Registration of Cyprus Company

Your consultant

Alina Marinich

Senior Business Consultant

Today, Cyprus is recognized as a leading international commercial and financial center, attracting global entrepreneurs who choose registration company in Cyprus due to its advantageous business environment, including favorable tax rates, strategic location, and efficient incorporation processes.

From a corporate perspective:

- belongs to common law countries, companies law in Cyprus was developed on the basis of English law and is quite flexible;

- offers accelerated company formation, it generally takes several days to set up a new company;

- enables to create a structure where the country of incorporation, country of residence of the director and country of the bank account coincide (requirement of most banks and counterparties);

- best option from the viewpoint of company management mechanisms (drawing up non-standard Articles, shareholders agreement, share option scheme, etc.).

From a tax perspective:

- not an offshore jurisdiction, not blacklisted or grey-listed by the FATF or OECD;

- relatively low income tax rate (12,5%);

- IP Box regime – tax incentives for companies that work with IP Rights;

- no withholding tax on outgoing dividends;

- no tax on incoming dividends either;

- no capital gains tax (for example, no tax on members selling their shares in the company);

- wide network of double tax treaties with other countries;

- an opportunity to create substance in Cyprus and acquire a tax resident status; a work permit for foreign employees can be obtained in Cyprus rather quickly.

The most common uses of a Cyprus company are:

1) Holding shares / participations in subsidiaries (group of companies):

- no income tax on profit distributed to Cyprus non-resident shareholders;

- no tax on dividends received by a Cyprus holding company;

- no withholding tax on paid out dividends;

- no tax on the sale of shares in subsidiaries.

2) Holding intellectual property rights;

3) Trading (export / import):

- Cyprus membership in the EU allows the company to obtain a VAT number, which makes it possible to effectively conduct international trade;

- VAT rate ranges from 5 to 19%;

- a company can be exempt from VAT if it provides its goods or services to Cyprus non-residents;

- Cyprus has one of the lowest income tax rates – 12,5%.

Those wishing to establish a legal entity in Cyprus usually choose a private or public (less common choice) company with limited shareholder liability.

Business Structure Requirements

- At least 1 director – either an individual or a legal entity, without restrictions on citizenship or country of domicile. The residence of the director is irrelevant for the incorporation of the company. But it should be noted that the residence of the director of the company affects the residence of the Cyprus company itself.

- At least 1 shareholder – either an individual or a legal entity, a resident or citizen of / domiciled in any country.

- A secretary must be appointed. This function can be performed by both individuals and legal entities, residents and non-residents.

The secretary is usually the firm that provides directorship services and the registered office – it is more convenient to administer the company in Cyprus. It is important to note that the director of a company cannot act as secretary, unless the company has only one shareholder.

- There is no minimum share capital. A company usually issues 1.000 shares of EUR 1 each. All issued shares must be paid up by the shareholders.

Bearer shares, fractional shares, and no par value shares are not permitted to be issued. Cyprus company shares are registered shares, they can be divided into any number of classes and series and provide for special preferential rights.

Cyprus Company Registration Period

Incorporation of a new private company takes approximately from 3 to 4 weeks. Accelerated company formation is also available; in this case incorporation period is 7 – 10 working days.

Cyprus Offshore Company Registration Process

A Cyprus company incorporation procedure includes the following steps:

STEP 1 – Company Name Availability Check

We request 2 – 3 names to be checked with the Registry in order of priority. The name must meet the following requirements:

- it must not be identical or similar to the name of any existing company (either in spelling or pronunciation);

- it must end with a suffix denoting the type of entity (“Limited” or “Ltd”).

STEP 2 – Regulatory Compliance Process

The Prevention and Suppression of Money Laundering and Terrorist Financing Law requires corporate service providers to identify the beneficial owners of the company, the source of their funds and the nature of activities for which they will use the company. However frightening it may sound, this compliance check is quite simple and requires a client to supply the above information in free form, as well as provide proof of identity and of residential address for all the individuals in the company’s structure. Also, for each company, the beneficial owner signs an agreement for administration of the company and provision of audit services, as well as fills in a client information form, to be kept solely in our files.

STEP 3 – Payment of Invoices

Once the invoice payment is received, we initiate the company incorporation process (please refer to the “Fees” section below for details).

STEP 4 – Registration of Founding Documents

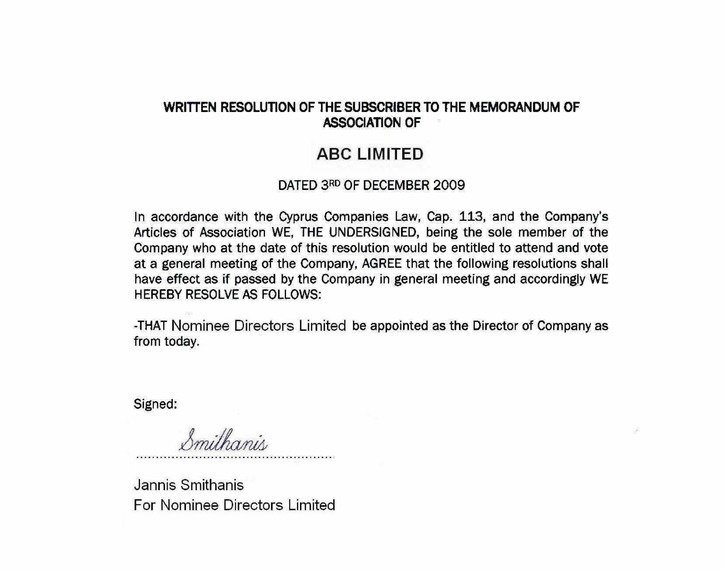

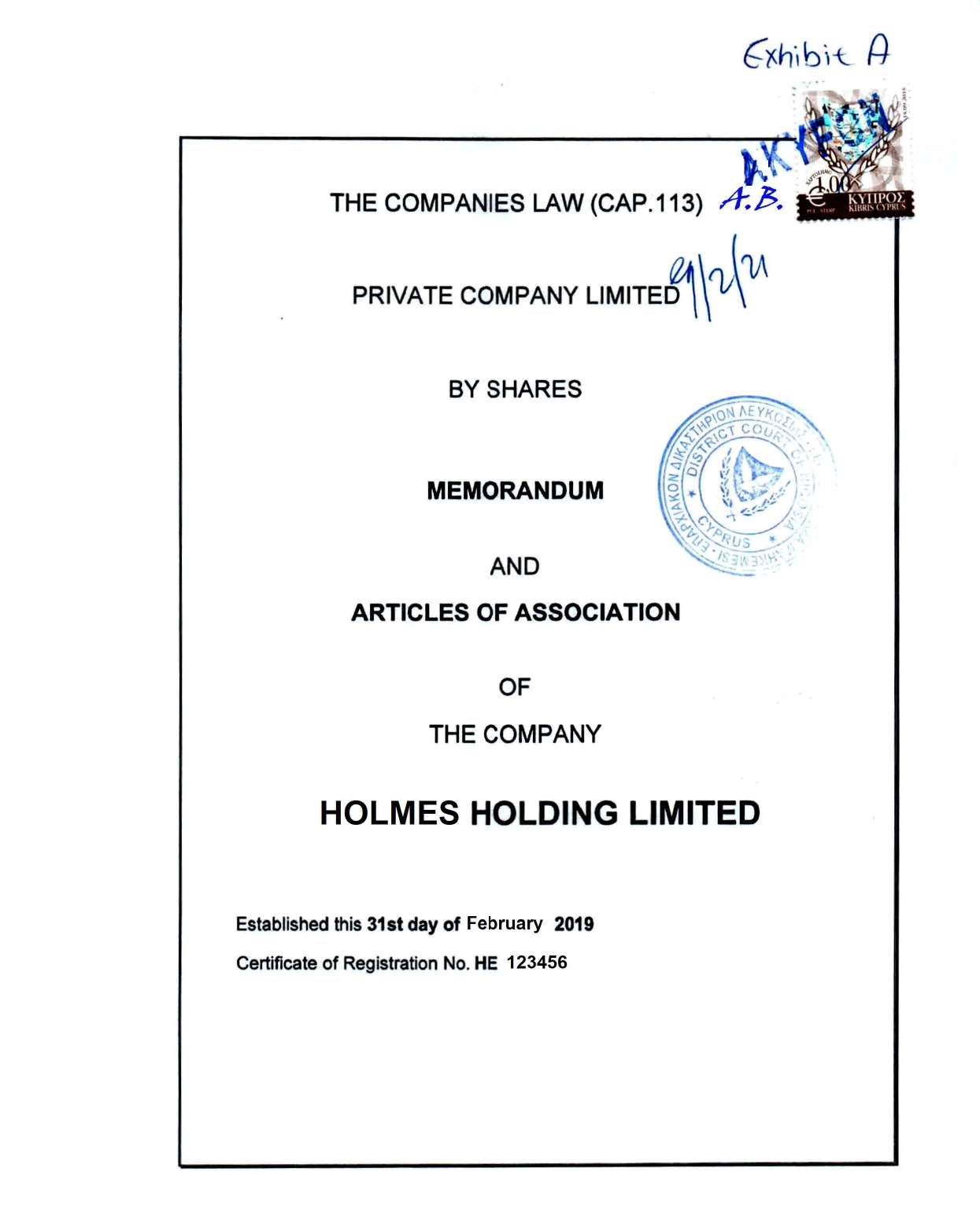

At this stage, a memorandum and articles of association are drawn up and signed. The memorandum states the name, structure and main objects of the company, the limited liability of the members (for companies with liability limited by shares/guarantee), the authorized capital and its division into shares, as well as other provisions (Companies Law, Chapter 113, Part 1, section 4). The articles set out the principles of relationship between the members of a Cyprus company, describe the procedures of convening meetings of shareholders, of making decisions, and of transferring shares. Future shareholders (before incorporation – subscribers) sign the memorandum and articles of association of the company and appoint the first director by resolution.

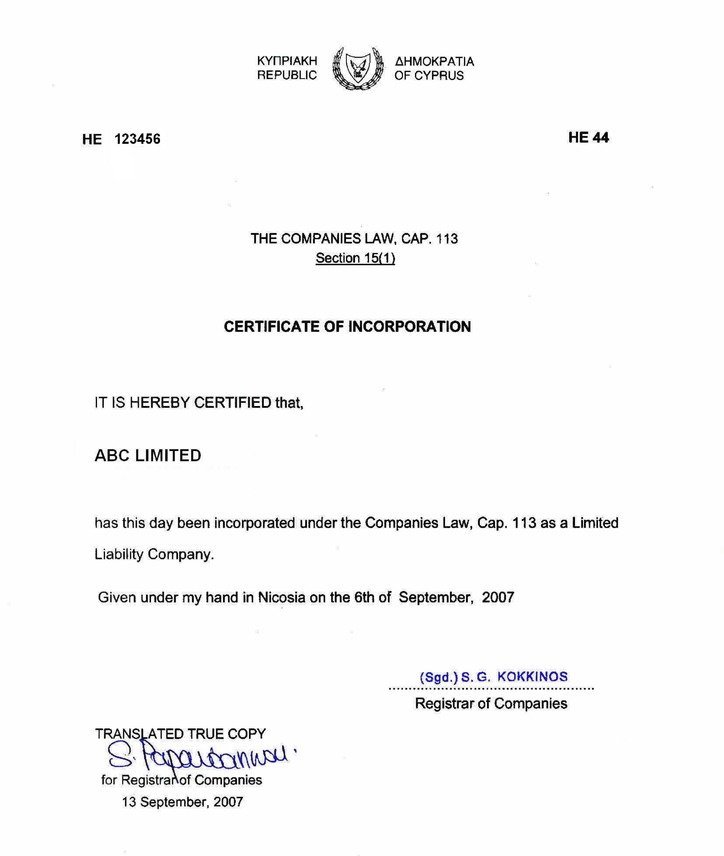

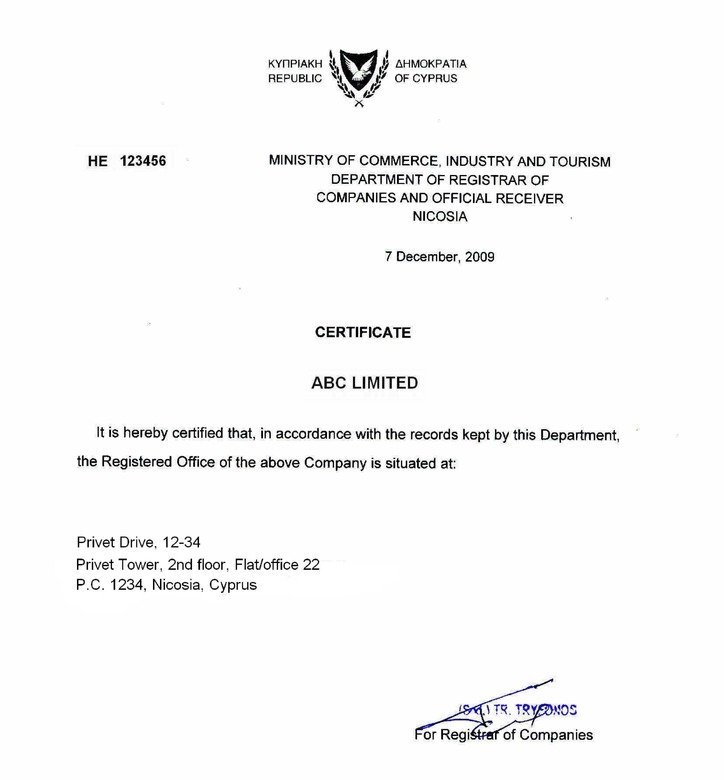

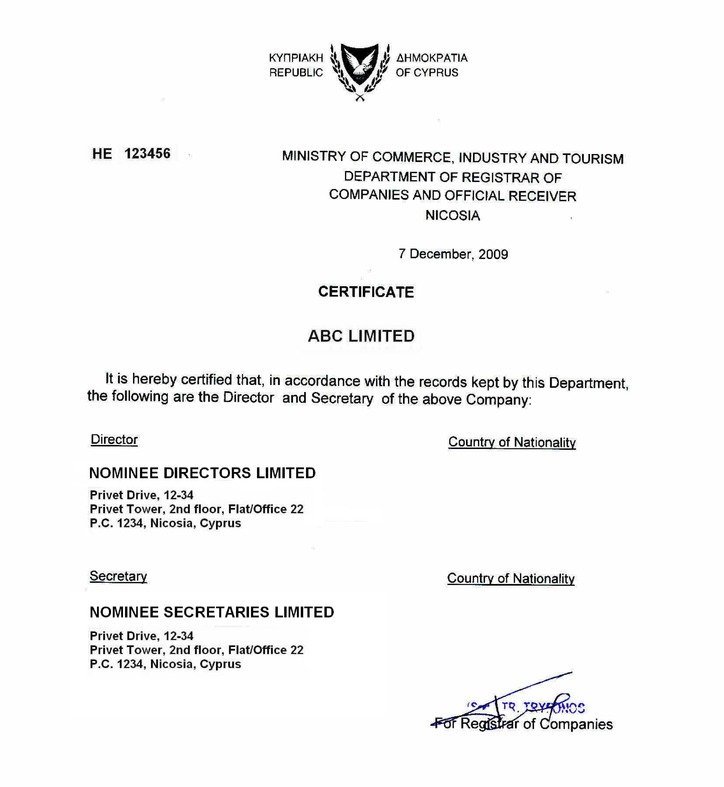

The memorandum and articles of association, as well as special forms with the details of the future company are submitted to the Registrar. Within a few days the company is assigned a registration number. Then, after another 2 – 3 days, the Registrar issues 4 certificates:

- Certificate of Cyprus Company Incorporation;

- Certificate of Directors and Secretaries;

- Certificate of Shareholders;

- Certificate of Registered Office.

These 4 certificates of a Cyprus company will be a documentary evidence of its legal existence. In addition, the Registrar issues the memorandum and articles stamped in confirmation of the company’s registration.

A special note should be taken of the obligation to submit beneficial ownership information within 30 days of the date of incorporation of the company.

STEP 5 – Preparation and Delivery of Company Documents

Upon incorporation, a set of constitutive documents is formed, which includes:

- Certificate of Incorporation (apostilled);

- Certificate of Registered Office (apostilled);

- Certificate of Director and Secretary (apostilled);

- Certificate of Shareholders (apostilled);

- Original resolution appointing the first director and an apostilled copy of such resolution;

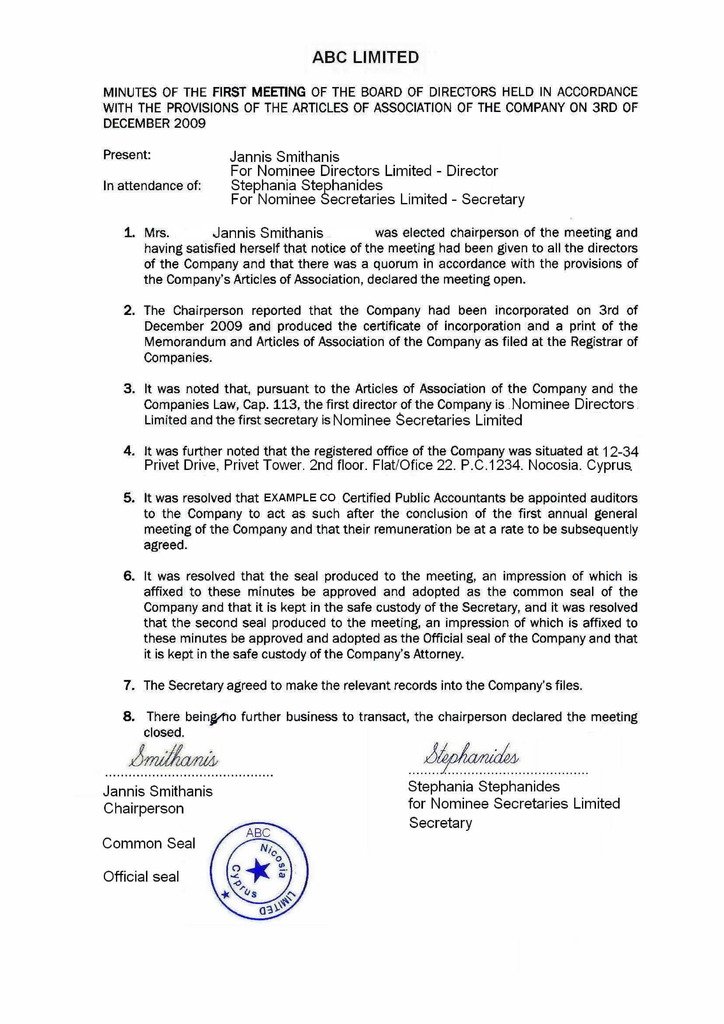

- Minutes of the first meeting of the Board of Directors;

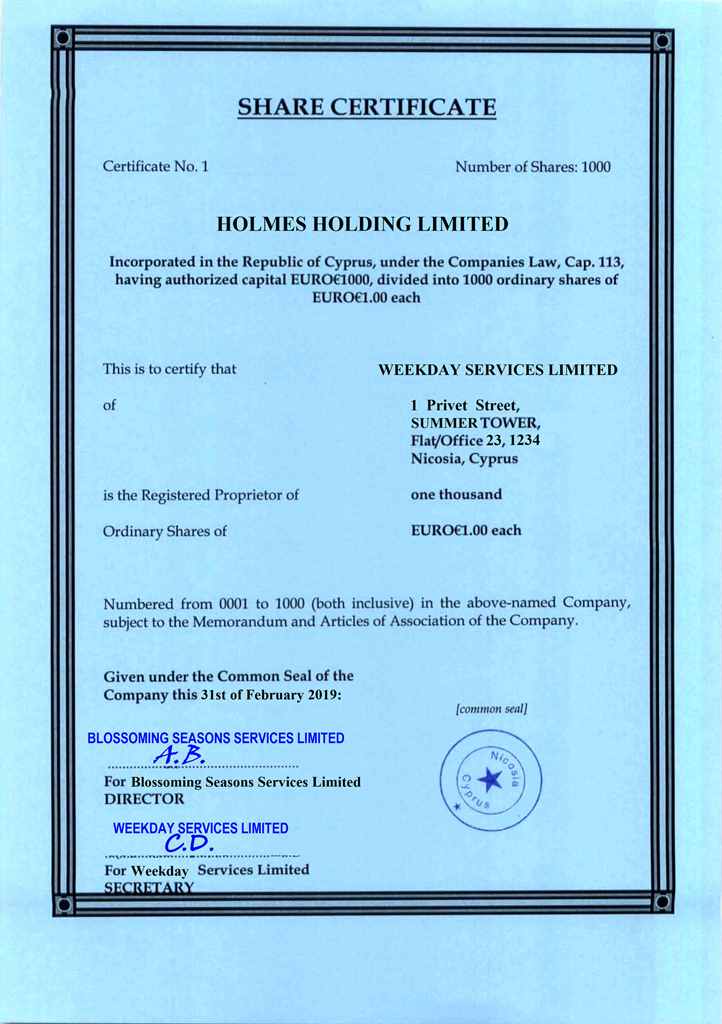

- Share Certificate(s);

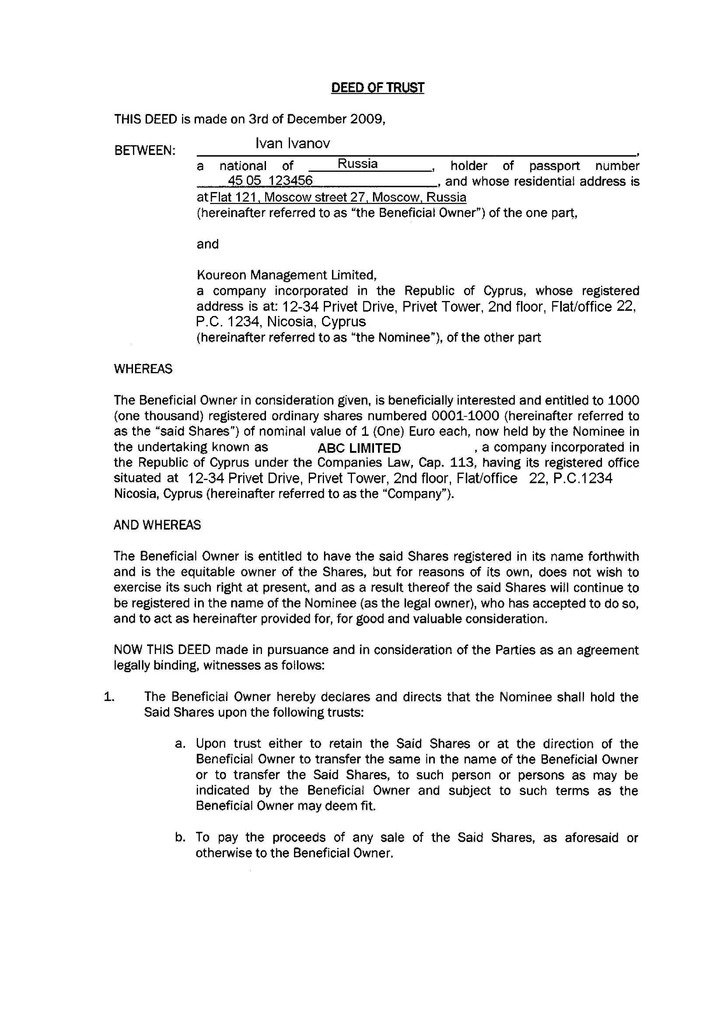

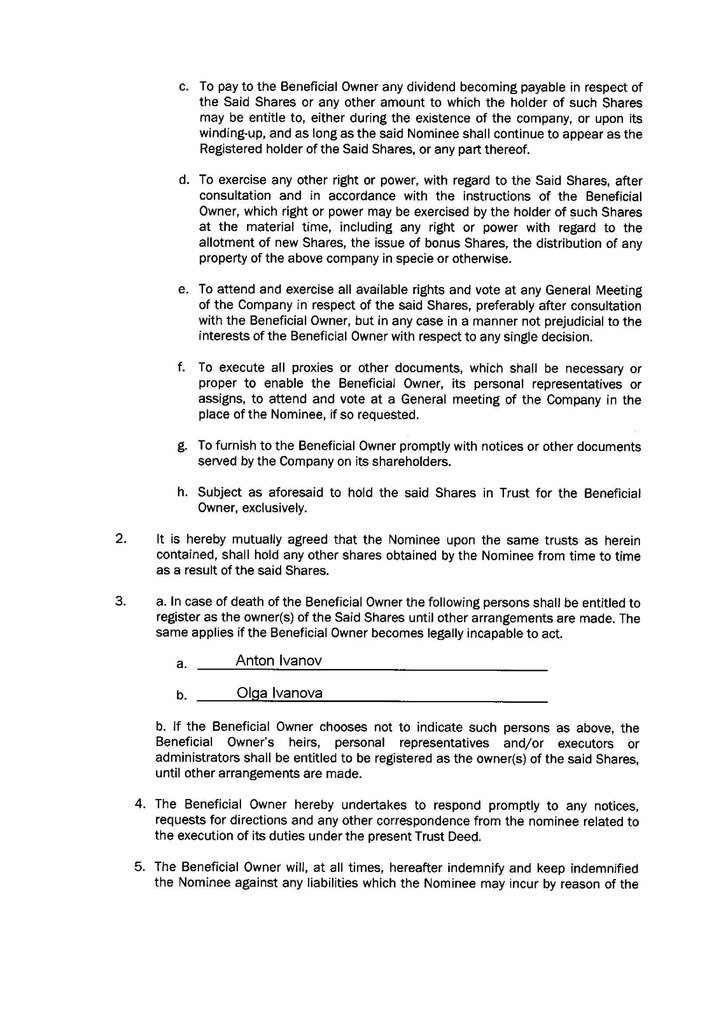

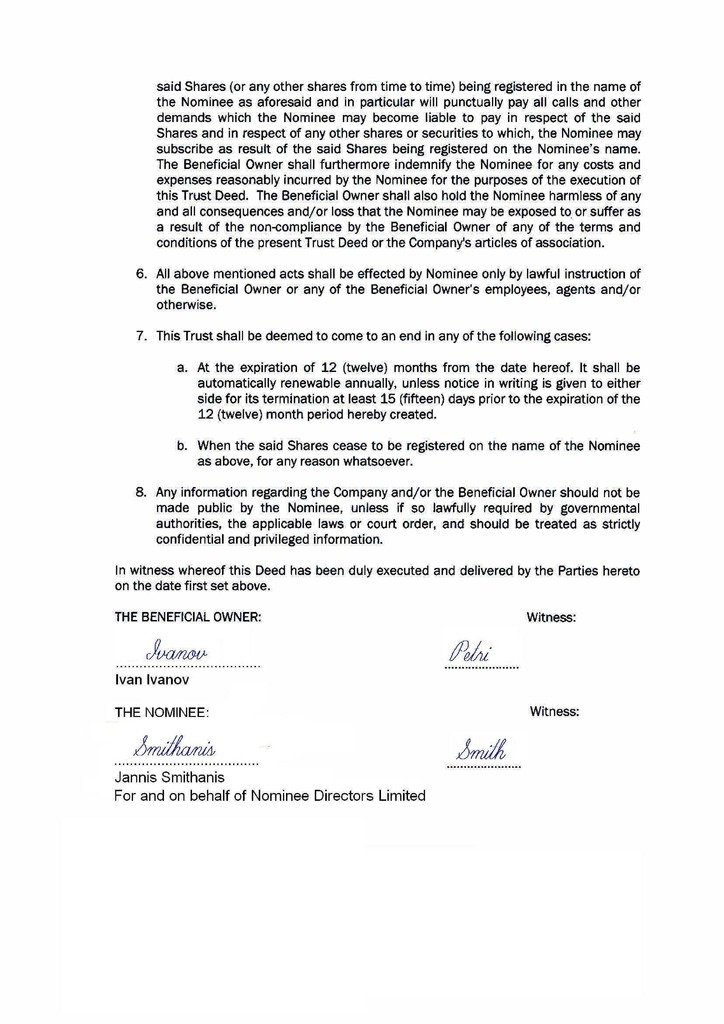

- Deed of Trust (if the company has issued shares to a nominee shareholder);

- Certified translation (Greek to English) of the Memorandum and Articles of Association;

- Apostilled copies of the Memorandum and Articles of Association (translated into English);

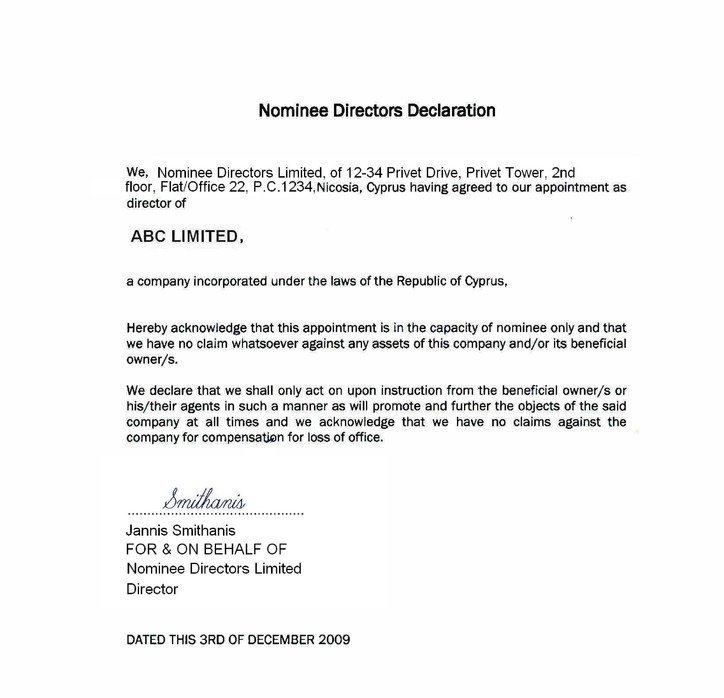

- Nominee Director Declaration (if the company has appointed a nominee director);

- Power of attorney (if the company has appointed a nominee director).

The client also receives the company seal.

Public Disclosure of Company Registers

As per the Cyprus laws information about company directors, shareholders and company secretary is publicly available.

Amendments to the Prevention and Suppression of Money Laundering and Terrorism Financing Law (2007) came into force in Cyprus on 23 February 2020, introducing a public register of beneficial owners and a number of new requirements for companies to file beneficial ownership information.

Within the meaning of the new law, the beneficial owner is a natural person who ultimately exercises control over the company. The control means direct or indirect (through another company, trust, etc.) ownership of a shareholding of at least 25% + 1 share in a company. If it is not possible to identify the beneficial owner by ownership of shares, additional may be applied.

Any changes in the beneficial ownership information must be filed with the Registrar within 14 days. In addition, the company must annually confirm the accuracy of the information contained in the register.

Full and unrestricted access to the register is provided to certain government authorities of the Republic of Cyprus, whereas all other persons could only access the following information by making a request for a fee (EUR 3,50 per company): name; month and year of birth; citizenship; country of residence; nature and scope of control. However, following the Judgement of the Court of Justice of the European Union (CJEU), access to the register of beneficial owners for the general public was suspended as of 23 November 2022. The relevant information to the competent and supervisory authorities continues to be provided with the applicable procedure. And the appropriate information also continues to be provided to the obliged entities (when the information on the beneficial owners is requested in order to perform customer due diligence).

Ongoing Company Maintenance

Annual Renewal Process

Cyprus companies used to be required to pay to the Registrar an Annual Government Levy of EUR 350. This levy has been abolished starting from 2024 (the levy already accrued for previous years is still payable, as well as late payment penalties).

Submission of Annual Returns

A limited liability company must deliver Annual Return to the Registrar.

Details of the company as at the anniversary date of incorporation, including registered office address, share capital, company secretary, director, shareholder and address of the place of company registers keeping are reported in the return.

Tax Obligations

Corporate Tax

Cyprus companies are considered tax resident in Cyprus and are subject to Cyprus tax on their worldwide income if they are managed and controlled from Cyprus. The profit of Cyprus companies is taxed at the rate of 12,5%.

Capital Gains Tax

This tax is levied at the rate of 20% on disposal of immovable property situated in Cyprus and on disposal of shares in non-listed companies that own such immovable property. There is no tax on the sale of shares.

Withholding Tax

Cyprus does not levy withholding tax on dividends, royalty or interest paid to non-residents, except where royalties are paid in respect of rights used in Cyprus.

Value Added Tax (VAT)

VAT is paid on the sale of goods and services, on the purchase of goods and services from the EU countries, and on the import of goods into Cyprus from non-EU countries. The basic VAT rate in Cyprus is 19%.

Audited Financial Reports

Cyprus companies must prepare and submit audited financial statements in accordance with International Accounting Standards. This is a statutory requirement irrespective of whether the company carried on any business or not. If the company remained dormant, the auditors must prepare and submit dormant accounts.

In Cyprus, companies must submit financial statements within a year of the financial year-end, which typically aligns with the calendar year. The financial year cannot exceed 12 months, except for the first year, which can be up to 18 months. Engaging audit and accounting services in Cyprus can help ensure compliance with these regulations and prepare financial statements according to local standards.

Annual Tax Filing

The company must submit returns to the tax authorities within 12 months of the financial year end, i. e. by 31 December of the year following the financial year. The tax return must be certified by the company’s auditor.

In addition to annual reporting, all companies must before 31 July of each financial year submit a provisional tax return showing the estimation of their profit in the current year. Based on this return, the company must pay provisional corporate tax (if there is any profit declared) in two equal instalments – by 31 July and 31 December in the same year. Adjustments to the provisional tax return can be made before 31 December.

Cost of Services

| Services | Fees (EUR)[1] |

| Total cost of incorporation (including a registered address and a local secretary services for the first year, compliance fee, preparation and provision of the corporate documents, and the company’s seal) | 2.250 |

| Annual renewal (starting from the second year), including provision of a registered address and a local secretary, but excluding compliance fee | 1.080

|

| Certificate of Good Standing | 295 (without apostille)

550 (with apostille) |

| Certificate of Incumbency | 255 (without apostille)

510 (with apostille) |

| Ordering from the Registrar certificate of directors / shareholders / registered address[2] | 295 (without apostille)

550 (with apostille) |

| Ordering certified by the Registrar copies of Memorandum and Articles of Association | 750 |

| Notarization of any document and apostille | 500 |

| Change of director / shareholders, including original certificate from the Registrar, but excluding compliance fee | 1.090 |

| Preparation and submission of “dormant” accounts (for companies that did not trade during the financial year and do not hold bank accounts), and conduct of an audit | 1.140 |

| Preparation and submission of financial accounts, and conduct of an audit | 100 – 350 per hour of work |

| Courier delivery | 220 |

| Compliance fee

Payable in the cases of:

|

350 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (director / shareholder / beneficial owner) or legal entity (director / shareholder) if such legal entity is administered by ITA + 200 for each additional legal entity (director / shareholder) if such legal entity is not administered by ITA 450 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |

[1] The invoices will include 19% VAT on the services provided, except Annual Levy and payment of taxes.

[2] Cost per certificate.