Company Registration in Hong Kong

Your consultant

Alina Marinich

Senior Business Consultant

Hong Kong, a special administrative region of the People’s Republic of China, is recognized as one of the world’s leading financial centers. Its appeal for those looking to register a Hong Kong company lies in the region’s robust legal system based on common law, financial stability, and transparent regulatory environment. Unlike traditional offshore jurisdictions, Hong Kong is rarely included on international stop lists by countries and financial institutions, which enhances its credibility for global business. Additionally, companies that register a Hong Kong company and conduct all business activities and earn income exclusively outside Hong Kong may benefit from tax exemptions, making it an attractive choice for international entrepreneurs.

Key Specifics of Registering a Business in Hong Kong

- Not a classic offshore-zone

- Large number of double taxation treaties with other countries

- No requirements as to the minimum amount of share capital

- Bearer shares are not allowed

- No exchange control

- No tax on Hong Kong companies that meet all of the following requirements: operate outside the country of registration, have no economic presence and which source of income is outside the Hong Kong territory

- Establishing economic substance in Hong Kong requires a physical presence with an office and employees.

Hong Kong Company Registration Period

Registering a company in Hong Kong takes from 1 to 5 business days from the date of filings to the Registry in Hong Kong.

Purchasing a ready-made (shelf) company will take 1 or 2 hours after the necessary documents and information are provided.

Hong Kong Company Registration Process

A step-by-step guidance will follow here:

STEP 1

Preparations phase

You need to choose the name of the new company.

You need to decide on the structure of the company: director, shareholder, beneficial owner and attorney (if needed).

It is also necessary to specify the amount of the share capital and distribution of shares between the shareholders.

Name verification

We request several company names to be checked with the Registry for their availability (at least 2 names). Such names:

- can be in English, or Chinese, or both English and Chinese;

- must end with a suffix denoting the type of entity (“Limited” or “Ltd”).

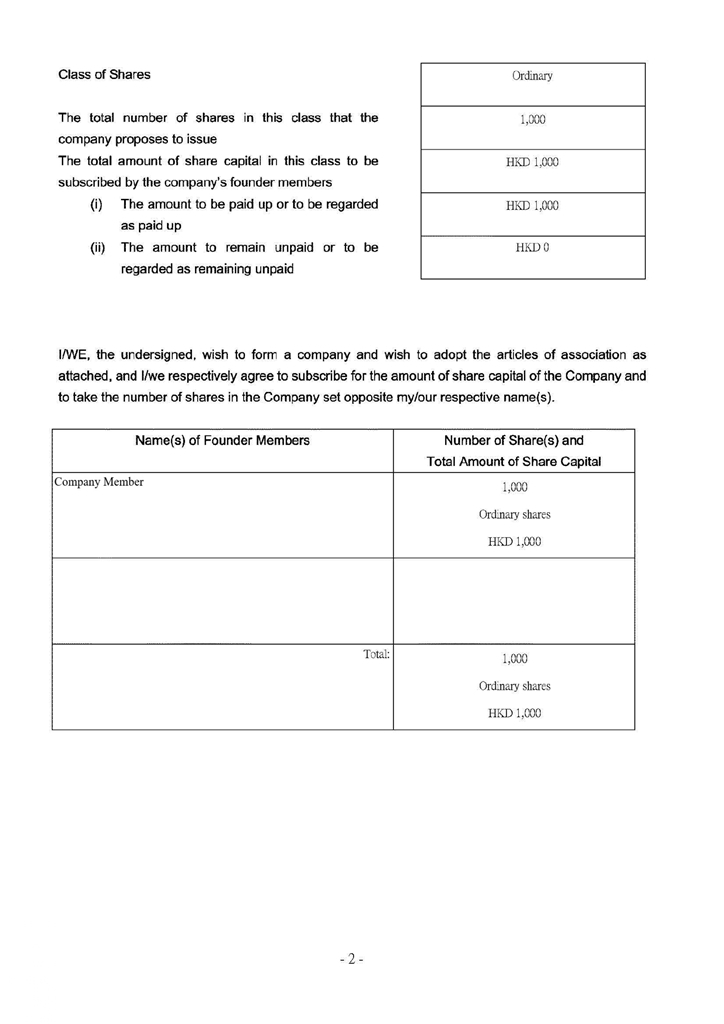

Share capital

There is no minimum share capital requirement. Hong Kong company must issue at least 1 share (payable immediately upon issue or at the time designated by the terms of the issue and specified in the relevant resolution). Usually the share capital is HKD 1.000 which is divided into shares of HKD 1 each. Share capital can be expressed in any major currencies. Bearer shares and shares without par value are not allowed.

Number of Directors

A minimum of 1 individual director is required. The director must be a natural person who can be of any nationality and need not be resident in Hong Kong. Directors must be at least 18 years of age and must not be bankrupt or convicted for any malpractices. Corporate directors can also be appointed but in addition to the individual director(s). Meetings of the Board of Directors can be held anywhere in the world.

Number of Shareholders

A minimum of 1 and maximum of 50 shareholders are allowed. There is no residency requirement for shareholders. Director and shareholder can be the same or different person(s). The shareholder must be at least 18 years of age and can belong to any nationality. The shareholder can be a person or a company (i. e. individual or corporate). Shareholders meetings can be held anywhere in the world.

Company secretary

Appointing a company secretary is mandatory. The secretary can be an individual or a corporate body and must reside in Hong Kong or have its registered office or a place of business in Hong Kong. The sole director of a company can not also be the company secretary.

The company secretary is responsible for maintaining the statutory books and records of the company and must also ensure the company’s compliance with all statutory requirements. The secretarial services provided by our company are included in the incorporation and / or annual renewal packages (and our secretary company holds Trust or Company Service Provider / TCSP License).

Compliance process

You need to provide documents for directors / shareholders / beneficial owners / attorneys and also detailed information as for the activity and geography of business.

Proof of identity:

- Scanned copy of valid passport

- Scanned copy of ID card

- Scanned copy of driving license

Proof of address (proof of residence):

- Recent utility bill (not older than 3 months)

- Recent bank statement (not older than 3 months)

- Other equivalent document which contains the address (for example, any ID document confirming the current residential address if this document is not used as proof of identity)

Invoice settlement

After receiving the invoice payment, we launch the company’s incorporation process (you may find our fees below – at the point “Fees”).

STEP 2

Registration application

The registration of the company in Registry takes 1 – 2 business days (after receiving the payment as well as the documents and information stated at the point “Compliance procedure”).

Initial corporate documents

The apostilled set of corporate documents will be ready in 7 – 9 business days after registration.

The documents issued after registration:

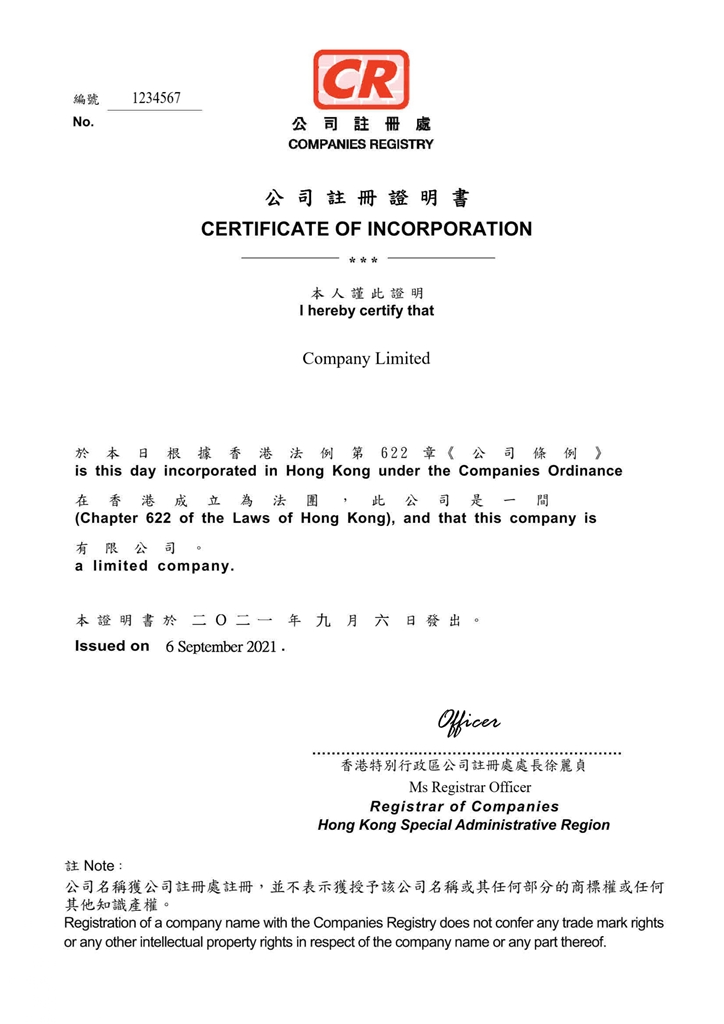

- Certificate of Incorporation – a simple copy. The Hong Kong Registry of Companies issues the certificate of incorporation electronically (as a secured PDF file e-signed by the Registrar’s authorized employee).

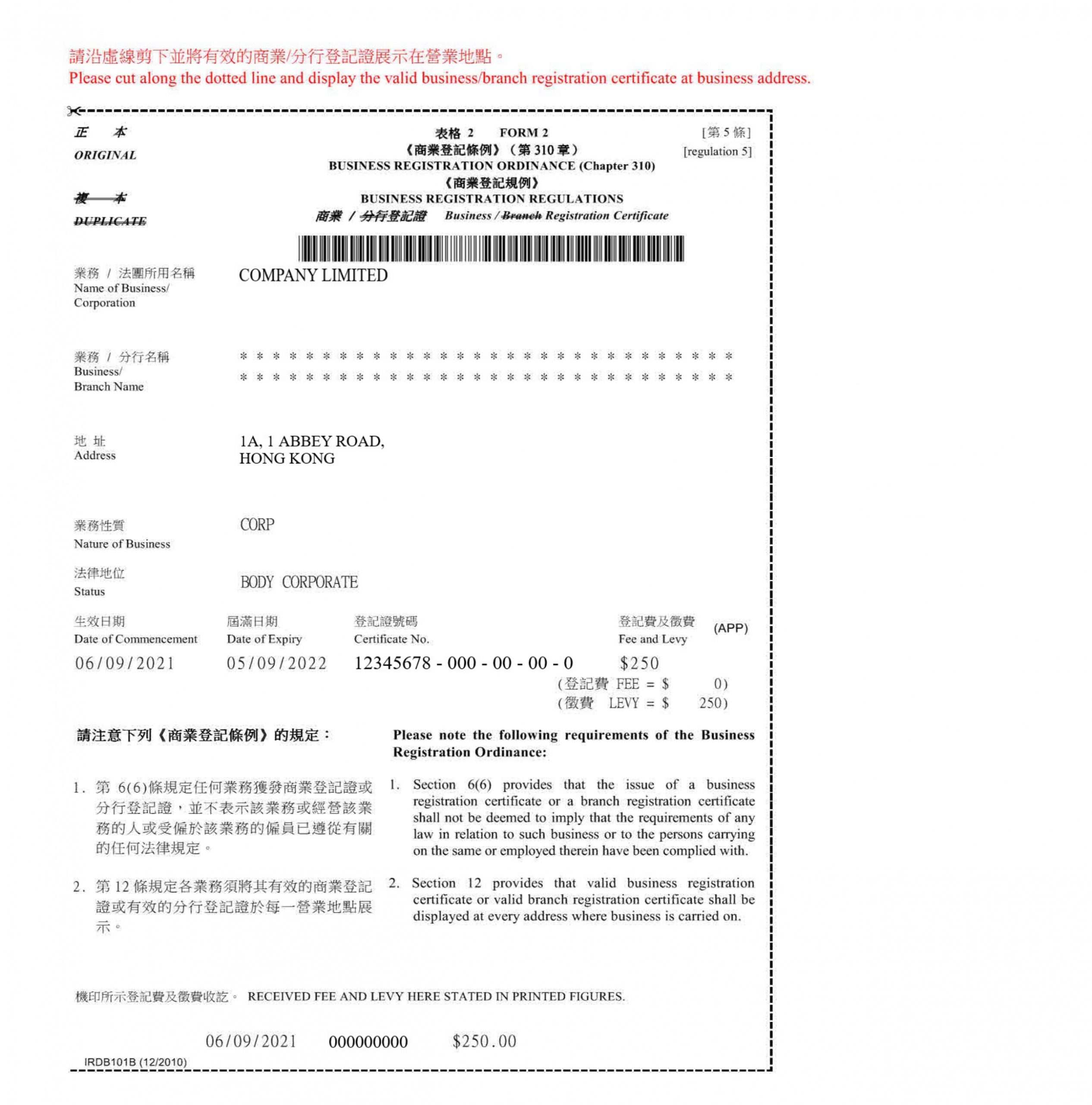

- Business Registration Certificate – a simple copy. The Hong Kong Inland Revenue Department issues the certificate electronically (as a secured PDF file e-signed by the Inland Revenue’s authorized employee).

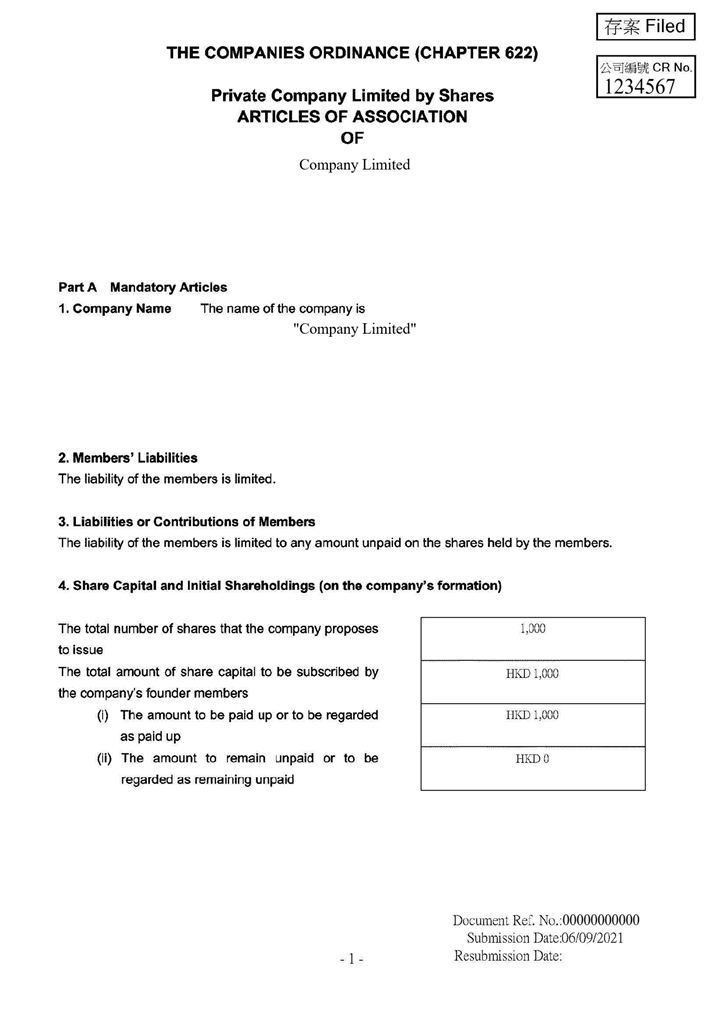

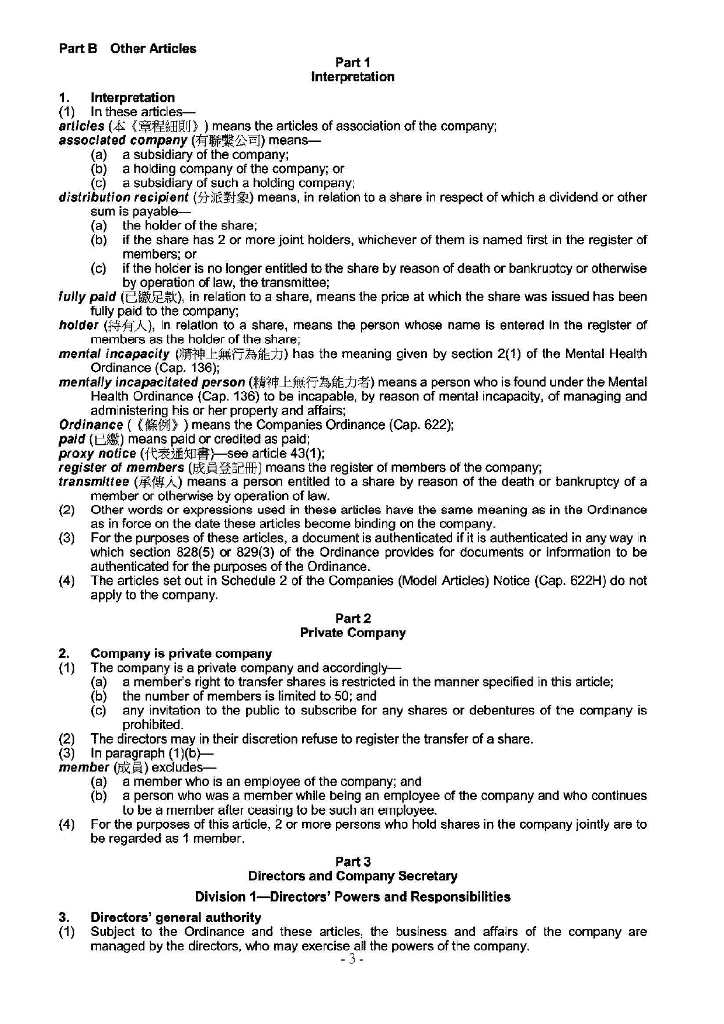

- Articles of Association – a simple copy stamped FILED, with the registration number allocated to the company. It is common practice to file Articles of Association with the Registry without subscribers’ signatures because there is no such statutory requirement. The subscribers can sign the original Articles for the company file, if necessary.

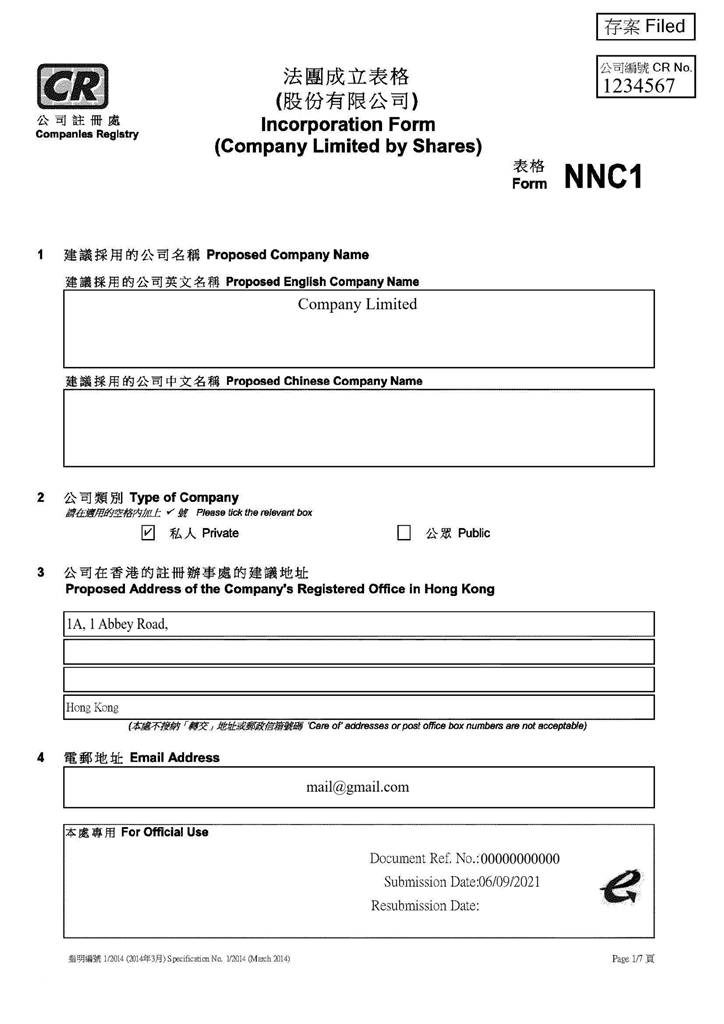

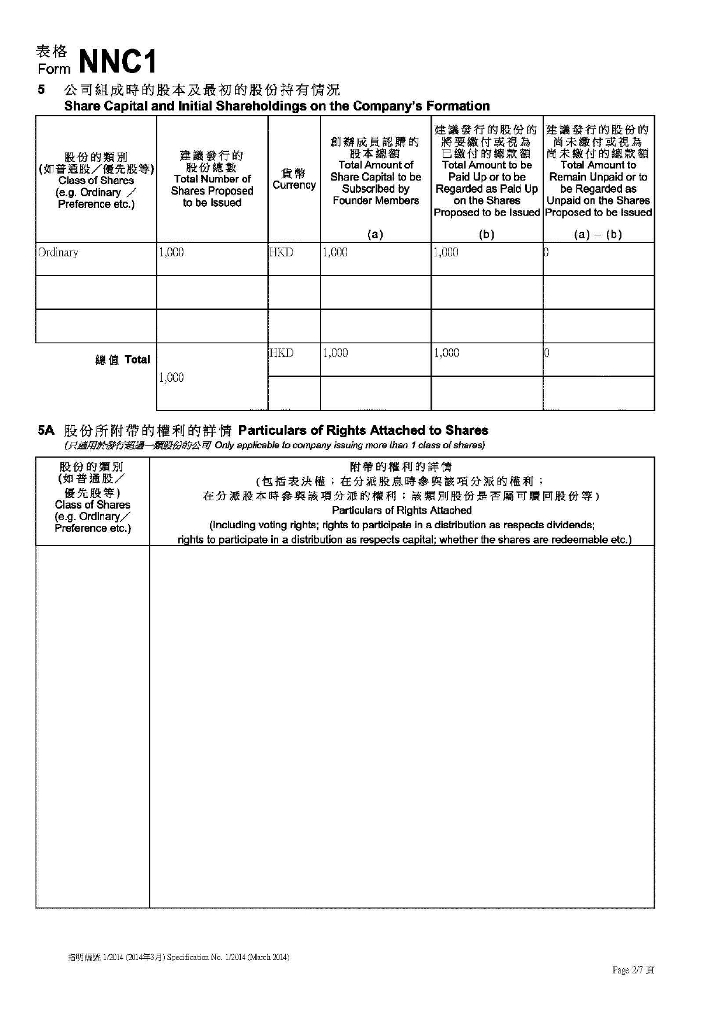

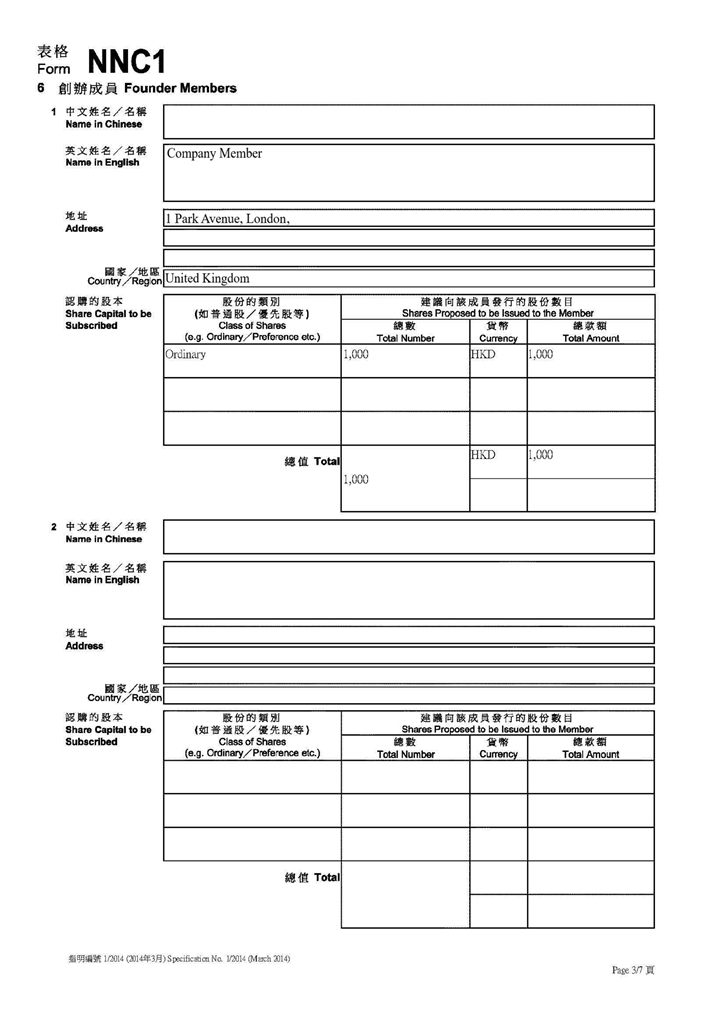

- Incorporation Form (NNC1) – a simple copy. This is a form with basic data on the company in terms of address, share capital, corporate structure of the company (i.e. secretary, director and shareholders). It also exists in electronic form by analogy with the documents above. The Hong Kong Registry of Companies issues the incorporation form electronically (as a secured PDF file).

Then preparation and signing of other corporate documents:

- Consent to act as a director;

- First Resolutions of the Founder Member(s);

- First Resolutions of Director(s);

- Share Certificate;

- Register of Directors;

- Register of Shareholders;

- Register of Secretaries;

- Significant Controllers Register.

Additionally:

Documents establishing the relations with nominee director and / or shareholder in case nominee service is provided.

Apostilled corporate documents set

After signing of all needed documents an apostilled set of corporate documents is prepared.

Copies of documents included into the apostilled set are certified by an authorized employee of the Hong Kong registered agent, with his signature certified by the Commissioner for Oaths:

- Certificate of Hong Kong Company Incorporation;

- Business Registration Certificate;

- Incorporation Form (NNC1);

- Articles of Association;

- First Resolutions of the Founder Member(s);

- First Resolutions of Director(s);

- Register of Directors;

- Register of Shareholders;

- Register of Secretaries.

STEP 3

KYC document collection

We collect the hard copies of certified KYC documents which we initially requested in scanned copies (the list of these documents you may find at the point “COMPLIANCE PROCEDURE”).

Corporate package delivery

The set of documents delivered to the client upon Hong Kong company incorporation includes:

- Apostilled set;

- First Resolutions of the Founder Member(s) – original;

- First Resolutions of Director(s) – original;

- Share Certificate – original;

- Company seal.

Public Register Disclosure

Information about company directors, shareholders and company secretary is public information as per Hong Kong company laws.

Effective from the 1st day of March 2018, every company incorporated in Hong Kong, except for those listed in the Hong Kong Stock Exchange (HKSE), are required to create and maintain a register of all persons who have significant control of the company.

An individual or legal entity has significant control over the company when the following basic requirement is met:

- the person holds, directly or indirectly, more than 25% of the issued shares in the company

or - (if the company does not have a share capital) the person holds, directly or indirectly, a right to share in more than 25% of the capital or profits of the company.

The Law provides for an additional list of criteria.

The information contained in the Significant Controllers Register is not open to the public inspection. Each company is required to keep a Significant Controllers Register at the company’s registered office.

Ongoing Company Maintenance

Annual Renewal

Each company should be renewed on the annually basis (starting from the second year) before the date of each anniversary of its incorporation. In Hong Kong the company is also required to file annual return.

Annual Return Filing

A local limited liability company must deliver Annual Return (Form NAR1) to the Companies Registry. A substantially higher registration fee is payable for late delivery of the return.

Details of the company as at the anniversary date of incorporation, including registered office address, share capital, company secretary, director, shareholder and location of company record are reported in the return.

Tax Obligations

Hong Kong follows a territorial principle of taxation i.e. only profits which arise in or derived from the territory of Hong Kong are subject to tax. Profit tax for companies conducting their business outside of Hong Kong is not enforced.

Hong Kong has one of the lowest tax rates in Asia and in the world. The current profit tax rate that is applied to businesses operating in Hong Kong is 8.25% on the first 2 million HKD of profits and 16,5% on everything thereafter, and no capital gains tax. In addition, there are numerous deductions from which your business will be able to benefit.

Audited Financial Reports

A company registered in Hong Kong must maintain a complete record of its accounting transactions. Utilizing accounting services in Hong Kong, all financial transactions must be recorded in compliance with the Hong Kong Financial Reporting Standards.

The financial statements should be audited by a Certified Public Accountant in Hong Kong. The audited financial statements must include statement of financial position / balance sheet, auditor’s report, and statement of comprehensive income / profit and loss account.

When a Hong Kong company is incorporated, it’s first financial year commenced on the date of incorporation and ends on a date determined by the Board of Directors. The Board should specify a date as the first financial year end of the company before the first anniversary date of incorporation. The first financial year end must fall within 18 months from the date of registration.

Annual Tax Return Submission

Every limited company must complete and lodge the Profits Tax Return together with the supporting documents, which are its audited financial statements, tax computation with supporting schedules showing the amount of assessable profits (or adjusted loss), and other documents and information as required within the prescribed time frame.

Fees and Charges

| Services | Fees (USD) |

| Hong Kong company incorporation (including services of registered agent and registered address for the first year, apostille services and courier delivery) | 2.250 |

| Annual renewal starting from the second year (registered agent and registered address services), not including compliance fee | 1.570 |

| Professional (nominee) Director services per annum (without issue of the apostilled Power of Attorney) | 575 |

| Professional (nominee) Shareholder services per annum | 430 |

| Courier delivery | From 250 |

| Compliance fee

Payable in the cases of:

|

350 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (director / shareholder / beneficial owner) or legal entity (director / shareholder) if such legal entity is administered by ITA + 120 for each additional legal entity (director / shareholder) if such legal entity is not administered by ITA 450 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |