Seychelles Company Formation

Your consultant

Alina Marinich

Senior Business Consultant

The Republic of Seychelles is a stunning archipelago of 115 islands in the Indian Ocean, northeast of Madagascar. Known for its favorable tax environment and welcoming offshore jurisdiction, Seychelles offers significant advantages for those looking to open a company in Seychelles. An International Business Company (IBC) formed here benefits from the Territorial Tax regime, providing entrepreneurs with tax-free opportunities to conduct business.

If you are seeking a reputable, tax-free jurisdiction where the Register of Beneficial Owners is kept confidential and not publicly accessible, Seychelles is an excellent choice for your next offshore company formation.

Key Specifics of Seychelles Company Formation

- Taxation is based on territorial principal

- Offshore company is completely tax exempt

- A minimum of one Director is required – individual or corporate

- A minimum of one Shareholder is required – individual or corporate

- No requirements as to the minimum amount of share capital

- Shares with no par value permitted

- Option to create Seychelles economic substance by maintaining local presence and activities.

Seychelles Company Incorporation Period

On average, it takes 7 working days to incorporate an IBC in Seychelles after all necessary documents are provided and the proposed names are checked with the Registrar.

Seychelles Company Registration Process

A step-by-step guidance will follow here:

STEP 1

Business Name Check

We request several names to be checked for their availability and legal compliance with the Registrar. It usually takes up to 24 hours. Names shall contain the word “Limited”, “Corporation”, “Incorporated” or an abbreviation of one of such words – “Ltd.”, “Corp.”, “Inc.”.

Organization System

There must be minimum one Director & Shareholder in a company who can be the same person, individual or corporate. There is no restriction on Director’s/Shareholder’s residence either.

Regulatory Compliance Process

To establish proof of identity we require one of the following documents:

- Scanned copy of valid passport

- Scanned copy of ID card

- Scanned copy of driving license

To establish proof of residence we ask to send us one of the following documents:

- Scanned copy of any ID document (passport / ID card / driving license) confirming the current residential address (if this document is not used as proof of identity)

- Recent utility bill not older than 3 months

- Recent bank statement not older than 3 months

Capital and Share Allocation

For a Seychelles company formation, share capital requirements are minimal. A Seychelles IBC must issue at least 1 share with or without par value in any fiat currency. The standard authorized share capital is 5.000 divided into shares of 1 USD each. No extra government fees are therefore levied upon incorporation or annual renewal of a Company for an increased authorized share capital as compared to BVI jurisdiction for instance.

Invoice Settlement Process

Once receiving confirmation of your payment, we start the incorporation procedure.

STEP 2

Registration Application Submission

Following a request for incorporation and having submitted the payment of a relevant registration fee along with the documents required to be filed with for company formation, the Registrar will issue a unique Company number to the proposed IBC together with the Company’s Certificate of Incorporation. By that time the Company is considered to have been officially formed.

When the Company has been set up, you will receive the final set of these basic corporate documents:

- Certificate of Incorporation

- Memorandum and Articles of Association

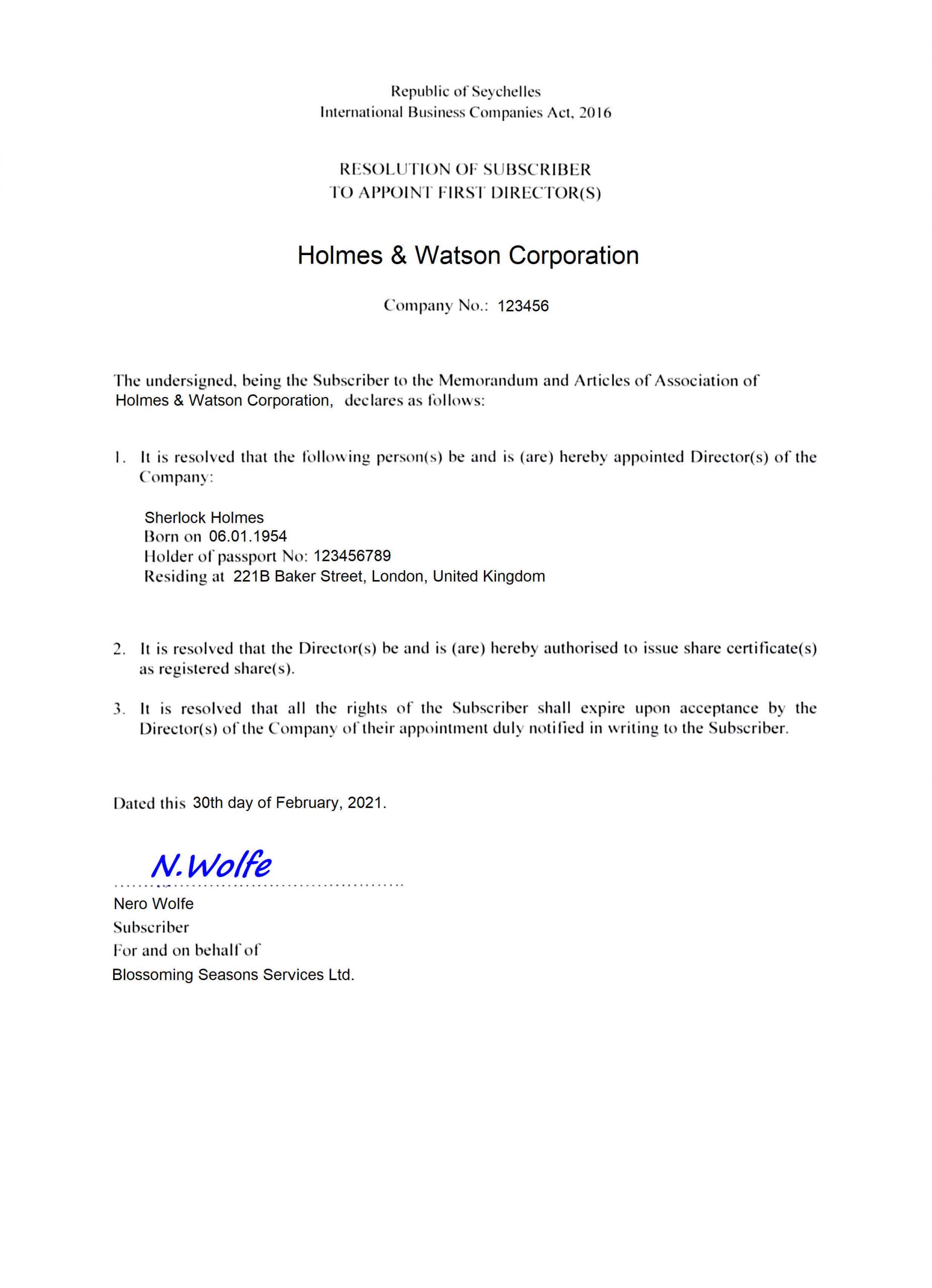

- Subscriber’s Resolution to appoint First Director(s)

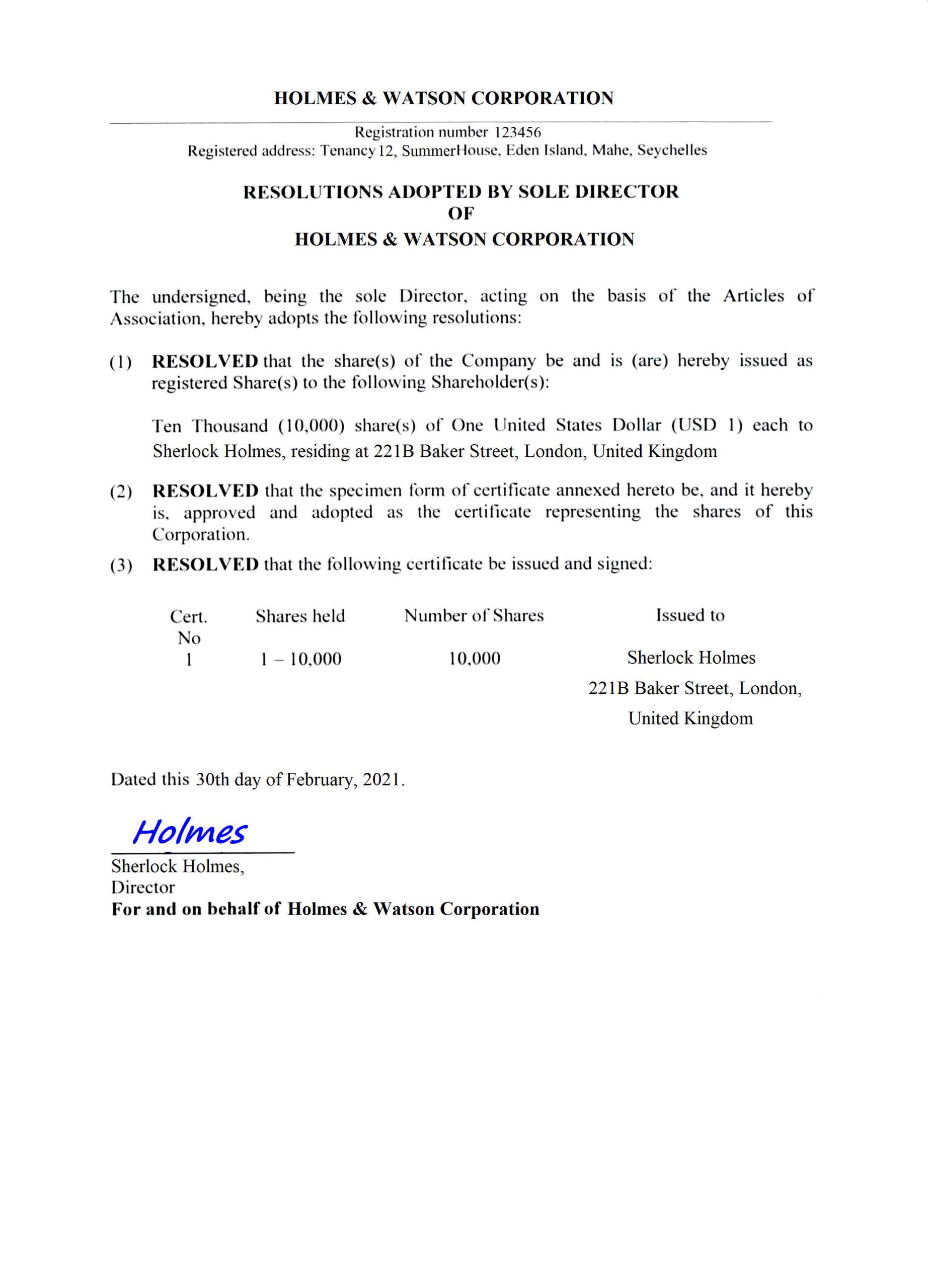

- Resolution on First Shares Allotment

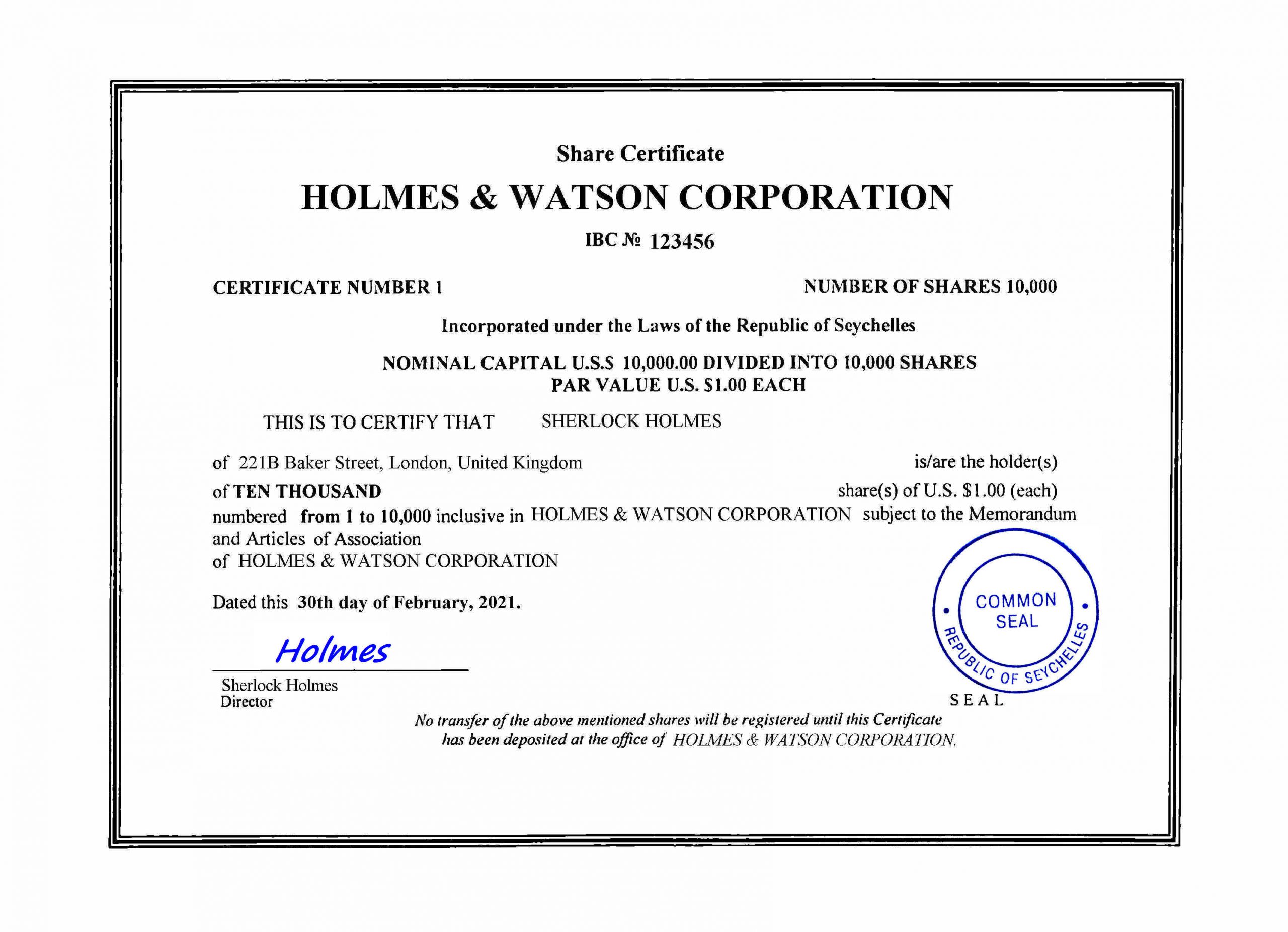

- Share certificate

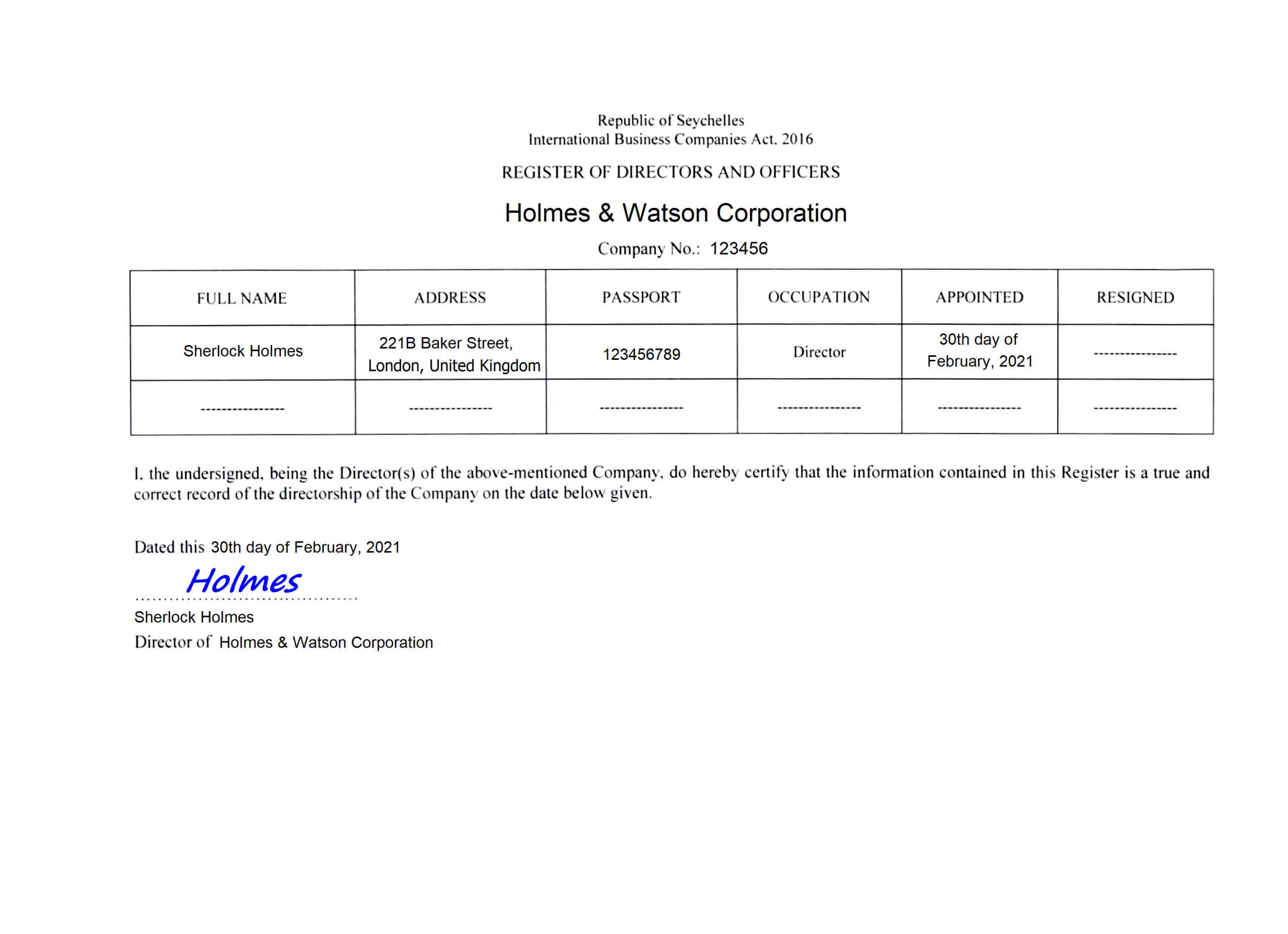

- Register of Directors

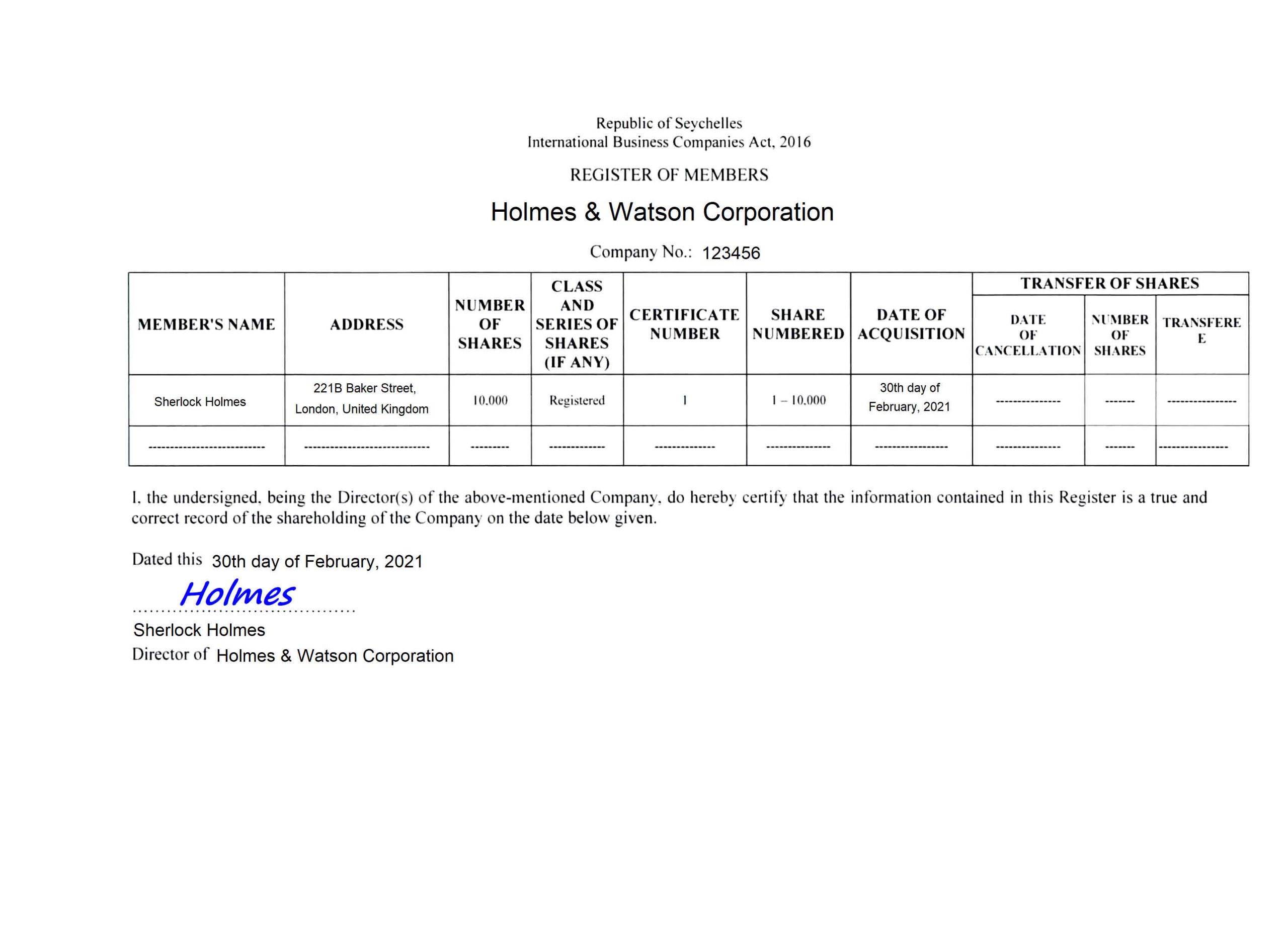

- Register of Shareholders

In case the Company uses nominee director’s services, additional documents are applicable:

- Agreement for provision of Director nominee service

- Apostilled Power of Attorney

- Consent Letter

In case the Company uses nominee shareholder’s services, these documents are applicable:

- Agreement for provision of Shareholder nominee service

- Declaration of Trust

Signing of the above-mentioned documents

STEP 3

We collect the KYC documents from the client: the certified copies of the documents listed in Step 1 point “Compliance Procedure”. We dispatch a package of corporate documents to the client’s location.

Yearly Company Renewal

On a yearly basis, every offshore company must be renewed on or before the date of each anniversary of its incorporation. To maintain a Seychelles IBC in good standing, one should pay annual government fees, professional fees for Registered Agent and Registered Office address (as a legal address of an IBC), which remain the lowest in contrast to other offshore jurisdictions.

Tax Obligations and Policies

Seychelles use a territorial tax system. IBCs are therefore not subject to taxation in Seychelles, if they generate income outside the territory of Seychelles.

Companies, both resident and non-resident, are liable to pay business taxes on domestic source income.

| Business tax rates for companies and trusts | |

| Income | Rate |

| The first SCR 1.000.000 | 25% |

| Above SCR 1.000.000 | 33% |

Disclosure and Transparency of Records

In August 2020 the Beneficial Ownership Act came into force, introducing new requirements for Seychelles IBCs. The Register of Beneficial Owners shall be submitted to the Financial Intelligence Unit in such form and manner as may be specified by the FIU. The information is kept in confidentiality and not publicly accessible. The Register of Beneficial Owners shall be maintained at the registered address in Seychelles.

A company shall also file for registration by the Registrar a copy of its Register of Directors and ensure that the information presented is accurate.

Besides, every company shall keep at its Registered Office in Seychelles a Register to be known as a Register of Members, and must be able to produce legible evidence of its contents.

The records listed above shall be preserved under Registered Agent maintenance for at least 7 years and be kept at company’s Registered Office in Seychelles.

Maintenance of Financial Records

A company shall keep reliable accounting records that are sufficient to show and explain the company‘s transactions, enable the financial position of the company to be determined with reasonable accuracy at any time, and allow for accounts of the company to be prepared.

In relation to an IBC, “accounting records” means the following documents:

- Bank statements

- Receipts

- Invoices

- Vouchers

- Title documents

- Contracts and agreements

- Ledgers

- Any other documentation underpinning a transaction

Company‘s accounting records shall be kept at its registered office or such other place as the directors consider appropriate for this purpose. Where the accounting records are kept outside Seychelles, the company shall lodge, not less than on a biannual basis, the accounting records at the company’s registered office in Seychelles.

An IBC may keep the accounting records in digital form, provided that it informs its Registered Agent of the physical address where original accounting records are kept.

A company that fails to comply with the requirements commits an offence and is liable on conviction to a fine not exceeding USD 10.000.

A director who contravenes the requirements commits an offence and is liable on conviction to a fine not exceeding USD 10.000.

Moreover, a Registered Agent shall preserve the company’s accounting records for at least 7 years from the date of completion of the transactions or operations to which they each relate.

Specific companies are required to annually prepare a Financial Summary to be kept in Seychelles (together with other accounting records and documents) within 6 months from the company’s financial year end. For more details, please contact with our accountants in Seychelles.

Cost and Charges

| Services | Fees (USD) |

| Total cost of incorporation, including a basic compliance fee, professional fees for RARO* services for the first year, preparation and provision of original constitutive documents of the company and their apostilled copies, share issue documents, and a common seal | 1.250 |

| Annual renewal (starting from the second year), including professional fees for RARO* services, but not including compliance fee | 990 |

| Professional (nominee) Director services per annum (including issue of the apostilled Power of Attorney) | 580 |

| Professional (nominee) Shareholder services per annum (the same person as the Director) | 430 |

| Courier delivery | 250 |

| Compliance fee

Payable in the cases of:

|

250 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (director / shareholder / beneficial owner) or legal entity (director / shareholder) if such legal entity is administered by ITA + 200 for each additional legal entity (director / shareholder) if such legal entity is not administered by ITA 350 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |

*RARO – Registered Agent and Registered Office