Relocation Services in UAE

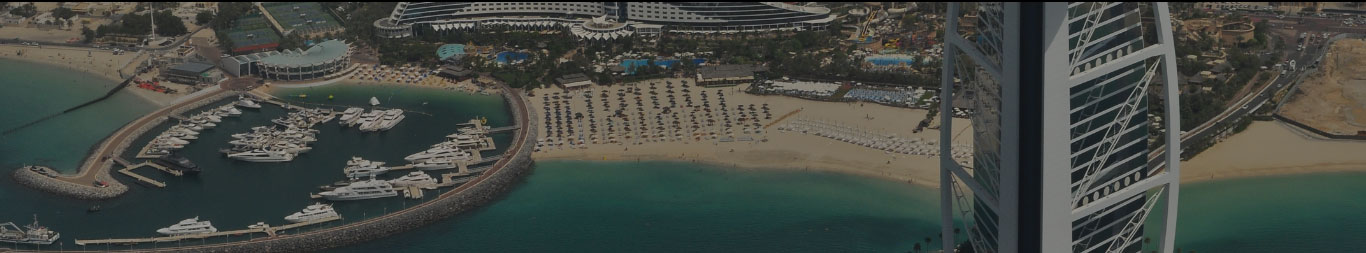

The decision to relocate a company to the Dubai (UAE) is a strategic move for entrepreneurs and enterprises seeking entry into the Middle Eastern market or desiring to operate internationally from the UAE.

Dubai, as the largest financial and logistical hub within the Middle East and North Africa (MENA) region, offers unparalleled access to key global markets including Europe, Africa, and Asia. The UAE’s stable economy, high living standards, and neutral position globally, have consistently established it as a secure haven for business immigration.

If you are considering how to streamline your move to Dubai and integrate into the new market effectively, engaging with our specialists is advisable. ITA Company is a team of experienced consultants who render comprehensive services, encompassing the establishment of corporate entities, bank account openings, visa applying for staff and their families, and consultation on related real estate matters. Our expert team ensures that your transition to the UAE is as seamless as possible by offering consistent, high-quality assistance throughout the entire relocation process.

Company Relocation Process

Outlined below are the main steps to consider when planning business relocation to the UAE.

The initial step is to scrutinize the multiple benefits the UAE offers for businesses. Key advantages include:

After recognizing the benefits, the subsequent step is selecting the appropriate business form, which will influence corporate structure requirements, registration procedures, and the scope of allowable activities within the UAE.

The UAE offers three principal business entities:

— Established within Free Economic Zones;

— Around 50 such zones available in the UAE;

— Specialized zones for certain industries like IT, jewelry, or logistics;

— Authorized to operate only within the designated economic zone or beyond;

— Simplified setup process, more streamlined and less bureaucratic, often taking a shorter time to set up than in the mainland;

— Ability to create substance and obtain residence visas for shareholders and employees.

— Incorporated on the mainland outside of free zones;

— Authorized to operate within the local market;

— 100% foreign ownership, as of June 1, 2021 a local sponsor is not required, however, this excludes businesses categorized as having “strategic significance”;

— Wider range of business activities compared to free zone companies;

— More complicated procedure of establishing a company, requiring the issue of Power of Attorney in case of distant incorporation;

— Ability to create substance and obtain residence visas for shareholders and employees.

— Established for conducting business abroad, not allowed to conduct business within the UAE;

— Exempted from taxes in the territory of the UAE;

— Easy process of incorporation requiring minimum documentation;

— Reduced regulatory requirements in comparison with onshore companies;

— Inability to have a physical office in the UAE and apply for residence visas for investors and employees.

The decision about where to register your company is crucial and can greatly influence its future course. Key factors include:

Proximity to clients and partners

Financial planning for establishment

Needs for a special infrastructure

Unique characteristics of free zones and type of license

Company structures in the UAE come in different legal configurations, with the following being the most prevalent:

The company registration procedure in the UAE entails the following steps:

Bear in mind that additional certifications or authorizations might be required in your business sector to secure the license. For example, entities in the healthcare, education, or food sectors are subject to supplementary criteria and must obtain approvals from the respective departments.

To secure residence visa in the UAE, a company must be registered onshore, either in the mainland or in a free economic zone, as offshore companies do not grant the right to apply for it. Once the company is established and licensed, the foreign owner can apply for an investor visa. Residence visas for employees are also available, with the number determined by the chosen business package. Both investor and employee visas are valid for two years, renewable, and allow holders to sponsor family members if they can prove ownership or a lease agreement for residential property in the UAE.

The UAE, recognized as a global financial hub, imposes specific requirements for the opening of banking accounts. Local banks give a preference for entities registered within the UAE, due to strict regulatory frameworks and the necessity to establish an economic nexus with the country. The economic nexus, such as maintaining a physical office in the UAE or the residency of an individual, will significantly facilitate the account opening procedure. A personal visit by the account signatory is compulsory for account opening, and depending on the bank, the presence of the beneficiary may also be required.

Our Expertise in Relocation Support – How Can ITA Assist?

The establishment of a company within the UAE is not always a straightforward process, and we recognize that clients often view their company merely as an instrument to achieve specific business objectives. We are here for helping you to navigate all possible challenges.

We commence by identifying your distinct needs and suggest the most advantageous Emirates and Free Zones for your enterprise. Our specialists will support you in making the best decision for the relocation of your business and in developing the right strategy.

We supervise all essential procedures for your company’s establishment:

- Verification of the business name;

- Compilation, preparation, and submission of requisite documentation for registration;

- Selection of the license;

- Coordination with governmental bodies concerning all matters related to the establishment of your company.

We consult on optimizing your financial flow and recommend the most appropriate UAE banks for international transactions. We facilitate the opening of both corporate and personal bank accounts:

- Gather all necessary documentation for the account opening;

- Arrange and accompany the account signatory for a bank interview, ensuring a direct interaction with bank officials;

- Prepare you for the interview by reviewing essential documents, emphasizing important aspects, providing comprehensive guidelines on typical inquiries made by bank officials, and outlining what bank representatives expect from you;

- Handle subsequent communication with the bank after the account opening interview.

We assist in the recruitment of employees and applying for residence visas. Our support encompasses the entire process, including:

- Drafting, finalizing, and negotiating all necessary documentation with migration authorities;

- Accompanying clients to medical facilities for health screenings;

- Attending with clients the Federal Migration Service for fingerprinting and biometric data collection;

- Submitting documents to migration authorities for the issuance of visas and Emirates ID cards.

We can help with the procurement of specific licenses or authorizations that your business may require, such as:

- Licenses from the Food Safety Department for dining establishments and food retail outlets;

- Permissions from Dubai Municipality for various retail facilities;

- Authorizations from Dubai Land Department for brokers, property developers, and real estate management companies;

- Permits from the Roads and Transport Authority for enterprises that interact with transportation infrastructure.

We provide a comprehensive suite of accounting services, including:

- Registration of your company for corporate taxation and acquisition of a tax identification number in the UAE;

- Assistance with VAT registration and issuance of a VAT number;

- Preparation and auditing of financial statements;

- Preparation and filing of tax returns;

- Consultation on VAT and other tax matters.

- We adopt a customized approach to ensure that your business is structured in a manner that is both efficient and effective, thereby enabling you to concentrate on realizing your primary goals within the UAE.

Started

With over 10 years of experience and 1500+ successful projects, ITA Business Consultants is your go-to partner for international tax planning. Our team of 200+ experts collaborates with 150+ international banks across 40 jurisdictions. Ready to elevate your business? Fill out the form and let’s connect!

FAQ

The time required to relocate a business to the UAE is subject to variation based on factors such as business type, complexity, and the readiness of documentation. On average, company registration in the UAE can be completed within a few days to several weeks. ITA does its best to expedite the process by providing expert assistance and guidance, ensuring that all necessary requirements are met so that your business can start operating as soon as possible.

Eligibility for residence visas in the UAE requires that the company be registered either on the mainland or within a free economic zone; offshore companies do not confer eligibility for residence visas. Following the establishment of your business and the procurement of the necessary licenses, foreign owners may apply for an Establishment Card and an investor visa. Furthermore, it is possible to apply for residence work visas, with the number of visas dependent on the chosen business package.

Banks in the UAE generally mandate the physical presence of the account signatory during the account opening process, in adherence to regulatory requirements. A personal visit is usually essential to authenticate identity and sign banking forms. Some banks may offer the option of remote account opening under exceptional circumstances; however, this is atypical and contingent upon the bank’s internal policies. We recommend inquiring directly with every bank for their specific protocols concerning remote account opening procedures.

The essential documents to relocate a business to the UAE typically include the trade name reservation, completed application forms, passport copies of the business owners, a detailed business plan, and an office space lease agreement. Specific sectors may require additional paperwork. For accurate preparation of all documents, we recommend to seek advice from the relevant authorities or a business setup specialist.