Cayman Islands Company Set Up

Your consultant

Alina Marinich

Senior Business Consultant

GENERAL INFO

The Cayman Islands is an overseas territory of the United Kingdom, located in the Caribbean and consisting of 3 islands that are a part of the offshore jurisdiction: Grand Cayman, Cayman Brac, and Little Cayman.

The islands are adjacent to such states as Cuba (the northern neighbor), Mexico – in the west, with Belize, Guatemala and Honduras the Cayman Islands border in the southwest and in the southeast the border of the islands is divided with Jamaica.

The capital of the Cayman Islands, George Town, is located on the west coast of Grand Cayman Island.

The basis of the state structure of the Cayman Islands is the principle of parliamentary democracy. The country applies English common law, the official language is English, and the local currency is the Cayman Islands Dollar (KYD).

The residents of the Cayman Islands have one of the highest Gross Domestic Product (GDP) per capital – USD 91.392 in 2021. At the same time, almost all food and consumer goods have to be imported. Vegetables and fruits are grown for domestic consumption, dairy farming is widespread. The government’s main source of income is indirect taxation. Imported goods are subject to import duty from 5% to 22%. Duty on automobiles depends on their value.

The Cayman Islands is a thriving offshore financial center known for its extensive business opportunities and robust financial services sector. With over 68.000 companies registered—including nearly 500 banks, 800 insurance firms, and 5.000 mutual funds—it offers a dynamic environment for opening a business in the Cayman Islands. While tourism remains the backbone of the local economy, contributing 70% of GDP and 75% of foreign exchange earnings, the islands attract millions of visitors annually, primarily from the USA and Canada, further supporting a vibrant business landscape.

Key Specifics of Setting Up a Company in the Cayman Islands

- Offshore company is completely tax exempt

- Small amount of government fees

- Confidentiality

- No requirements as to the residency of company’s officers

- No requirements as to the minimum amount of share capital for companies

- No obligation to submit financial statements or accounts of the company to governmental bodies

Legal System of the Region

The Cayman Islands’ legal system is based on English common law. The Companies Law 1961 is formed on English law and it is the primary law governing companies in Cayman Islands. The latest amendments were introduced in 2021 – Supplement No. 8 published with Legislation Gazette No. 4 of 12th day of January 2021. In addition, the Cayman Islands is one of the first offshore jurisdictions to rely on structures for investment activities.

This state is suitable for many fields of activity, including funds, blockchain technologies, trading and storage of assets. There are no requirements for the directors and founders of the company, which also applies to shareholders, who, according to the Companies Act, can be individuals and legal entities of any residency.

A distinctive feature of the British Overseas Territory is the absence of corporate tax and foreign exchange controls. The relatively simple procedure for creating funds gradually led to the fact that about 80% of all hedge funds created all over the world are registered in the Cayman Islands.

Initially, the Cayman Islands focused on US clients, many American law firms actively opened offices in George Town and helped with the development of offshore legislation.

Types of Business Entity

The principal forms of business organization in the Cayman Islands are:

- Ordinary resident company;

- Ordinary non-resident company;

- Exempted company;

- Limited partnership;

- Exempted limited partnership.

For offshore solutions, the most common structure is the exempted company.

Exempted Company

If the company intends to conduct most of its activities outside the Cayman Islands, then it may be registered as an exempted company. As the name suggests, such a company is exempt from paying Cayman taxes.

The main features of an exempted company are as follows:

- It is not required to hold an annual general meeting on the islands (requirement for resident and non-resident companies);

- It is possible to make changes to the Articles of Association and Memorandum of Association without restrictions, but it is necessary to notify the Registrar on any changes;

- If a company is listed on the Cayman Islands Stock Exchange, it may sell shares to the public in the Cayman Islands;

- It is possible to issue shares with or without par value;

- The trade name does not need to include the word “Limited” or the abbreviation “Ltd.”;

- Registrar must give a month’s notice to a company if it is going to be struck off the register;

- Share capital can be nominated in any currency or in several types of currencies;

- In the Annual Return submitted to the Registrar, it is necessary to declare the following:

- no changes have been introduced to the Articles of Association and Memorandum of Association other than those of which Registrar has been notified;

- the provisions of the Companies Act have been complied with;

- the company’s activities took place primarily outside the Cayman Islands; and

- all bearer shares are kept by an authorized person.

Restriction on Activities

The formation of an exempted company in the Cayman Islands is available to foreign founders who plan to operate outside the country of incorporation. For the purposes of maintaining the status of an offshore company, a Cayman exempted company’s activities shall not violate the following restrictions:

- A company cannot conduct commercial activities with residents (all of them should be carried out outside of the Cayman Islands);

- It is prohibited to conduct activities in the insurance, securities investment, financial, company management, trust business, mutual fund administration and banking sectors without obtaining special licenses or registering with Cayman Islands Monetary Authority (CIMA);

- A company cannot involve resident companies in management of a company;

- It is prohibited to take loans from residents;

- A company that is not listed on the Cayman Islands Stock Exchange is prohibited from making any invitation to the public in the Cayman Islands to subscribe for any of its securities;

- It is prohibited to purchase real estate (only rent is allowed).

Cayman Islands Company Incorporation Period

Registration of a company in the Registrar takes on average 2 – 5 working days.

Cayman Islands Business Registration Process

Company Name Check Requirements

The Government of the Cayman Islands has established certain requirements that the founders must comply with when choosing a trade name for an exempted company:

- The trade name should not be simply translated, should not have complete similarity or be identical to the name of another company already existing in the register of companies. However, if the company has granted permission or is in the process of dissolution, then such a name can be used for the new exempted company;

- Trade name registration can be done in any language, but translation into English is mandatory;

- Company name should not contain the following words: “Chamber of Commerce”, “building society”, “royal”, “imperial”, “empire”, “municipal”, “chartered”, “co-operative”, “assurance”, “bank”, “insurance”, “trust”, “gaming” or “lottery”;

- According to the Registrar, the name of the company should not have any connection with His Majesty the King of Great Britain, any member of the Royal Family, or the Royal Government, as well as with any public council or government body that has been incorporated by Royal Charter.

Company Structure Members

Beneficiary

The Cayman Islands began consultations on the establishment of a Centralized Beneficiary Registry in 2021. The authorities plan to introduce the Centralized Beneficiary Registry by 2023.

Since 2017, the Cayman Islands have introduced a requirement for companies to keep records of their beneficial owners and provide them upon request to the Government’s General Registry.

This includes:

- an individual who owns, directly or indirectly, 25% or more of the shares, and also has the right to vote on behalf of the company or has the right to appoint directors and exercise influence or control over the company;

- a legal entity that, by virtue of its shares held directly in the company or its direct control over the company, would be the beneficial owner if it were an individual.

Shareholders

The minimum number of shareholders for an exempted company is one. The maximum number is not limited, unless otherwise provided by the Articles of Association.

There are no residency or qualification requirements for a shareholder, it may be either an individual or a legal entity. Use of nominee service is allowed.

There are no requirements for holding an annual general meeting of shareholders – they can be held in the Cayman Islands or elsewhere, unless otherwise provided by the Articles of Association, including via telephone call. The minutes of meetings may be stored in any place specified in the corporate documents.

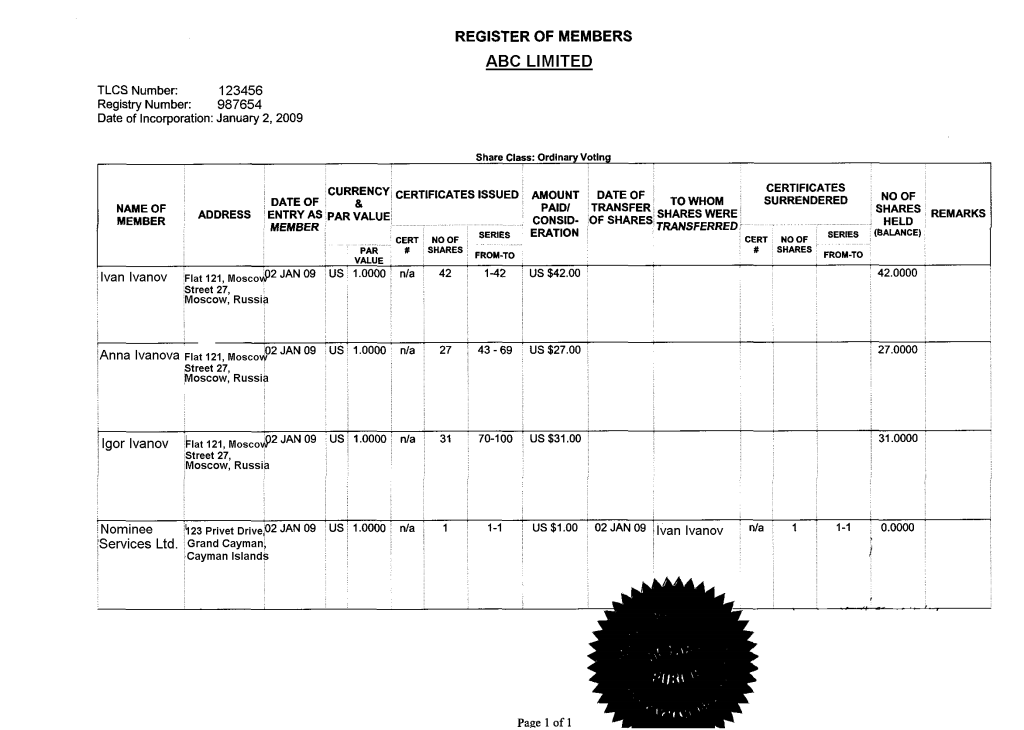

Register of Shareholders contains all information about each member of the company, as well as the amount of payments on shares and rights. This document is confidential and is provided upon the request of the inspection authorities only if there are justified reasons for that.

Director

In exempted company at least one director must be appointed, who may be either an individual or a legal entity. There are no residency or qualification requirements for the director. There are no mandatory requirements for holding meetings of directors in the Cayman Islands or anywhere else, unless otherwise provided by the Articles of Association.

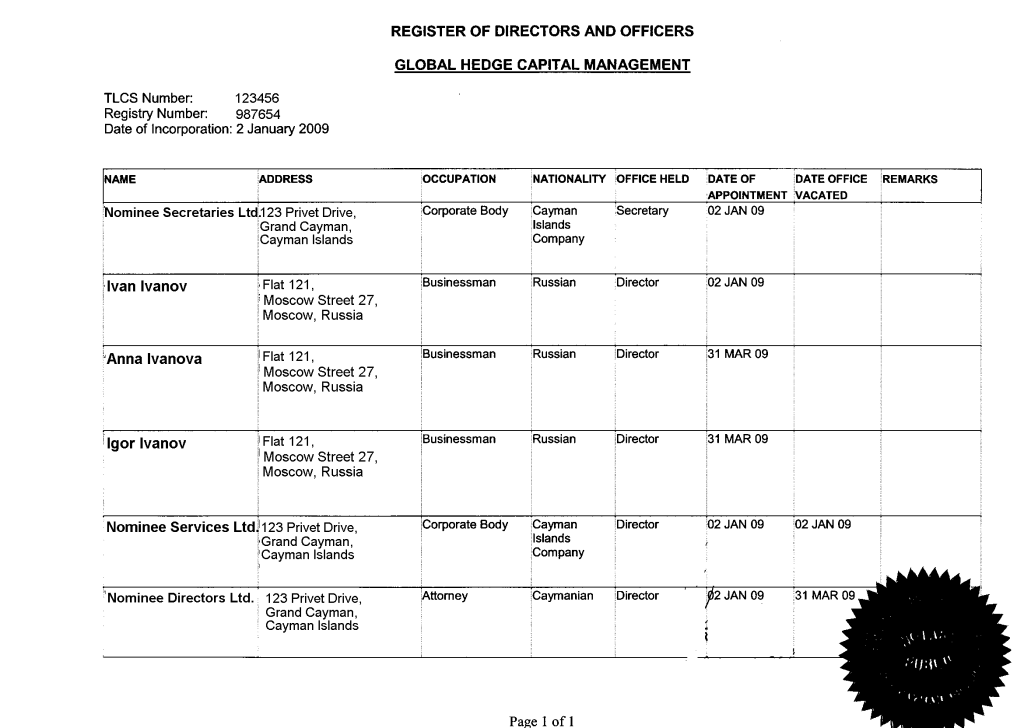

Each company must keep a Register of Directors and officers with their names and addresses in the local registered office and is obliged to send a copy of the register to the Registrar within 90 days from the date of registration as well as notify the Registrar of any changes related to directors or officers, including name changes, within 30 days of the change. This Register is public.

In case of violation of the abovementioned requirements and provisions of Section 55 of Companies Act, a fine of USD 1.000 plus USD 100 for each day of violation is imposed on the company. Every director and manager of a company who intentionally, knowingly and willfully authorizes, permits or allows such violation shall incur the same penalty.

Secretary

Companies incorporated in the Cayman Islands may not appoint a company secretary. There are no residency or qualification requirements for a secretary. However, the appointment of a legal entity as a secretary is not allowed.

Requirements to Share Capital

There is no minimum share capital requirement. A company must have at least one share in issue, but there is no minimum paid-in capital requirement. The share capital can be nominated in any currency or in several types of currencies. Bearer shares are allowed. Different classes of shares can be issued.

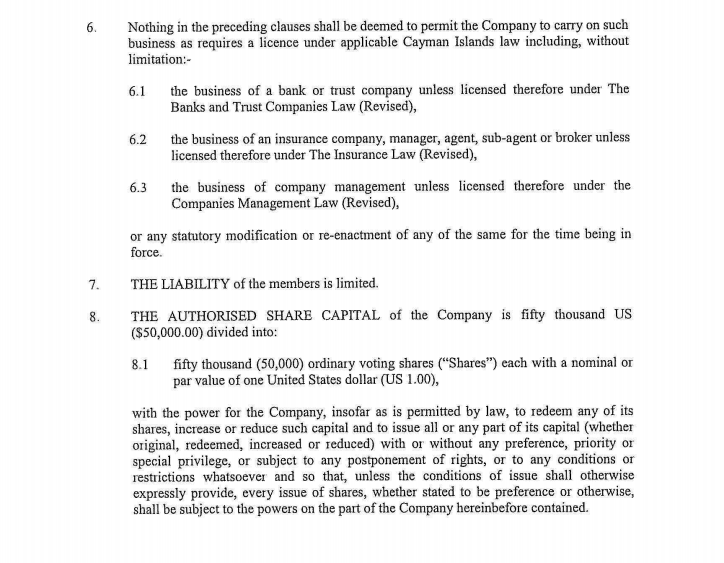

It should be noted that the Cayman Islands does not limit the exempted company’s authorized share capital, but it is recommended to form it within the limit of USD 50.000. The standard par value of a share is USD 1.

Local Registered Office

All companies must have a local registered office in the Cayman Islands. For exempted and non-resident companies a local registered office must be provided by a local CIMA licensed company management, law or accountancy practice or trust company.

The address of the local registered office must be notified to the Registrar. Until notice is given, the company is deemed to have failed to comply with legal requirements.

In addition to the above documents (Register of Directors, Register of Shareholders, Register of Beneficiaries), the following information should be kept at the local registered office: Register of Mortgages and Fees relating to company property, Partnership Interests.

Also, an exempted company in the Cayman Islands must keep accounting records for all financial transactions, the data in which is stored for at least 5 years and is provided at the request of tax auditing services and regulatory authorities.

Company Seal

There is no statutory requirement for an exempted company to have a common seal.

Registration of an Exempted Company

To register a company in the form of an exempted company, the following steps are required:

STEP 1 – Name Availability Check

We request 2 – 3 names to be checked with the Registry in order of priority. The names check usually takes up to 24 hours. Make sure that the chosen trade name fully complies with the established requirements.

STEP 2 – Compliance Procedure

The Anti-Money Laundering and Counter-Terrorist Financing legislation requires corporate service providers to identify the beneficial owners of the company, the source of their funds and the nature of activities for which they will use the company. This compliance check is quite simple and requires a client to provide the above information in free form, as well as proof of identity and of residential address for all the individuals in the company’s structure. Also, for each company, we sign an agreement with the beneficial owner for administration of the company, as well as have a client information form filled in to be kept solely in our files.

STEP 3 – Invoice Payment

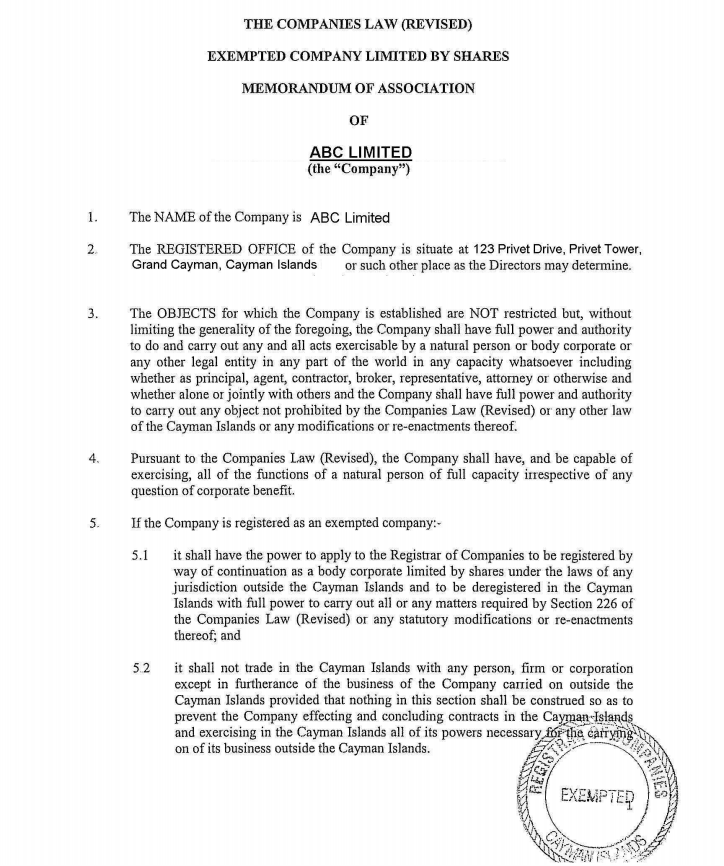

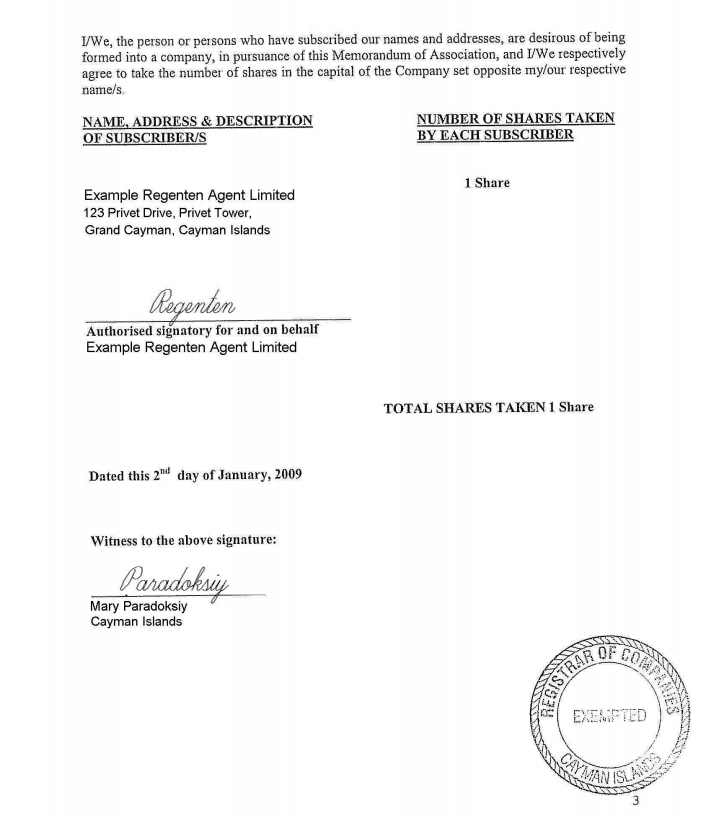

STEP 4 – Preparing a Package of Documents for Company Incorporation in the Cayman Islands

Documents required to proceed with incorporation:

- Memorandum and Articles of Association;

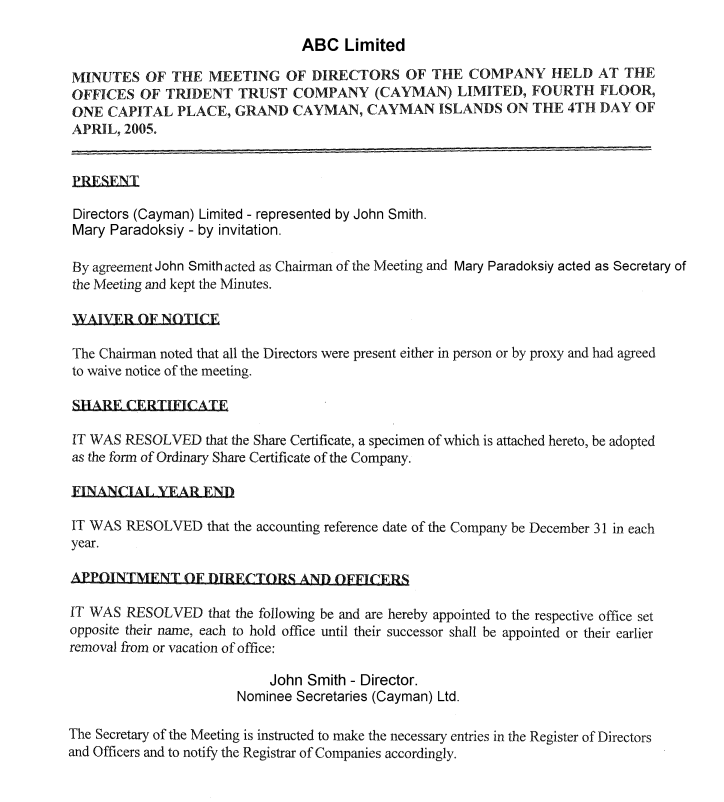

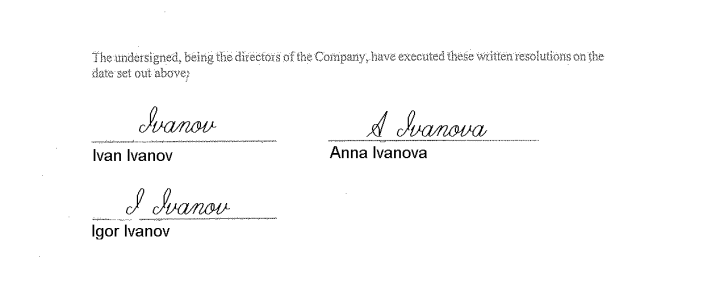

- Minutes of the first Meeting of the Subscribers (appointing the first director);

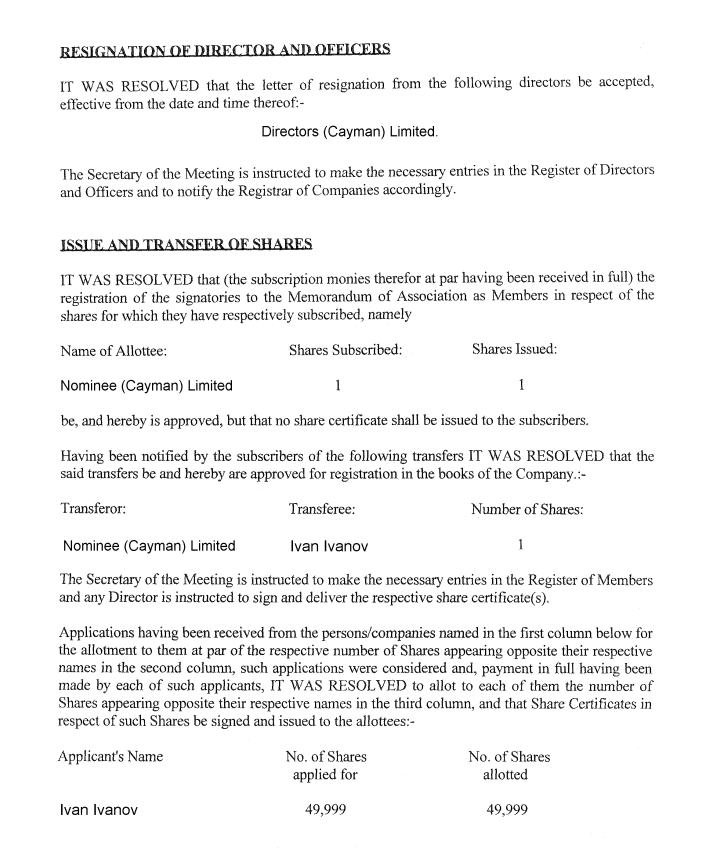

- Minutes of the first Meeting of Directors (issuing the shares);

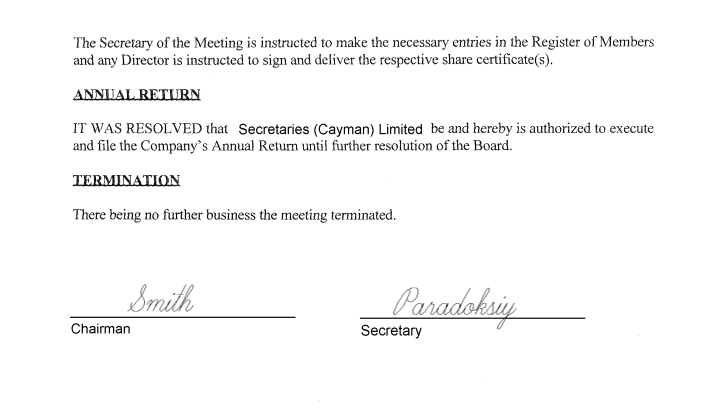

- First Sole Director’s Resolution of issue of shares;

- Register of Directors and Officers;

- Declaration of the founders, which confirms that the main activity of the company will be carried out outside the Cayman Islands.

The following documents are also prepared:

- Register of Members (kept by the registered agent);

- Register of Beneficial owners (kept by the registered agent);

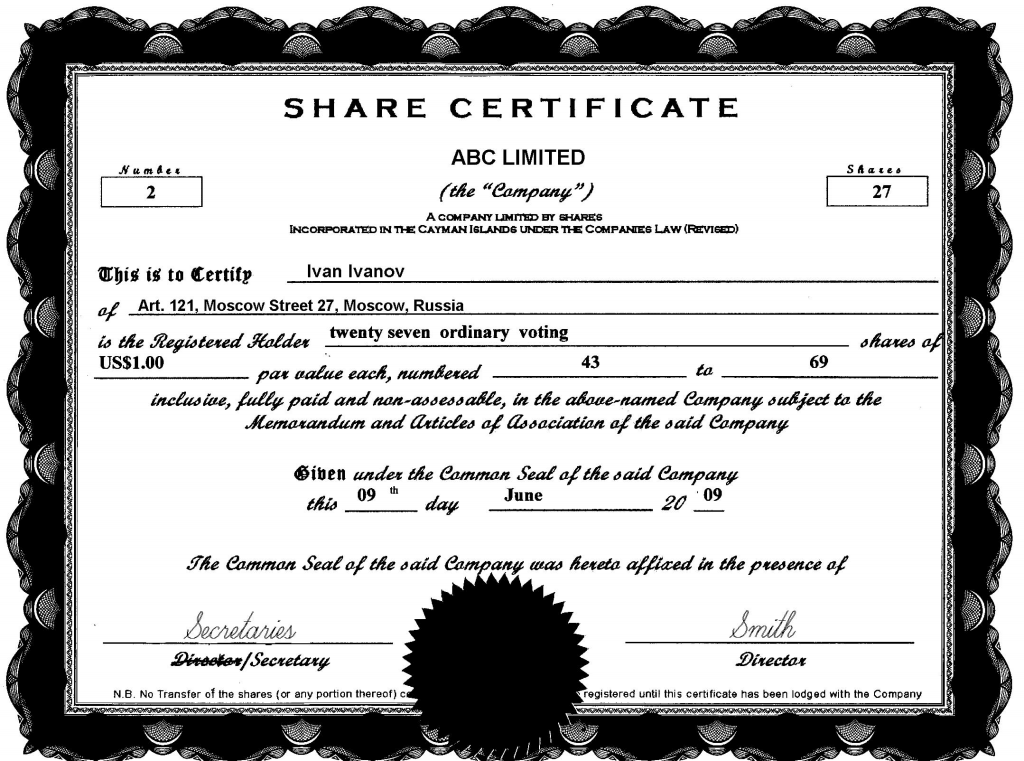

- Share certificate.

If a company has a nominee director:

- Resolution effecting the issuing of Power of Attorney;

- Apostilled Power of Attorney;

- Consent Letter;

- Director Resignation Letter;

- Nominee Director’s Declaration.

If a company has a nominee shareholder:

- Deed of Trust.

STEP 5 – Application for Registration

We submit at least 2 copies of documents for the company to the Registrar and pay the registration fee.

STEP 6 – Preparing the Constitutive Documents and Providing Them to the Client

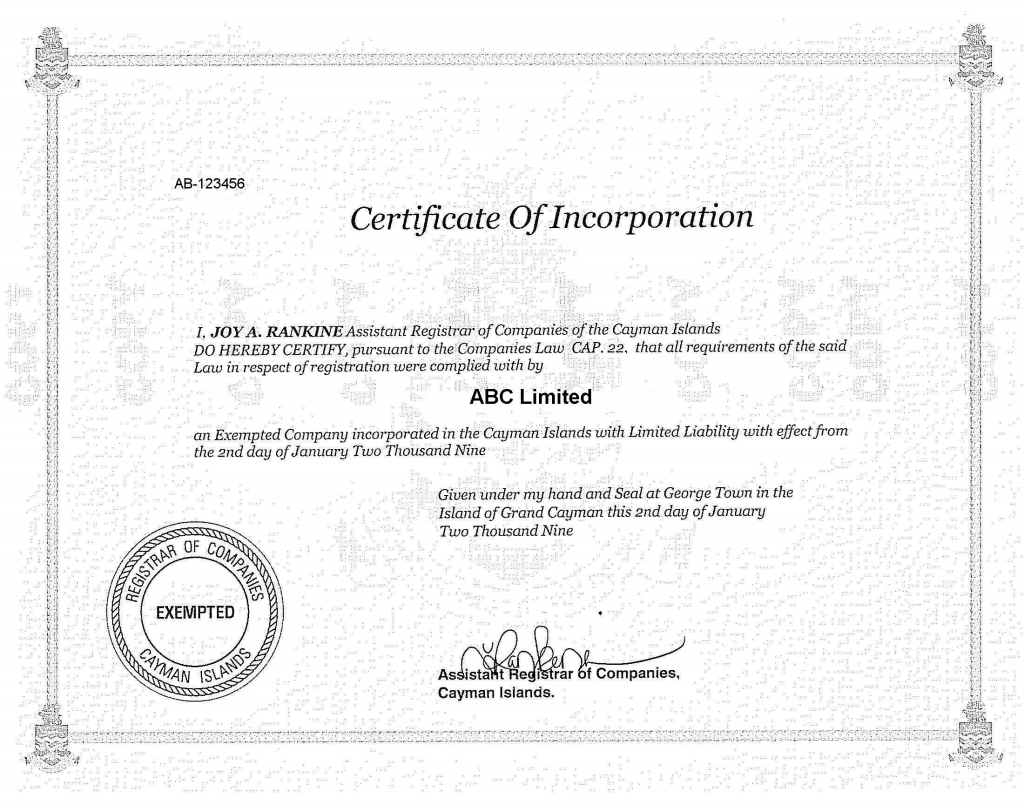

Upon Cayman company incorporation, we hand over the original constitutive documents, including minutes, share certificates and deeds of trust (if applicable), as well as an apostilled set of copies of the following documents:

- Certificate of Incorporation;

- Memorandum and Articles of Association;

- Minutes of the first Meeting of the Subscribers;

- Minutes of the first Meeting of Directors.

Privacy and Confidentiality

As for now, the information about the members and the beneficial owners of the company is not public one and is disclosed only to the registered agent. It is not filed to governmental bodies.

It is worth pointing out that in 2022 privacy in the Cayman Islands remains at the proper level due to the availability of a nominee service and a closed registers of shareholders and beneficiaries. Public information: type of company, date of incorporation, company number, status, location of its local registered office and names of directors.

Capital and Funding

As noted above, the Cayman Islands was one of the first offshore jurisdictions to rely on structures for investment activities. The current Mutual Funds Act was passed in 1993.

Until 2020, most funds in the Cayman Islands were unregulated: closed-ended funds that met certain characteristics received the status of “Exempted” and could operate without additional licenses from CIMA.

However, under pressure from the UK and a number of EU countries, offshore jurisdictions were forced to reform their legislation and introduce special licenses for closed-ended funds.

The Cayman Islands boasts a well-developed and established fund legislation, which, combined with a strong banking infrastructure, makes the jurisdiction highly attractive for starting an investment fund. As of September 2021, it was home to a total of 23.791 registered funds, including 14.305 private ones.

Different Fund Categories

If we divide funds by type of regulation, then there are 5 types of funds in the Cayman Islands:

- Administered Fund

An open fund that has an administrator licensed by CIMA. At the same time, for such funds there are no restrictions regarding the maximum number of investors or the minimum amount of investments in the fund. It is mandatory to appoint a local administrator with a license.

- Registered Fund

An open fund that is more suitable for professional investors, since the minimum investment amount from one investor must be at least USD 100.000.

- Licensed Fund

An open public fund for retail investors, with no minimum investment requirements. But this type of fund is rarely registered, since CIMA requirements for the applicant will be as strict as possible, including a very thorough check of promoters and fund managers.

- Limited Investor Fund

A fund with a small number of investors (up to 15) who have the right, according to the documents of the fund, to change directors or fund managers. At the same time, this type of funds does not contain restrictions on the minimum investment amount. Previously, similar funds were exempted from licensing, but now obtaining a separate license is a mandatory requirement.

- Private Fund (the most common type of fund in the Cayman Islands)

Private fund – a structure formed as one of the three types of entity (company limited by shares; limited liability partnership; or unit trust) and designed to raise funds from third parties for the purpose of further investment.

These are closed-ended funds, the subscription for shares of which takes place privately, through the direction of targeted offers to investors.

Structure requirements for Private Fund are as follows:

- At least 2 directors who must be individuals, without restrictions on the country of citizenship or domicile;

- At least 1 founder, either an individual or a legal entity, without restrictions on the country of citizenship or domicile;

- Auditor – a legal entity holding a special license and approved by the Cayman Islands regulator;

- Administrator – a legal entity holding a special license, without restrictions on the country of registration;

- Management company – a legal entity, without restrictions on the country of registration;

- No requirements for a minimum share capital, par value or number of issued shares;

- The share capital can be nominated in USD;

- Different classes of shares can be issued.

Registration Process for Private Fund

STEP 1 – Determining the Fund Structure

- Defining the fund’s characteristics, such as open-ended or closed-ended type and classes of shares

- Determining who will be the fund’s directors, manager, auditor, custodian and administrator

STEP 2 – Compliance Procedure

The procedure is similar to the client check performed when incorporating a company.

STEP 3 – Name Availability Check

We request 2 – 3 names to be checked with the Registry in order of priority. The names check usually takes up to 24 hours. The name must meet the following requirements:

- it must not be identical or similar to the name of any existing company;

- it must not contain prohibited names;

- it must contain the word “Fund” and end with a suffix denoting the type of entity (“Limited” / “Ltd”).

STEP 4 – Invoice Payment

STEP 5 – Application for Registration

At this stage of the application, the following documents must be ready: draft investment memorandum, draft constitutive documents of the fund, draft engagement letters with the management company, auditor and administrator. In addition, the documents for the directors and promoters of the fund are required: CV, clean criminal record certificate, diplomas, and reference letters.

STEP 6 – Drafting the Investment Plan and the Offering Memorandum

STEP 7 – Appointing the Custodian and the Auditor

STEP 8 – Filing the Memorandum and Articles of Association

STEP 9 – Drafting and Delivery of Incorporation Papers

Upon registration, we hand over the original constitutive documents, including minutes, share certificates and deeds of trust (if applicable), as well as an apostilled set of copies of the following documents:

- Certificate of Incorporation;

- Memorandum and Articles of Association;

- Minutes of the first Meeting of the Subscribers;

- Minutes of the first Meeting of Directors.

Requirements Imposed on the Created Fund by the Regulator

Since the license is issued and the account is opened, the fund can begin active work with investors. But the regulation of the fund and its subsequent obligations, of course, do not end at the stage of issuing a license.

Firstly, the funds are required to implement a policy to counter money laundering obtained by criminal means, appoint employees who will be responsible for checking investors and conducting their thorough identification. Funds must report to the Regulator and in some cases to law enforcement agencies, if they become aware of any suspicious transactions by investors.

Secondly, funds should collect and exchange information within the framework of FATCA and CRS. This requires the adoption of a specific data collection policy and the submission of standardized reports annually.

Fines for violations of these duties can total up to a million dollars.

Thirdly, funds are required to submit financial statements with an audit report to CIMA.

Useful Web Resources

| Government Agency | Web-page |

| Cayman Islands Government | https://www.gov.ky/ |

| Cayman Islands Department of Trade and Investment | https://www.dci.gov.ky/ |

| Cayman Islands General Register | https://www.ciregistry.ky/ |

| Cayman Islands Financial Services | https://caymanfinance.ky/ |

| Cayman Islands Government – Gazette Office | https://www.gov.ky/gazettes/ |

| Cayman Island Monetary Authority | https://www.cima.ky/ |

Economic Substance Requirement

The International Tax Co-operation (Economic Substance) Act, 2018 was applied from the 1st day of January 2019. It was later amended in 2021.

The Act effects all companies and limited liability partnerships registered in the Cayman Islands, but does not include investment funds, domestic companies, entities that are tax residents outside the Cayman Islands. More responsibilities are imposed on Cayman entities carrying out “relevant activities”.

The Cayman entity carrying the “relevant activity” shall follow the legislation requirements on creating of a real economic presence in state and report about it annually to the Tax Information Authority in the Cayman Islands (TIA). This usually brings the company to tax implications in the country of presence.

“Relevant activities” in accordance with the Act mean any of the following:

- banking business;

- distribution and service centre business;

- financing and leasing business;

- fund management business;

- headquarters business;

- holding company business;

- insurance business;

- intellectual property business; or

- shipping business;

but does not include investment fund business.

The entity carrying the relevant activity is required to satisfy the ES Test (Economic Substance Test). The entity satisfies the ES Test if the relevant activity:

- conducts core income-generating activities in relation to that relevant activity in the Cayman Islands;

- is directed or managed in an appropriate manner in or from the Cayman Islands in relation to that relevant activity;

- having regard to the level of relevant income derived from the relevant activity carried out in the Islands (has an adequate amount of operating expenditure incurred in the Islands; has an adequate physical presence (including maintaining a place of business or plant, property and equipment) in the Islands; and

- has an adequate number of full-time employees or other personnel with appropriate qualifications in the Islands).

There are some peculiarities of ES Testing for a number of activities. For example, entities performing holding company business are subject to a “reduced” ES Test, when the “high risk intellectual property” businesses are subject to rigorous requirements.

Should the entity carry more than one relevant activity, it is required to satisfy the ES Test for each selected activity.

Prior to making its annual return all Cayman entities are obliged to make a notification to the Cayman Islands General Registry. In addition, relevant entity shall notify the TIA annually of:

- whether or not it is carrying on a relevant activity;

- if it is carrying on a relevant activity, whether or not it is a relevant entity;

- in the case of an entity that is carrying on a relevant activity and is tax resident in a jurisdiction outside the Islands and shall provide appropriate evidence to support the information provided in the notification as may reasonably be required by the authority.

Relevant entity’s failure to satisfy the ES Test may result in penalties for up to USD 12.500 and for USD 125.000 if it is not satisfied in the subsequent financial year. The Act also states a penalty (fine up to USD 12.500 or with 5 years imprisonment, or both) for a person to knowingly or willfully supply false or misleading information to the TIA. Kindly contact ITA Business consultants for the detailed information.

Annual Renewal

Following the year of registration and thereafter each Cayman company shall be renewed.

For the company to be renewed it is necessary to pay the following fees:

- Government fee;

- Registered Agent Fee (including provision of the registered address).

VAT and Taxes

For exempted companies there is no tax on income, VAT, capital gains and distributed dividends for 20 years from the date of registration.

Stamp duty is paid in relation to real estate transactions at a rate of 7,5%. The tax is also paid on transactions with shares of real estate companies. For mortgages and certain other transactions, stamp duty is levied at rates of 1% – 1,5%.

Accounting Records Keeping

Cayman Islands accounting regulations require that a company’s accounts be maintained in a manner sufficient to clearly show and explain all transactions and to determine the company’s financial position with reasonable accuracy at any time, for at least five years from the date of each transaction. There is no obligation to submit these accounts to governmental bodies unless the company is regulated by the Cayman Islands Monetary Authority (CIMA).

Fees and Prices

| Services | Fees (USD) |

| Company incorporation (including yearly services of registered agent and registered address, apostille services) | 5.580 |

| Annual renewal (starting from the second year), not including compliance fee | 5.200 |

| Professional (nominee) Director services per annum (not including issue of the apostilled Power of Attorney) | 580 |

| Professional (nominee) Shareholder services per annum | 430 |

| Courier delivery | 250 |

| ES classification, ES report filing, ES Legal Assessment | Upon request |

| Compliance fee

Payable in the cases of:

|

250 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (director / shareholder / beneficial owner) or legal entity (director / shareholder) if such legal entity is administered by ITA + 200 for each additional legal entity (director / shareholder) if such legal entity is not administered by ITA 350 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |