Audit, Accounting and Bookkeeping Services in Dubai

All legal entities registered in the UAE are obliged, in one way or another, to keep track of their financial operations and maintain up-to-date information about their assets and liabilities. Being thoroughly familiar with the requirements of the Emirati law, international standards of accounting, as well as best practice of local and international business, our dedicated team of accountants will provide you with hands-on support and assistance throughout the financial year, on a daily, weekly, or monthly basis dependent on the specific needs of your business.

UAE Incorporation Services

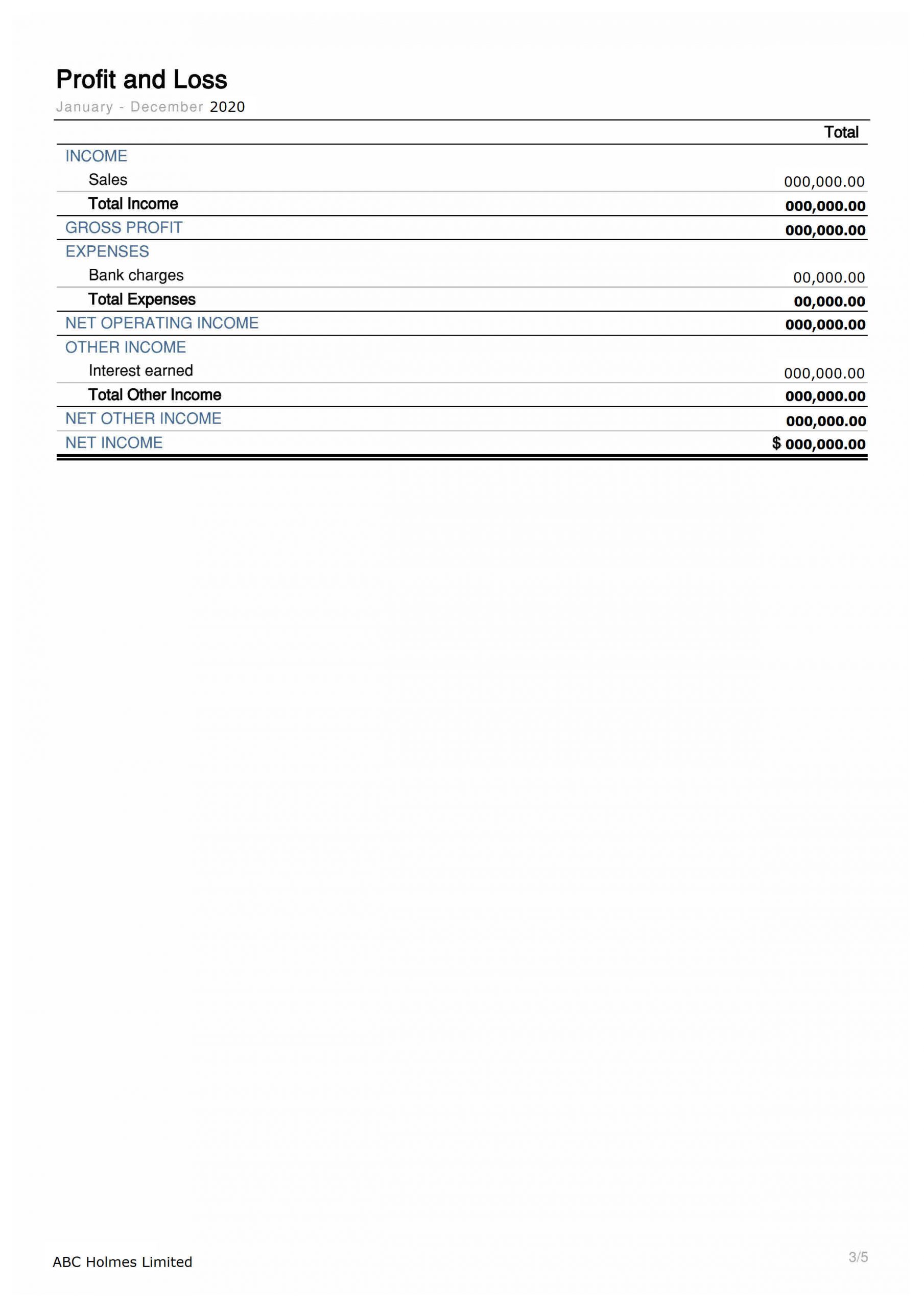

Offshore companies in the UAE do not have an obligation to file their financial statements with government authorities. Nevertheless, they are obliged to keep documents related to their economic activities and have them detailed enough to make it possible for the directors to determine the company’s financial position with reasonable accuracy at any time. We recommend to our clients to prepare and keep management accounts for their offshore companies. Being basically a simplified version of financial statements, management accounts cost less both in time and fees, but without any doubts are considered sufficient for accurate determination of the company’s financial position. Our professionals will find no difficulty in preparing such accounts for your offshore company in the UAE.

A sample page from managements accounts of a UAE company

Accounting for Free Zone Companies

An entity registered in a Free Trade Zone within the UAE must keep accounting records sufficient to correctly ascertain its financial position, assets and liabilities. In some Free Zones such financial accounts are subject to mandatory audit and are to be submitted to Free Zone authorities along with an auditor’s report, while in others no audit is required.

| Emirate | Free Zone | Audit requirement |

| Abu Dhabi | Abu Dhabi Global Market (ADGM) | Audit is required, however the companies that simultaneously meet both conditions stated below are exempt from this requirement: – turnover – not more than 13.500.000 USD; – number of employees – not more than 35. |

| Abu Dhabi | Khalifa Industrial Zone Abu Dhabi (KIZAD) | Audit is required. |

| Dubai | Jebel Ali Free Zone (JAFZA) | Audit is required. |

| Dubai | Dubai Internet City (DIC) | Audit is required. |

| Dubai | Dubai Multi Commodities Centre (DMCC) | Audit is required. |

| Dubai | Dubai South (former Dubai World Central / DWC) | Audit is required. |

| Ras Al Khaimah | Ras Al Khaimah Economic Zone (RAKEZ) | Audit is required. |

| Sharjah | Hamriyah Free Zone (HFZA) | Audit is required, however there are exemptions for some types of licenses. |

| Sharjah | Sharjah Airport Free Zone (SAIF) | Audit is required. |

| Umm Al Quwain | Umm Al Quwain Free Trade Zone (UAQ FTZ) | Audit is required. |

The following Free Zones are the ones with no mandatory audit:

| Emirate | Free Zone | Audit requirement |

| Ajman | Ajman Free Zone (AFZA) | No audit is required. |

| Dubai | International Free Zone (IFZA) | No audit is required. |

| Fujairah | Fujairah Creative Сity (FCC) | No audit is required. |

| Fujairah | Fujairah Free Zone (FFZ) | No audit is required. |

| Sharjah | Sharjah Media City (SMC) | No audit is required. |

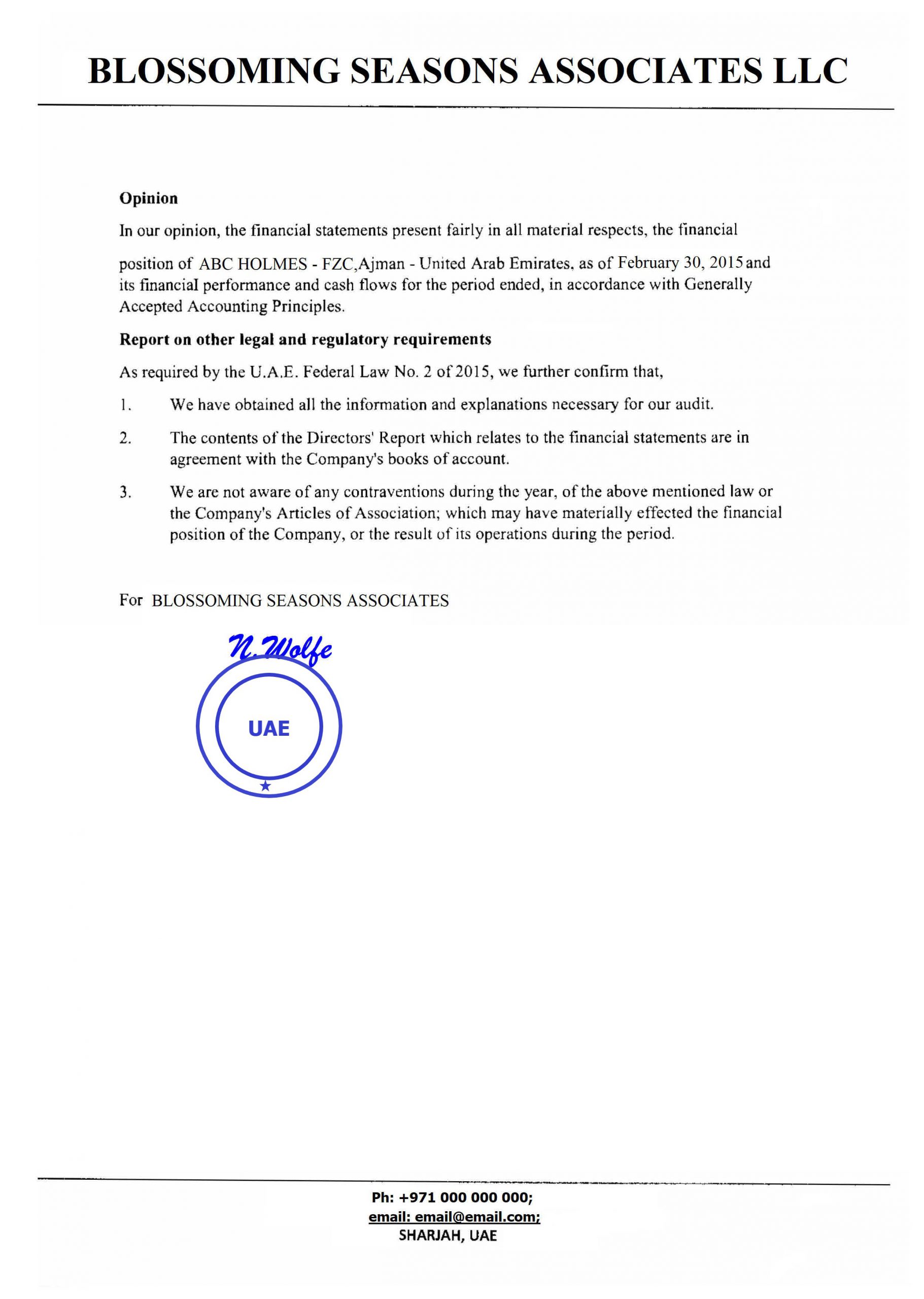

The company’s first accounting period begins on the date of incorporation and lasts for no more than 18 months. Every subsequent accounting period lasts exactly 12 months from the end-date of the previous period. Financial statements must be approved by the Board of Directors and signed by at least one director within 3 months of the end of the financial year, and submitted to the government authorities in 30 days upon that. All in all, once a financial year is over, a company has up to 4 months to finalize, have approved by an auditor (where required), and submit its financial statement to the authorities. If you company owns more than a 50% share in any other entity or several of them, it would be required to prepare a consolidated financial statement for the whole group.

The conclusions of an auditor’s report on the financial statement of a UAE company

Accounting for Mainland Companies

For every company registered in the UAE mainland, a financial statement shall be prepared each year and approved by an independent auditor. In its basic outline, the requirements are quite similar to those existing in Free Zones, with the natural exception that no mainland company is exempt from having its financial statements audited.

The first reporting period begins on the date of incorporation, and lasts from 6 to 18 months. From then on, each following reporting period would be 12 months as counted from the end date of the previous one. By the end of a reporting period, a company must finalize its financial statement and obtain an auditor’s report to approve it. This statement, along with the auditor’s report, is then to be presented at the general meeting of the shareholders within 3 months of the end of the financial year.

If a mainland company holds shares of 50% or more in other entities, it must prepare a consolidated financial statement to cover both its own particulars and those of its subsidiaries.

Get Advice Before Getting Started

Tax burden is an important factor to consider in planning your business in the UAE, and we would recommend that you seek professional advice to ascertain in advance all potential costs and administrative complexities. Choosing the right corporate structure for your business is also crucial, as it will have a lasting impact throughout your UAE company’s subsequent operation. Our dedicated advisors will be more than happy to assist you in this.

Due Diligence and Internal Audit

If you already have a running UAE company, our experienced audit team will be able to carry out Internal Audit to monitor and analyze its operational activities with a view to a streamlining and optimization of the existent business structure. If you have any plans to purchase, invest into, or deal with a company in the UAE, you may be interested in a comprehensive Due Diligence Audit to scrutinize all aspects of its financial position – in which you can rely on our assistance and support as well.

Basic Fees for Our Services

| Advice on tax burden and corporate structure | AED 660 (USD 180) / hour |

| Keeping accounts and records of your company as a structured archive of financial documents. They will be available to you at any time upon request | AED 660 (USD 180) / hour |

| Drafting financial statements, arranging for an auditor’s approval, submission to government authorities | AED 330 (USD 90) – AED 1.320 (USD 360) / hour |

| Fee for an audited financial statement with a minimal number of transactions (for a dormant company) | AED 6.280 (USD 1.710) |

The total fee for closing a financial year will depend on the quality, quantity, and complexity of the source documents you provide. We charge on a time-spent basis, with hourly rates ranging from USD 90 to USD 360 depending on the exact nature of work and the qualifications of the professional you would prefer to have assigned to it.

Accounting and Audit Issues

ITA Business Consultants, headquartered in the UAE, specializes in helping businesses fully comply with local regulations and corporate requirements. With extensive expertise in UAE company formation, audit and accounting, regulations, ITA ensures your business meets all legal obligations, including maintaining proper records, drafting financial statements, securing auditor approvals, and submitting mandatory reports to authorities. Our team guides you through the complexities of UAE compliance laws, enabling smooth operations and positioning your company for sustainable growth in this dynamic market.