Tax Residency Certificate

A Tax Residency Certificate is the primary evidence that your UAE company is liable to pay taxes in the country, and registered with the government authorities in this capacity.

This certificate would be a key attachment to submit along with your application for benefits under a Double Taxation Agreement (DTA), or sometimes it might be requested by banks, both Emirati and overseas, as a part of their Compliance requirements. Individuals resident in the UAE can also apply for a Certificate confirming their residence.

Being a local-based advisory firm, we are thoroughly familiar with the regulations and practice of the Emirati tax authorities, and will make sure your company obtains a Tax Residence Certificate swiftly, smoothly, and with all additional authentications that may be required to successfully use it in the way you intend.

Get a Tax Residency Certificate for a Company

All Tax Residence Certificates in the UAE are issued by the Federal Tax Authority, FTA. The application procedure is remote and streamlined, via the Authority’s web portal. However, every application must be accompanied by a number of documents supporting the applicant’s claim of being a UAE-based and UAE-operated, thus liable to taxation in the UAE, business. For a company, these documents are:

- A copy of your company’s trade license, i.e. the basic license which give it the right to carry out its principal activities in the UAE;

- Authorized Signatory’s passport and Emirates ID copies. Normally, a company’s director is expected to act as its Authorized Signatory, but a special Powers of Attorney may be issued to another person to act in this role;

- A copy of the Articles of Association and Memorandum of Association of your company;

- Audited Finacial Statements for the year in which you want your company to be confirmed as a UAE tax resident;

- A bank statement of your company’s account;

- A certified copy of the tenancy contract for your company’s office premises in the UAE.

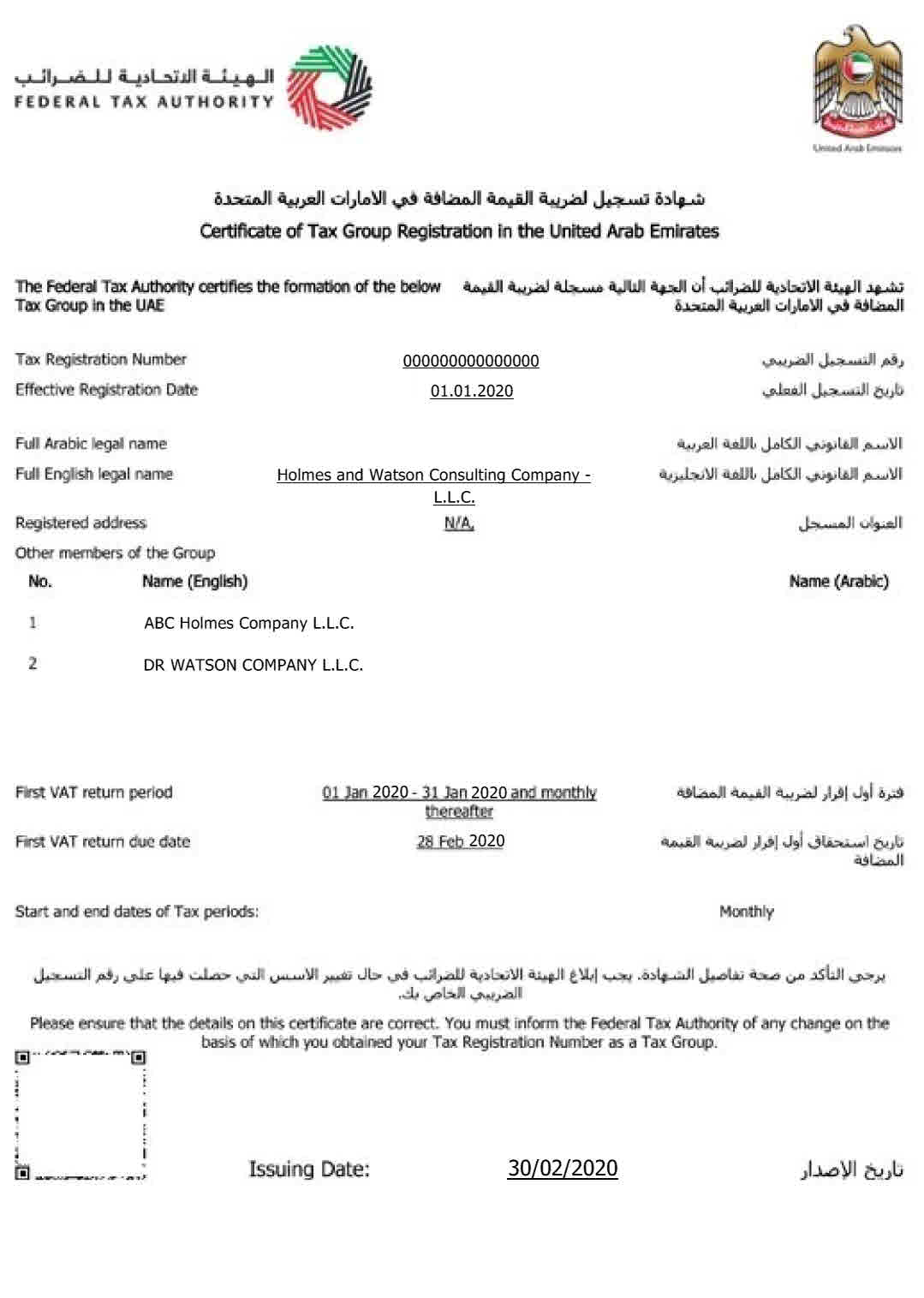

Tax Residence Certificate issued to a UAE company

To apply for a Tax Residence Certificate in the UAE, a company must have been operating in the country for at least a year. Once the certificate is issued, it will be valid for a year from the date of execution.

Get a Tax Residency Certificate for an Individual

If you permanently reside in the UAE under a Resident Visa, you too can apply for a Tax Residence Certificate to confirm your status. Just like companies, individuals are to submit their applications to the FTA, and must file a set of documents along with them to prove their residence in the UAE. For a natural person, these documents are:

- A copy of your passport;

- A copy of your Emirates ID;

- A copy of your Residence Visa;

- A copy of any document comprehensively proving your main source of income, like an employment agreement or a corporate resolution to pay you dividends;

- A bank statement for your personal account;

- Immigration Report on Residency confirming that you have been staying in the UAE for more than 185 days within the year for which you need to obtain the Certificate.

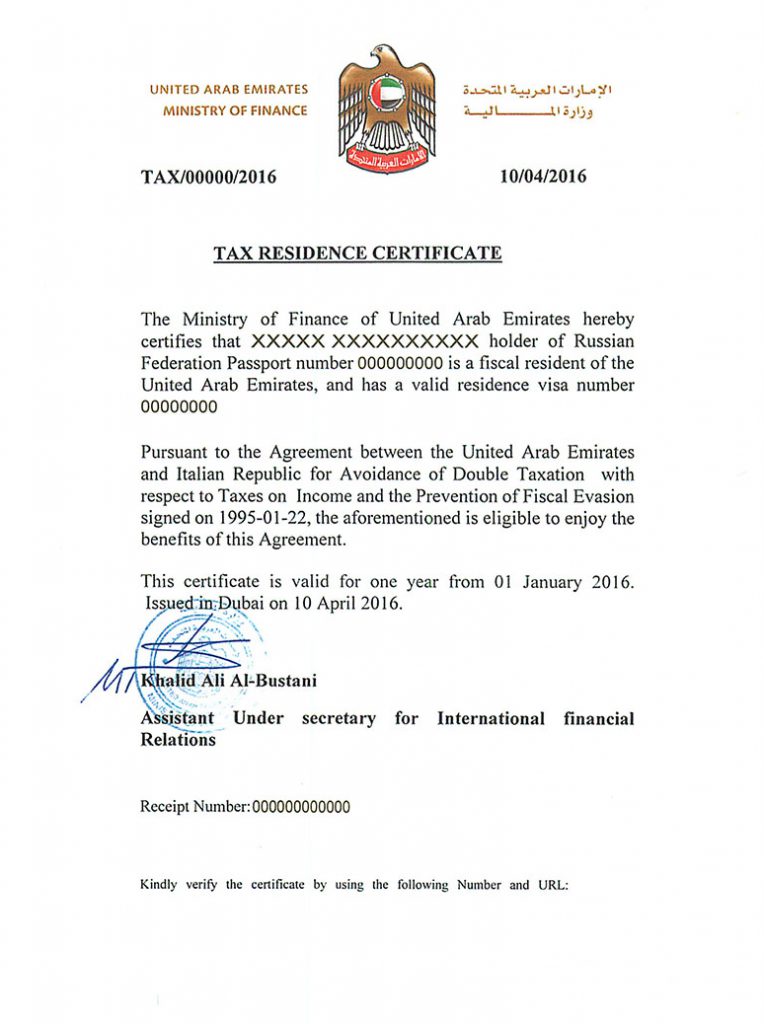

Tax Residence Certificate issued to an individual

A Certificate of Tax Residence issued to an individual is valid for one year.

Requirements for Tax Residence Certificate

To obtain Tax Residence Certificate, the company should meet certain criteria:

- The company should be in the Registrar not less then for 1 year;

- The company’s shareholder/manager should have UAE residence visa;

- The company’s financial statements should be audited;

- The company should prove that it has a real office inside UAE.

Since the UAE is not party to the Hague Convention of 5 October 1961, which abolishes the requirement for legalization of foreign official documents, it may also be necessary to submit the Certificate for legalization to the consulate of a country where they will be used.

Our professionals will provide you with the services for the attestation and legalization of documents in the UAE, the costs and terms of legalization will depend on the type of document and the country for which the legalization is performed.

Documents for Submission to Apply for Certificate

- 01

Valid Trade License

- 02

Certified Articles of Association or Memorandum

- 03

Copy of identity card for the Company Owners or partners or directors

- 04

Copy of passport for the Company Owners or partners or directors

- 05

Copy of Residential Visa for the company owners or partners or directors

- 06

Certified audited report

- 07

Certified bank statement for at least 6 months during the required year

- 08

Certified Tenancy Contract / Title Deed

Double Taxation Avoidance Agreements

Double taxation is defined when similar taxes are imposed in two countries on the same tax payer on the same tax base, which harmfully affects the exchange of goods, services and capital and technology transfer and trade across the border.

Public and private companies, investment firms, air transport firms and other companies operating in the UAE, as well as residents, benefit from Avoidance of Double Taxation Agreements (DTA). With the purpose of promoting its development goals, the UAE concluded 115 DTA to with most of its trade partners.

Purpose of Double Taxation Avoidance Agreements

- Promote the development goals of the UAE and diversify its sources of national income

- Eliminating double taxation, additional taxes and indirect taxes and fiscal evasion

- Remove the difficulties relating to cross-border trade and investment flows

- Offer full protection to tax payers from double taxation, whether direct or indirect and avoid obstructing the free flow of trade and investment and promoting the development goals, in addition to diversify sources of national income and increase the size of investments inflows

- Take into consideration the taxation issues and the global changes in the economic, financial sectors, and the new financial instruments and the mechanisms of transfer pricing

- Encourage the exchange of goods, services and capital movements

List of Countries with Double Taxation Avoidance Agreements

| Recipient | WHT (%) | ||

| Dividends | Interest | Royalties | |

| Albania | 0 / 5 / 10 | 0 | 5 |

| Algeria | 0 | 0 | 10 |

| Andorra | 0 | 0 | 0 |

| Argentina | 10 / 15 | 12 | 10 |

| Armenia | 0 / 3 | 0 | 5 |

| Austria | 0 | 0 | 0 |

| Azerbaijan | 5 / 10 | 0 / 7 | 5 / 10 |

| Bangladesh | 5 / 10 | 10 | 10 |

| Barbados | 0 | 0 | 0 |

| Belarus | 5 / 10 | 0 / 5 | 5 / 10 |

| Belgium | 0 / 5 / 10 | 0 / 5 | 0 / 5 |

| Bosnia and Herzegovina | 0 / 5 / 10 | 0 | 0 / 5 |

| Brunei | 0 | 0 | 5 |

| Bulgaria | 0 / 5 | 0 / 2 | 0 / 5 |

| Canada | 5 / 10 / 15 | 0 / 10 | 0 / 10 |

| China | 0 / 7 | 0 / 7 | 10 |

| Comoro Islands | 0 | 0 | 0 |

| Croatia | 5 | 5 | 5 |

| Cyprus | 0 | 0 | 0 |

| Czech Republic | 0 / 5 (1) | 0 (1) | 10 (1) |

| Egypt | 0 | 0 / 10 | 10 |

| Estonia | 0 | 0 | 0 |

| Fiji | 0 | 0 | 10 |

| Finland | 0 | 0 | 0 |

| France | 0 | 0 | 0 |

| Georgia | 0 | 0 | 0 |

| Germany | 5 / 10 / 15 | 0 | 10 |

| Greece | 0 / 5 | 0 / 5 | 10 |

| Guinea | 0 | 0 | 0 |

| Hong Kong | 0 / 5 | 0 / 5 | 5 |

| Hungary | 0 | 0 | 0 |

| India | 10 | 0 / 5 / 12.5 | 10 |

| Indonesia | 10 (1) | 0 / 5 | 5 |

| Ireland | 0 | 0 | 0 |

| Italy | 5 / 15 | 0 | 10 |

| Japan | 5 / 10 | 0 / 10 | 10 |

| Jersey | 0 | 0 | 0 |

| Jordan | 7 | 0 / 7 | 10 |

| Kazakhstan | 0 / 5 | 0 / 10 | 10 |

| Kenya | 5 | 10 | 10 |

| Korea, Republic of | 5 / 10 | 0 / 10 | 0 |

| Kosovo | 0 / 5 | 0 / 5 | 0 |

| Kyrgyzstan | 0 | 0 | 5 |

| Latvia | 0 / 5 | 0 / 2.5 | 5 |

| Lebanon | 0 | 0 | 5 |

| Liechtenstein | 0 | 0 | 0 |

| Lithuania | 0 / 5 | 0 | 5 |

| Luxembourg | 0 / 5 / 10 | 0 | 0 |

| Macedonia | 0 / 5 | 0 / 5 | 0 / 5 |

| Malaysia | 0 / 10 (2) | 0 / 5 | 10 |

| Maldives | 0 | 0 | 0 |

| Malta | 0 | 0 | 0 |

| Mauritius | 0 | 0 | 0 |

| Mexico | 0 | 0 / 4.9 / 10 | 10 (1) |

| Moldova | 5 | 6 | 6 |

| Montenegro | 0 / 5 / 10 | 0 / 10 | 0 / 5 / 10 |

| Morocco | 0 / 5 / 10 | 0 / 10 | 0 / 10 |

| Mozambique | 0 | 0 | 0 / 5 |

| Netherlands | 0 / 5 / 10 | 0 | 0 |

| New Zealand | 15 | 0 / 10 | 10 |

| Pakistan | 10 / 15 | 0 / 10 | 12 |

| Panama | 5 | 0 / 5 | 5 |

| Philippines | 0 / 10 / 15 | 0 / 10 | 10 |

| Poland | 0 / 5 | 0 / 5 | 5 |

| Portugal | 5 / 15 | 0 / 10 | 5 |

| Romania | 0 / 3 | 0 / 3 | 3 |

| Russia (3) | 0 | 0 | N/A |

| Saudi Arabia | 5 | 0 | 10 |

| Senegal | 5 | 5 | 5 |

| Serbia | 0 / 5 / 10 | 0 / 10 | 10 |

| Seychelles | 0 | 0 | 5 |

| Singapore | 0 (1) | 0 (1) | 0 / 5 (1) |

| Slovakia | 0 | 0 / 10 | 0 / 10 |

| Slovenia | 0 / 5 | 0 / 5 | 5 |

| South Africa | 5 / 10 | 10 | 10 |

| Spain | 0 / 5 / 10 | 0 | 0 |

| Sri Lanka | 0 / 10 | 0 / 10 | 10 |

| Sudan | 0 | 0 | 0 / 5 |

| Switzerland | 0 / 5 / 15 | 0 | 0 |

| Syria | 0 | 0 / 10 | 18 |

| Tajikistan | 0 | 0 | 10 |

| Thailand | 5 / 10 (1) | 0 / 10 / 15 (1) | 15 (1) |

| Tunisia | 0 | 2.5 / 5 / 10 | 7.5 |

| Turkey | 5 / 10 / 12 | 0 / 10 | 10 |

| Turkmenistan | 0 | 0 | 10 |

| Ukraine | 0 / 5 (1) | 0 / 3 (1) | 0 / 10 (1) |

| United Kingdom | 0 / 15 | 0 / 20 | 0 |

| Uruguay | 5 / 7 (1) | 0 / 10 | 0 / 5 / 10 |

| Uzbekistan | 0 / 5 / 15 | 0 / 10 | 10 |

| Venezuela | 0 / 5 / 10 | 0 / 10 | 10 |

| Vietnam | 0 / 5 / 15 | 0 / 10 | 10 |

| Yemen | 0 | 0 | 10 |

- This DTT includes a ‘favoured nation’ clause. If this jurisdiction ever concludes a more favourable treaty WHT rate with a country other than the United Arab Emirates, then the more favourable treaty WHT rate will automatically apply to the UAE treaty as well. Note that the above-mentioned rates do not reflect the more favourable DTT rates but only the rates presented in the DTT between the United Arab Emirates and the relevant jurisdiction. The more favourable rates will need to be confirmed separately.

- The UAE-Malaysia DTT provides for a reduced rate of 10% where dividend payments are made from a UAE entity to a Malaysian entity. The DTT, however, provides for a lower rate of 0% where payments are made from a Malaysian entity to a UAE entity.

- Government institutions only.

Make Sure Your Certificate Is Accepted

It is worth noting that, should you need to submit a Tax Residence Certificate for your UAE company to any party overseas – which is always the case when you need it to apply for benefits under a DTA – it has to be legalized specifically for the country of destination. To help you save your time and avoid unnecessary administrative complexities, we will be able to offer you a turnkey package of getting a Tax Residence Certificate and having it legalized for the country of your choice.

You may find an up-to-date list of all countries which have DTAs with the UAE here: https://eservices.mof.gov.ae/Agreement/?id=1

Ahead

To make sure you enjoy a comfortable regime of taxation in the UAE and reap all benefits you expect from a DTA, it is crucially important to have full and up-to-date knowledge of the UAE tax regulations.

Our professional team will assist you with planning your taxes in the UAE in a well-informed and comprehensive manner, and with choosing and setting up a corporate structure most conductive to your aims and goals. If you are an owner of a business, we would be able to take on the administration of your company, its bookkeeping, and help you with getting registered for VAT or liaising with government agencies.

Both for businesses and individuals, we can find a reliable local bank to open an account with, and provide assistance with legalization of your documents for the UAE or other countries.

Fill out the form to book a consultation from our experts. Let us help you unlock new opportunities and grow your business with confidence.

*Price: from 11 570 AED

*Execution Period: 7 days