Company Registration Services in Singapore

Your consultant

Alina Marinich

Senior Business Consultant

Singapore is a well-established and highly reputed global financial center offering vast opportunities for international business. Known for its streamlined corporate procedures and cost-effective tax regime, it is an ideal jurisdiction to consider. Business setup consultants in Singapore can provide expert guidance to simplify the incorporation process and help you take full advantage of this favorable environment.

There are a number of entity forms available in Singapore, but the simplest to manage and thus the most popular one is private company, which allows the shareholders to limit their liability to the amount of contribution they made to it. There is also an option of becoming designated as an Exempt Private Company. This exempts an entity from the duty to prepare and file audited financial statements, although it still has to file a tax return and a non-audited annual report.

Singapore does not participate in the Competent Authority Agreement on automatic exchange of financial information. It has plans to exchange financial information with a number of countries under bilateral agreements, but so far they have been made only with Australia and the UK.

Key Specifics of Singapore Company Registration

- Not an offshore zone, yet offers tax benefits

- Double taxation treaties with many other countries

- Is not a party to the Convention on Apostille

- Bearer shares are not allowed

- No exchange control

- Territorial taxation: no taxes on companies which do not operate in Singapore and derive their income from outside the jurisdiction

Singapore Company Incorporation Period

It takes about 5 weeks to set up a company in Singapore.

Singapore Company Registration Process

The registration process normally takes the following steps:

STEP 1

You let us know of the proposed name for your company, its corporate structure, share capital volume, and intended activity. Please note that names are to be checked for availability with the Registrar, and must contain the words “Limited”, “Pte”, “Sendirian Berhad”, or “Sdn. Bhd.”

STEP 2

You provide us with the basic KYC documents: passport and proof of address for each person in the company structure (director, shareholder, beneficial owner), and a full set of corporate documents for each legal entity if there would be any in the structure. We will also need a detailed description of your business activities and source of funds.

STEP 3

After the KYC is approved, we provide you with our invoice.

STEP 4

Upon payment, we prepare a set of corporate documents and submit it to the Registrar for incorporation. These include:

- Memorandum and Articles of Association: it contains all the basic information of your company, including its name, entity type, business activities, full names and addresses of the shareholders, number of shares issued;

- Statutory Declaration of Compliance;

- Shareholder, Secretary and Director date forms;

- Consent to Act as a Director;

- Consent to Act as a Secretary;

- Statement of Non-disqualification to Act as a Director.

STEP 5

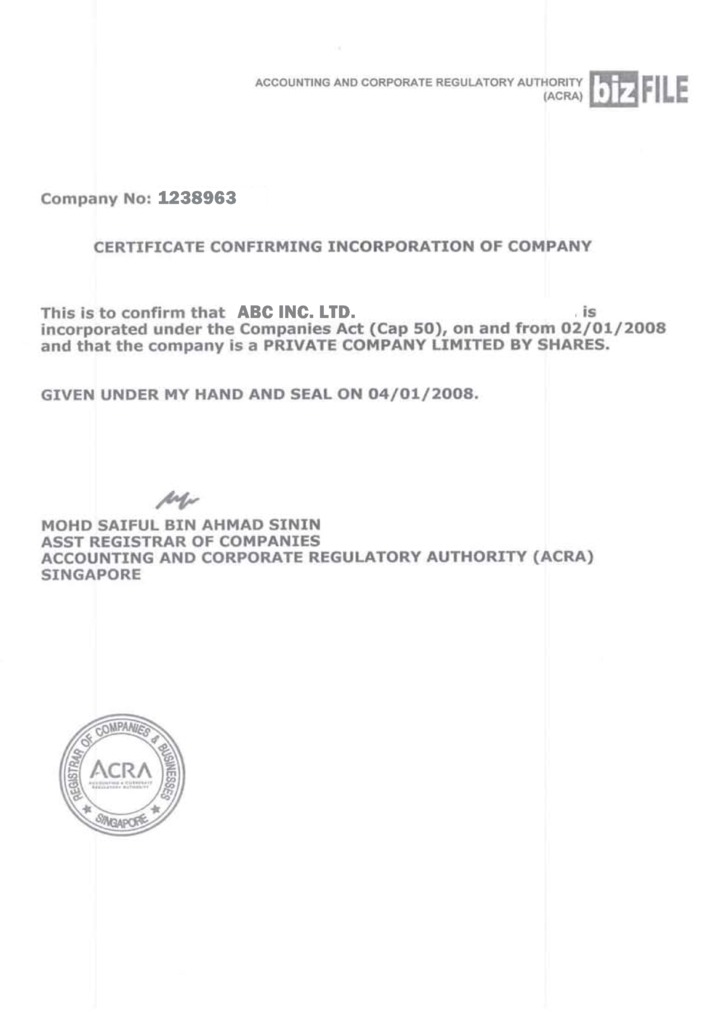

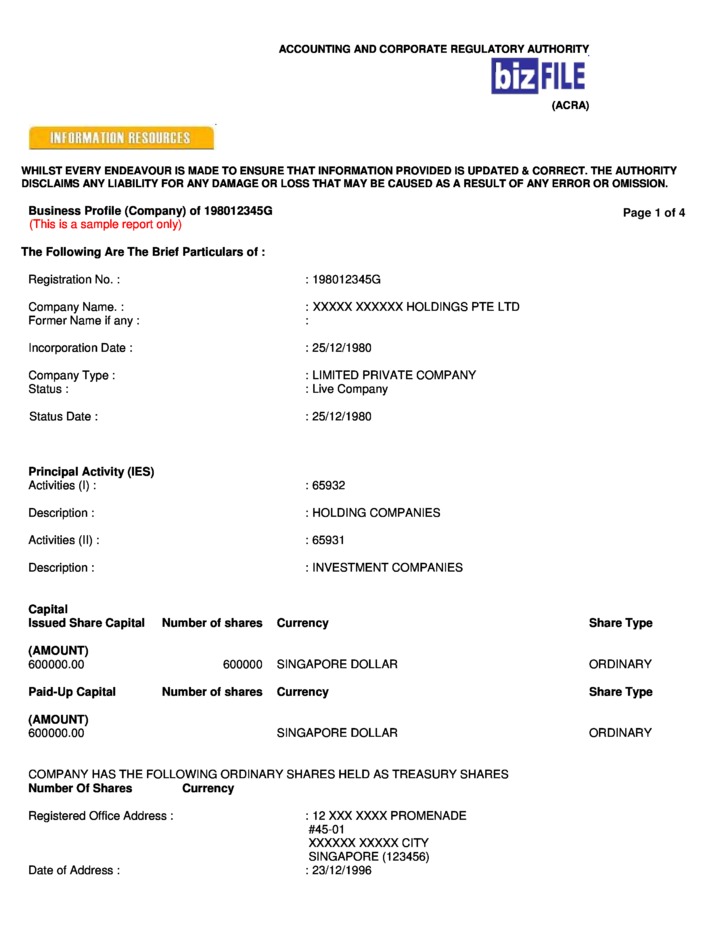

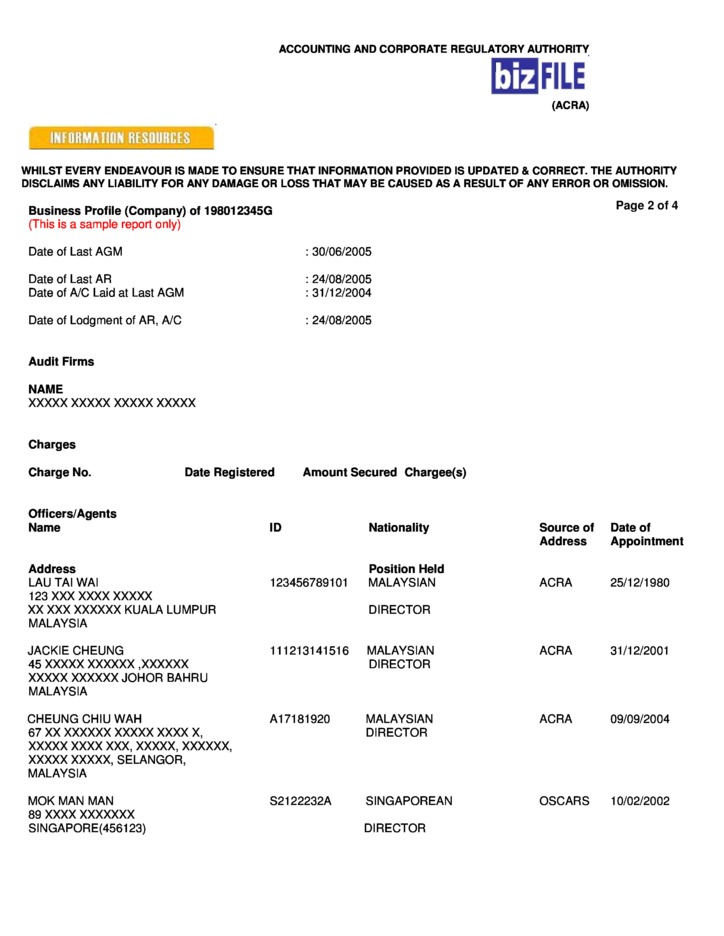

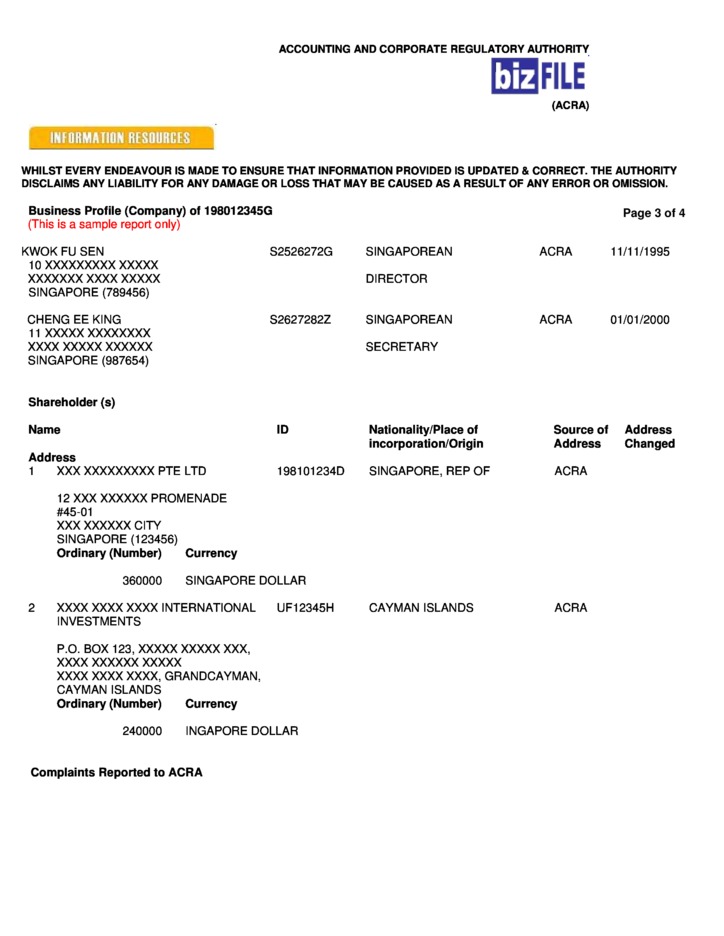

Once all the documents are processed, the Registrar finalizes the incorporation and issued the following:

- Certificate of Incorporation;

- Business Profile of your company, which will include the company’s registration number.

STEP 6

Once you have the registration number for your company, the shares can be issued, and we can order a company seal.

Please note that there are the following requirements to the directors and the shareholders of a Singapore company:

- At least one of the directors must be a resident of Singapore;

- A private company can have no more than 50 shareholders;

- Both entities and individuals can be shareholders;

- There is no minimal share capital requirement, but at least one share has to be issued;

- Shares with no par value can be issued, but not bearer shares.

Legalization of Company Documents

You will need your corporate documents to open an account with a bank, and they probably will be requested by your other business partners as well. If you need to provide your documents to an entity outside Singapore, they must be legalized first.

The most convenient and popular method of international legalization is apostille. However, Singapore has not signed the Apostille Convention, and therefore the only way to legalize Singapore-issued documents, is via the Consulate of the country where you need to submit them. Please note that it involves extra costs compared to apostille, and might be time-consuming as well.

Disclosure of Company Registers

The data of shareholders, directors and secretaries are to be filed with the Registrar and are publicly available. Companies are also obliged to identify their beneficial owners and maintain registers of them, which are available to the Registrar and the authorities of law enforcement. However, such registers are not available to the public.

Ongoing Singapore Company Maintenance

Yearly Renewal Process

Your company is being provided with the services of a secretary and a registered office on an annual basis. A secretary is the person or the entity authorized to keep all the corporate records and represent your company before the state authorities. A registered office is the address with which your company is associated for the purpose of maintaining registers, no matter if it has actual presence there or not. Typically, a company’s registered office matches the registered office of its service provider. You are charged for your registered office and secretarial services once each year.

Submission of Annual Return

You will need to file an annual return with the Registrar, within one month after each general meeting of the shareholders. In this return, you shall include the particulars of your activity and company structure. This annual return shall not be confused with annual financial statements as it relates only to corporate data, such as the details of the shareholders and the directors, or the date of your company’s latest register of beneficial owners. Neither its financial particulars nor the data of the beneficial owners are included into an Annual Return.

Taxation Requirements

As Singapore taxes its residents on a territorial basis, your company will not have to pay tax on income derived from outside Singapore. Otherwise, i.e. if you have clients within Singapore and receive income from them, the tax rate applicable is 17%, although there are several benefit regimes available for local business.

As another advantage for your Singapore company, it will be exempt from taxes on foreign dividends (subject to further conditions), on income from overseas branches, and also on the income you get for providing services outside Singapore, but only as long as the respective funds are not moved to Singapore (i.e. are held with a bank in another country).

You will also not have to pay withholding tax should you distribute dividends to shareholders outside Singapore. However, there is a withholding tax of 15% on interest and 10% on royalties paid to non-Singapore entities or individuals (subject to the provisions of double taxation treaties with target countries).

Preparation of Audited Financial Statements

Singapore companies must prepare and file annual financial statements with the tax authorities that comply with international accounting standards and are verified by an independent auditor. An experienced accounting company in Singapore can assist in ensuring these statements are accurately prepared and meet all regulatory requirements.

For private companies there is an option of becoming designated as an Exempt Private Company. This exempts an entity from the duty to prepare and file audited financial statements, although it still has to file a tax return and a non-audited annual report.

There are two conditions to getting recognized as an Exempted Private Company:

- Your company must have no more than 20 shareholders, among whom there must be no legal entities;

- The turnover of your business shall not exceed SGD 5.000.000 (Singapore dollars), which roughly equals USD 3.900.000.

Filing of Annual Tax Return

You company will have to prepare and file an annual tax return and a profit and loss statement, which are to be audited unless you have the exempt status. These are to be filed with your local tax authorities each year by the 30th day of November. You also need to file an estimated taxable income report 3 months prior to the end of each period, and VAT reports on a quarterly basis should you obtain a VAT number.

Our Price List

| Services | Fees (USD) |

| Total cost of company incorporation (including a registered address and a local secretary services for the first year, compliance fee, preparation and provision of the corporate documents, and the company’s seal) | 4.410 |

| Annual renewal (starting from the second year), including provision of a registered address and a local secretary, but excluding compliance fee | 4.140 |

| Services of a local director per annum | from 8.100 per year

+ from 10.500 as a refundable deposit[1] |

| Director’s on-going monitoring of transactions (at least 1 time per quarter) | 250 / hour |

| Opening an account with a local bank in Singapore | 4.410 |

| Preparation and filing of financial accounts | 100 – 400 per hour of work

(minimum 2.250) |

| Compliance Fee:

– for low and medium risk clients – for high risk clients

Paid in case of:

|

860

1.650

|

[1] Paid at director’s appointment; deposit is necessary due to the possibility of holding the company’s director accountable.