Economic Substance in the Seychelles

In the recent years, intergovernmental organizations have stepped up on their effort against the so-called shell companies, those legal entities which have no actual business to back up their existence on paper. To comply with the new regulatory standards, banks all over the world are now expected to scrutinize overseas entities in terms of their physical localization: whether a given company has a real office and employees anywhere. This is referred to as economic substance, and the normal expectation is that your company must be substantiated in the country of incorporation. Establishing economic substance in Seychelles for your business and enjoy its unique offshore advantages.

Having removed the prohibition for international business companies to have any operation within its territory, the Seychelles created a unique opportunity to set up a company with economic substance and still enjoy the benefits of an offshore jurisdiction. As a Seychelles-present legal firm, we possess the necessary skill and experience to guide you through the whole process of creating economic substance and offer solutions for every aspect of it.

Processing of correspondence for Seychelles companies

We are glad to offer a comprehensive correspondence processing package which includes the following services and facilities:

- Your own postal address to match the registered address of the company. We would not object if you make it publicly known as your post address, as well;

- Receiving and processing your incoming correspondence. We will notify you of all incoming mail within the first three workdays of each month;

- Scanning your mail for your preview, up to five pages a month;

- One monthly shipment of your correspondence to any address you will provide for this purpose.

Our fee is USD 970 a year. Please note that any extra shipments are charged separately, and additional scanning will cost you USD 10 per one page.

Dedicated Phone Line in Seychelles

If you need to stay in more direct contact with your partners, we would be able to install a dedicated phone line in the Seychelles for your company. Our services will include:

- Setting up an individual phone line with an exclusive Seychelles number for you. The fee is USD 550;

- Annual maintenance of the line, USD 1.000;

- Forwarding incoming calls to any phone number you provide, in any country. This will be charged per minute, and you will have our invoices monthly. There is also an option of paying in advance for a quarter or a year by making a deposit with us. The minimal deposit amount is USD 250.

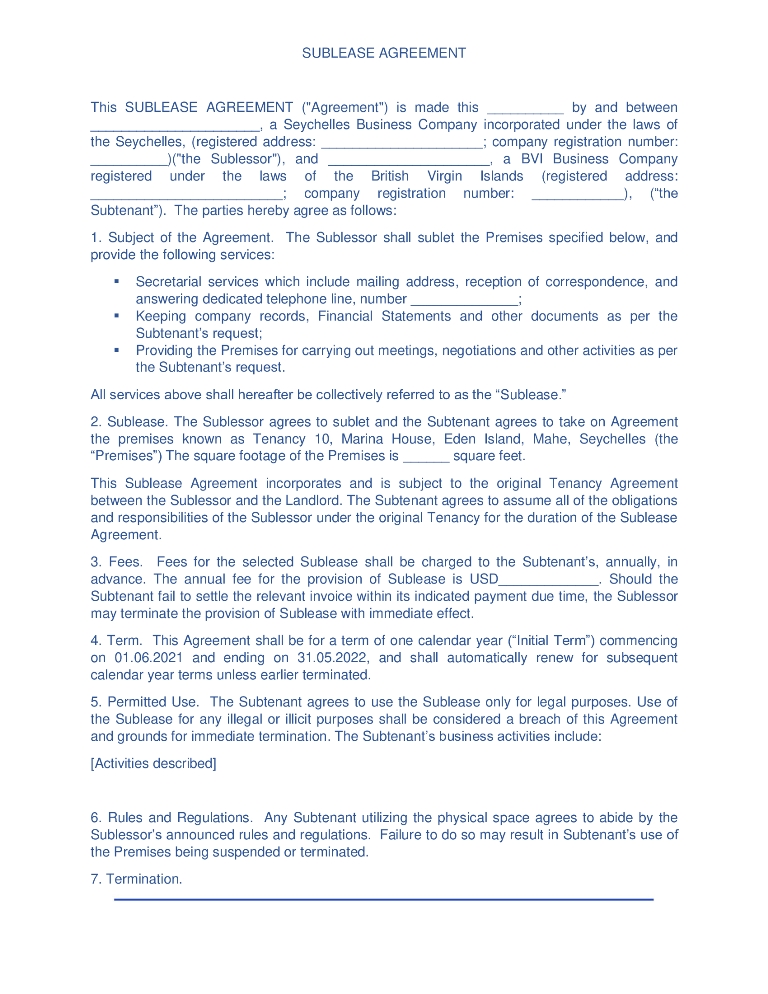

Office Rent at the Registered Address for Seychelles Economic Substance

If all your employees work remotely and you do not really need a fully-furnished physical office, it would be economical and convenient to sub-rent a small part of our own Seychelles office at the registered address of your company. Please note that, unlike the standard registered office option, this will include an actual rental contract for your office space. Our fee is USD 450 per month.

Renting a Custom Office in Seychelles

A still more advanced option is to rent a custom office at a distinct address. This would involve a research of the local market, comparison of prices and option, and should you need it, inspection of properties on offer as well. Our local presence puts us in a very confident position in this respect, and we would be able to take on both the search and all the interaction with landlords, leaving to you only the final choice and signing of the contract. A normal rental fee for a small office would be between USD 1.000 and USD 1.700 a month. Our own one-off fee will fall between 0.5 and 1 rate of the rent.

Staff Recruitment and Employment in Seychelles

As a local employer, we know how to choose and attract the best local talent – and where you do not have specific requirements, are able to provide our own employees for a part-time job with you.

A minimal salary in the Seychelles is SCR 5.250 or roughly USD 360 per month. Please note that 3% of the salary shall be withheld monthly for the Social Security Fund. As an employer, you will also have a duty to withhold for the state budget your employees’ income tax at the following rates:

| Amount Earned | Income Tax Rate |

| Below SCR 8.555.5 | 0% |

| SCR 8.555.51 – 10.000 | 15% on the amount exceeding SCR 8.555.5 |

| SCR 10.000.01 – 83.000 | a fixed sum of SGR 216.68 + 20% on the amount exceeding SCR 10.000 |

To be able to pay these taxes, your company would need a Seychelles Tax Identification Number. Our fee for obtaining it is USD 450. We will also be able to take on your salary tax paperwork for USD 175 per month for each employee.

Should you opt for a part-time contract with our employee, the fee would be USD 450 for you.

We will also be able to find a local professional to meet your specific qualification requirements. This will include searching for the right candidacies, providing you with their CVs for assessment, arranging for up to 3 job interviews, and drafting an employment agreement. Our one-off fees will be:

- For non-managerial staff, a single monthly salary;

- For management-level staff, two monthly salaries.

Seychelles Economic Substance: Fees for basic services

| Service Name | Fee (in USD) |

|

Incorporation and annual maintenance |

|

| Turnkey incorporation (including a compliance fee, original corporate documents, apostilled copies of the corporate documents, and a company seal) | 1.250 |

| Annual maintenance (starting from the second year), compliance fees excluded | 990 |

Compliance fee to be paid upon:

|

250 (basic, including one individual)

+ 150 for each new individual or company in the structure, if the company is administered by ITA + 200 for each new company in the structure if it is not under the ITA administration 350 (for High Risk companies) 100 (signing of documents) |

| Seychelles Economic Substance in Seychelles | |

| Postal service, per year | 635 |

| Individual pone line with 24/7 international call forwarding | 550 to set up

From 1.500 a year to maintain |

|

Office sub-rent at the registered office in Seychelles |

|

| Office sublease, at the registered address | 450 a month |

| Office rent, custom | 0.5 – 1 monthly rent as our fee + rent fee |

|

Staff Recruitment in Seychelles |

|

| Local employee

For ordinary employees For managers |

One monthly salary for non-managers Two monthly salaries for managers |

| Preparing and filing salary reports for income tax (for each employee) | 175 a month |

| Consultation on compliance to your bank’s economic substance policies | 200 per hour |

| Contacting your bank to specify their economic substance requirements | 200 per hour |