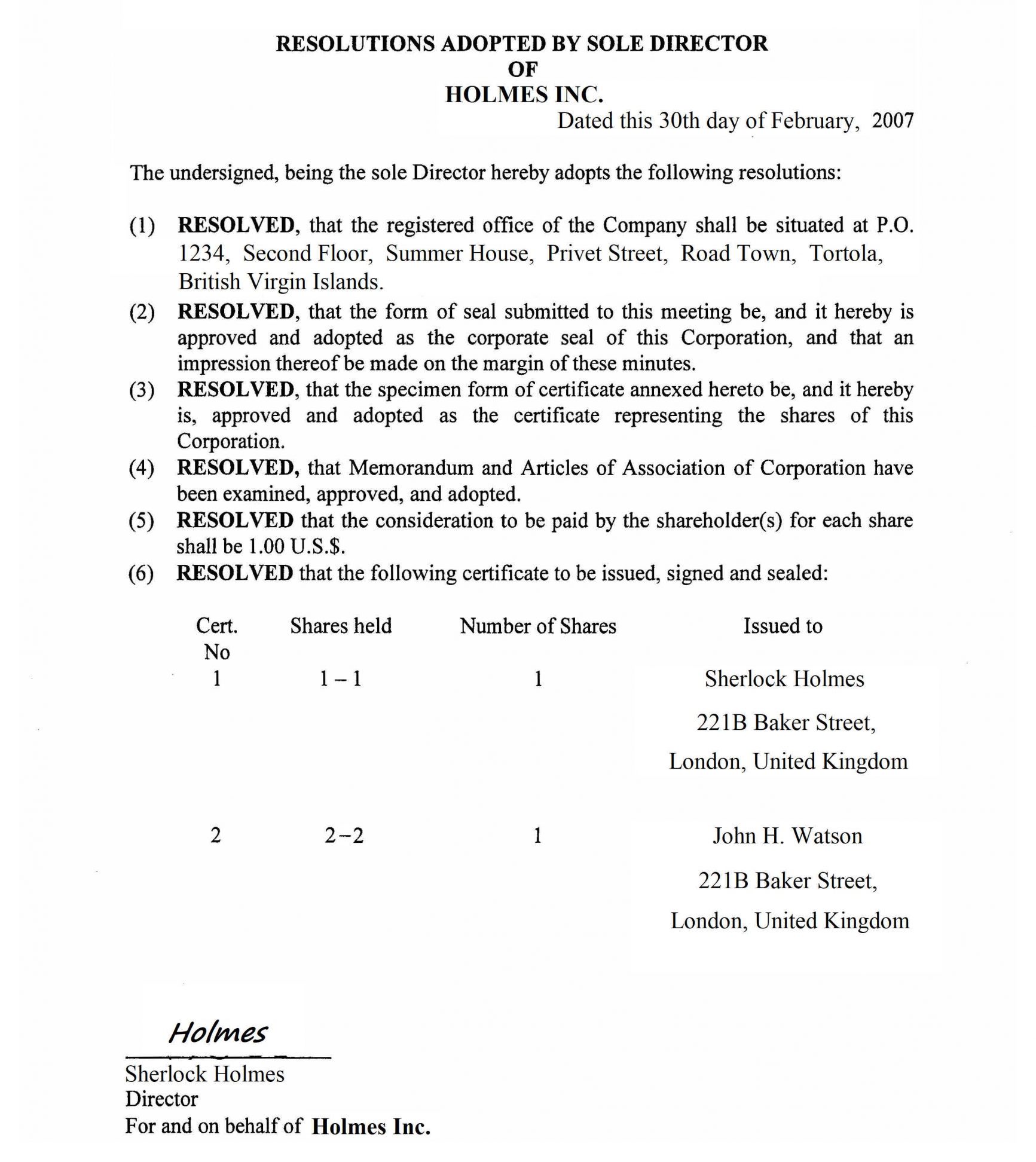

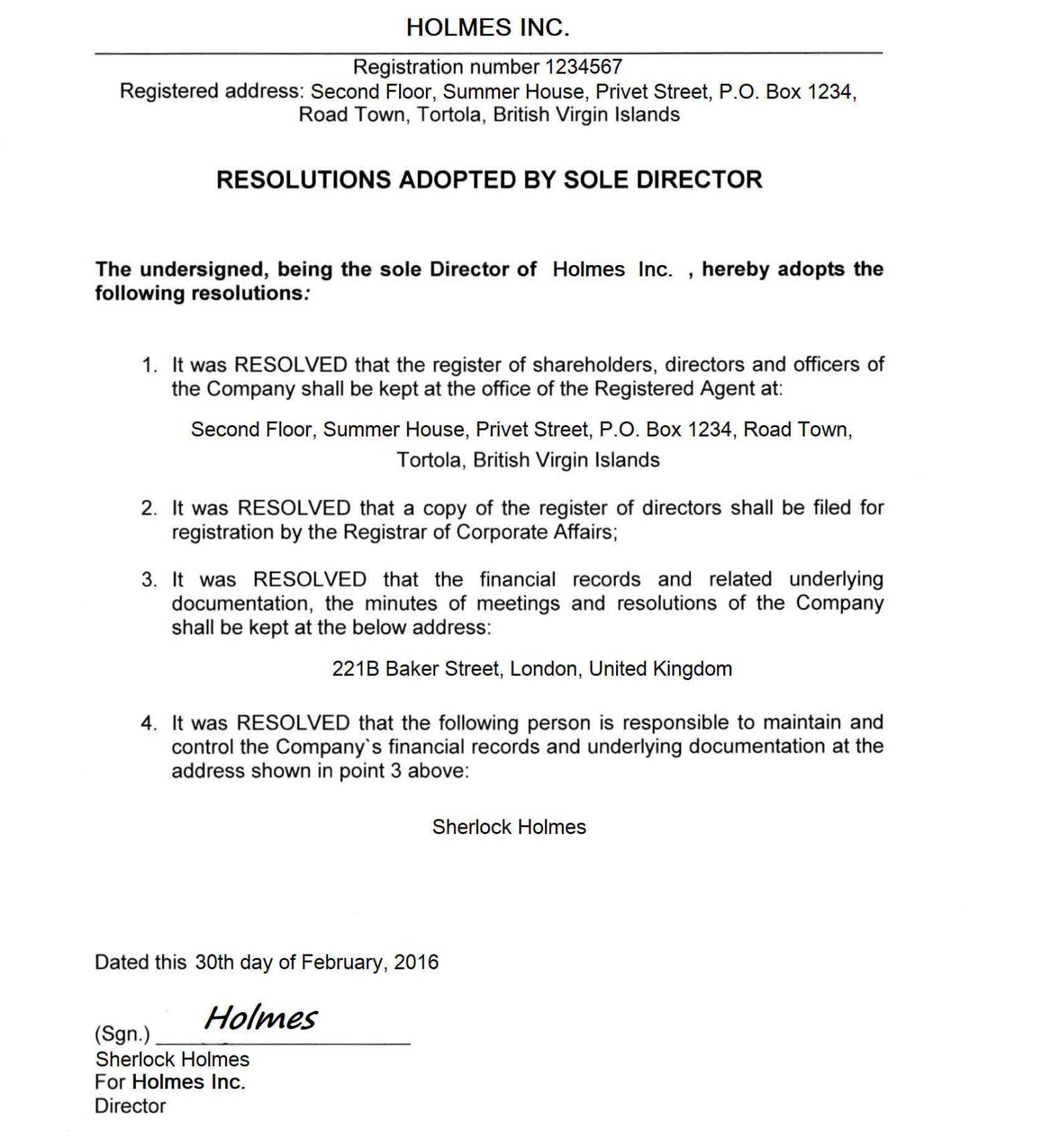

Documents signing

We will also prepare the documents for signing once the company is registered.

- The director of the company shall sign the following corporate documents:

- Consent to act as a director;

- Resolution on first share allotment;

- Resolution on records keeping address;

- Share Certificate.

- The beneficial owner shall sign the KYC documents and, if nominee service is provided, the beneficial owner and the nominee director and / or shareholder shall sign documents establishing relations between them. Standard timing for step 3 is approximate 1 – 2 weeks.

STEP 4

Collection of the KYC documents from the client

Kindly find the list of KYC documents to be provided for individuals and corporate entities in Step 2 point “Compliance Procedure”. The documents shall be duly certified by notary or by external lawyer using the special text of certification.

Corporate package is being dispatched to your location

1) Finally, we will hand over the following files of the company to you:

- Apostilled set of corporate documents and hard copies of Certificate of Incorporation, Memorandum and Articles of Association, Appointment of First Director;

- Seal of the company;

- Resolution on first share allotment;

- Share Certificate.

2) If nominee director and shareholder services are provided, we will hand over additional documents to you, namely:

- Documents, establishing and regulating relationship between the beneficial owner and the nominee director and shareholder, including the Declaration of Trust.

ECONOMIC SUBSTANCE REQUIREMENT

Economic Substance (ES) Companies and Limited Partnerships Act was enacted on 19 December 2018 and entered into force on 1 January 2019.

The ES Act effects all companies and limited partnerships registered in the BVI. More responsibilities are imposed on BVI entities carrying out “relevant activities”.

BVI entities carrying their activities in the BVI outlined as a “relevant activity” unless they are tax residents of a jurisdiction outside the territory of the BVI (provided the country of their tax residence is not on the list of non-cooperative EU countries) shall follow the legislation requirements on creating of a real economic presence in the BVI and report about it annually to International Tax Authority. This usually brings the company to tax implications in the country of presence.

“Relevant activities” mean any of the following:

- holding activity;

- distributor’s and service activity;

- banking;

- insurance;

- fund management;

- finance and leasing;

- activity of a parent company of a group;

- navigation;

- holding intellectual property.

In case your company handles any other activity, rather than “relevant” and is not subject for income tax in the BVI, it is still necessary to provide this information to your registered agent, who, in its turn, shall arrange respective filings to the International Tax Authority. So, the registered agent annually collects information from companies about their activity, assists with its classification, prepares necessary documents and reports the information to the International Tax Authority.

Failure to comply with the economic substance requirements may result in large penalties, such as a fine of up to USD 75.000 and imprisonment of up to 5 years. Kindly contact ITA Business consultants for the detailed information.

ANNUAL RENEWAL

Each BVI company shall be renewed annually starting from the second year.

For the company to be renewed it is necessary to pay the following fees:

- Government fee;

- Registered Agent Fee (including provision of the registered address).

If the company’s date of incorporation was from January to June, it shall be renewed not later than the 31st day of May next year. If the company’s date of incorporation was from January to June, it shall be renewed before 31 May next year. If the company’s date of incorporation was from July to December, it shall be renewed before 30 November next year.

TAXATION

The BVI jurisdiction is also famous for its territorial taxation regime. Income tax rate amounts to 0% for BVI entities conducting their activity outside the territory of BVI.

ACCOUNTING RECORDS KEEPING

The accounts of the company shall be in such form that is sufficient to show and explain the company’s transactions and determine, at any time, with reasonable accuracy the financial position of the company for a period of at least 5 years from the date of completion of the transaction to which the records and underlying documentation relate. There is no obligation to submit the accounts of the company to governmental bodies.

ANNUAL FINANCIAL RETURN

According to the new rules effective from 1 January 2023, a company shall file its annual financial return with its registered agent within 9 months after the end of the year to which this annual return relates (the first filing should be arranged by 30 September 2024). Registered agents are obligated to report to the FSC within 30 days after the failure to receive such annual returns in due time. The annual returns will not be filed to governmental bodies and will not be accessible to the public.

FEES

| Services | Fees (USD) |

| Company incorporation (including yearly services of registered agent and registered address, apostille services) | 1.880 |

| Annual renewal (starting from the second year), not including compliance fee | 1.470 |

| Professional (nominee) Director services per annum (without issue of the apostilled Power of Attorney) | 580 |

| Professional (nominee) Shareholder services per annum (the same person as the Director) | 430 |

| Courier delivery | 250 |

| ES classification, ES report filing, ES Legal Assessment | Upon request |

| Compliance fee

Payable in the cases of:

|

250 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (director / shareholder / beneficial owner) or legal entity (director / shareholder) if such legal entity is administered by ITA + 200 for each additional legal entity (director / shareholder) if such legal entity is not administered by ITA 350 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |

UAE Free Zone Companies

UAE Free Zone Companies

UK Companies

UK Companies

Cyprus Companies

Cyprus Companies

Hungary Companies

Hungary Companies

Romania Companies

Romania Companies

Hong Kong Companies

Hong Kong Companies

Singapore Companies

Singapore Companies

BVI Companies

BVI Companies

Seychelles Companies

Seychelles Companies

Cayman Islands Companies

Cayman Islands Companies