Company Incorporation in Romania

Your consultant

Alina Marinich

Senior Business Consultant

Romania has long been an attractive jurisdiction for doing business due to its European Union membership and strategic advantages. With Romania company registration, businesses can benefit from its high reputation, streamlined incorporation process, and the ability to open a bank account in the country of registration. Additionally, Romania provides an optimal environment for startups and small businesses, offering favorable taxation policies and cost-effective alternatives to pricier European countries like Switzerland, Germany, and Austria.

The most common and frequently used form of doing business in Romania is a limited liability company, SRL (“societate cu raspundere limitata”).

Key Specifics of Romania Company Registration

- Attractive conditions for small businesses with annual revenue of up to EUR 500.000;

- Positive image of a European jurisdiction;

- Not on any offshore blacklists;

- Quick Romania company registration;

- Local bank account can be opened;

- Quick and affordable creation of substance in the country of registration;

- 1% or 3% corporate tax (for company with annual revenue of up to EUR 500.000 and at least 1 (one) full-time employee) where the employee can also be the same as the director of the company if some requirements are met (see last page);

- Large network of double tax treaties.

Romania Company Structure Requirements

- The affairs of a limited liability company in Romania are managed by the administrator (acting as the director). The administrators can be physical persons or even legal entities (but a physical person which is representing that legal entity is required to be named as the director; and the more complicated procedure is required for appointment of a legal entity as the administrator). The minimum number of administrators is 1. The same individual can be both the administrator and the member. There are no statutory requirements as to the residency. However, if the administrator (director) wants also to be legally employed in Romania to meet the microenterprise requirements, not being a shareholder is a condition; and the administrator must apply for a long term stay visa “for other purposes” (commercial management of a company).

- The minimum number of shareholders / associates in a company is 1. They can be individuals or legal entities and there are no statutory requirements as to their residency. The maximum number of members is 50. In July 2020, Romania adopted amendments to its corporate law, abolishing the restrictions imposed by Article 14 of the Companies Law. These restrictions prohibited an individual or a legal entity from becoming the sole shareholder of more than one limited liability company registered under the laws of Romania, and prohibited a limited liability company from having another limited liability company consisting of one person as its sole shareholder. From 1 January 2023, shareholders can own more than 25% of shares in a maximum of 3 (three) different companies.

- Unlike most European jurisdictions, Romania does not require companies to have a secretary.

- The recommended minimum share capital is RON 200 (approximately EUR 50) divided into shares of minimum RON 10 each.

Romania Company Registration Period

A new limited liability company is registered within 2 weeks.

Process of Company Incorporation in Romania

A Romanian company incorporation procedure includes the following steps:

STEP 1 – Company Name Availability Check

We request 2 – 3 names to be checked with the Registry in order of priority. The name must meet the following requirements:

- must not be identical or similar to the name of an existing company, the name must be checked in the register for its availability, which takes 2 – 3 business days;

- can be in any language using Latin letters;

- the use of geographical names and the word “Romania” is restricted and requires special approval;

- must have an ending that denotes the type of company (“SRL”).

STEP 2 – Regulatory Compliance Process

The Prevention and Suppression of Money Laundering and Terrorist Financing Law requires corporate service providers to identify the beneficial owners of the company, the source of their funds and the nature of activities for which they will use the company. However frightening it may sound, this compliance check is quite simple and requires a client to supply the above information in free form, as well as provide proof of identity and of residential address for all the individuals in the company’s structure. Also, for each company, the beneficial owner fills in and signs a client information form, to be kept solely in our files.

STEP 3 – Invoice Payment Period

STEP 4 – Compilation of Company Formation Documents

Essential documentation for business registration:

- confirmation of company name reservation at the Trade Register;

- notarized proof of identity of the administrator / member (passport, national identity card);

- notarized proof of address of the administrator / member (address card or gas / electricity bill or credit / debit card bank statement, not older than 3 months);

- notarized financial declaration that the administrator / member has no public debt in Romania regarding the Romanian authorities;

- Articles of Association (“Act Constitutiv”) signed by all associates (members / shareholders);

- proof of the right to use the company’s registered address and having an office for the company to conduct business (lease / sublease agreement and land register extract not older than 30 days).

If the administrator / member is not a resident of Romania, they can sign the documents remotely, have the originals notarized and send them to Romania. Translation of documents into the Romanian language is done in Romania by an authorized translator (and certified by a public notary).

If the administrator / member is ready to travel to Romania for the company registration, all documents will be executed at a local notary. This will save the cost of translating some of the documents into Romanian and certifying these translations.

The documents can also be signed using an electronic signature.

STEP 5 – Submission to the Official Trade Registry

Documents can be filed with the Trade Register in two ways:

- in original, i.e. physically;

- in electronic form through the Trade Register online portal.

Within 3 business days of the filing, the Trade Register conducts a first initial checking, which results either in the registration of the company or a request for additional documents, indicating the deadline for their submission. After receiving the additional documents, the register conducts a second initial checking, as a result of which the company is either registered or a refusal to register is issued with an explanation of reasons. In such case, only a new filing can be made, with fee to be paid a second time.

STEP 6 – Creation and Delivery of Foundational Corporate Papers

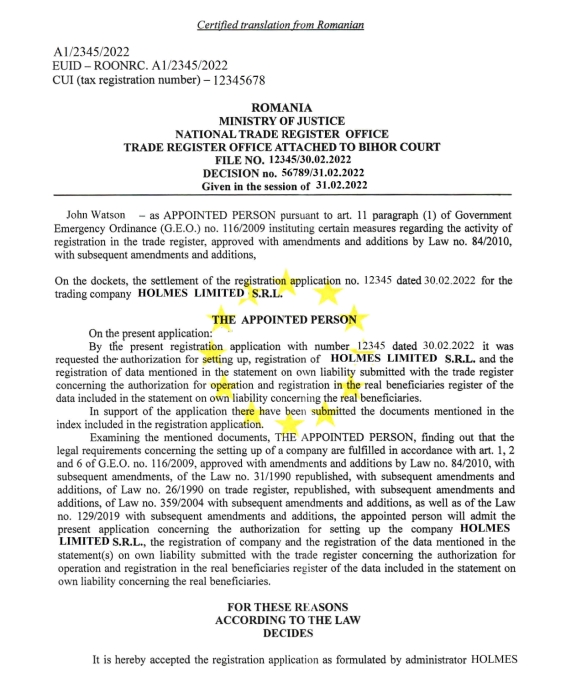

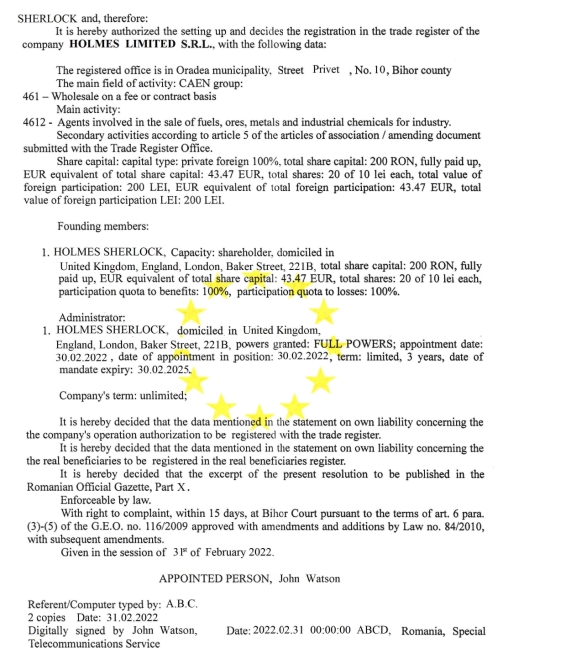

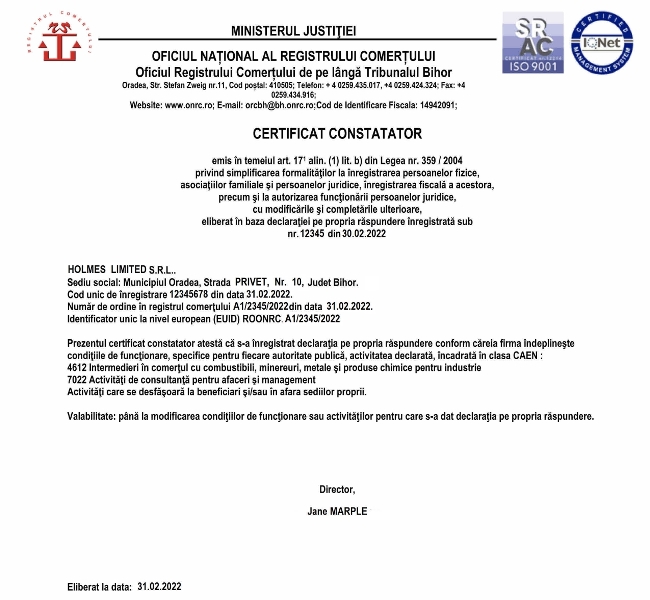

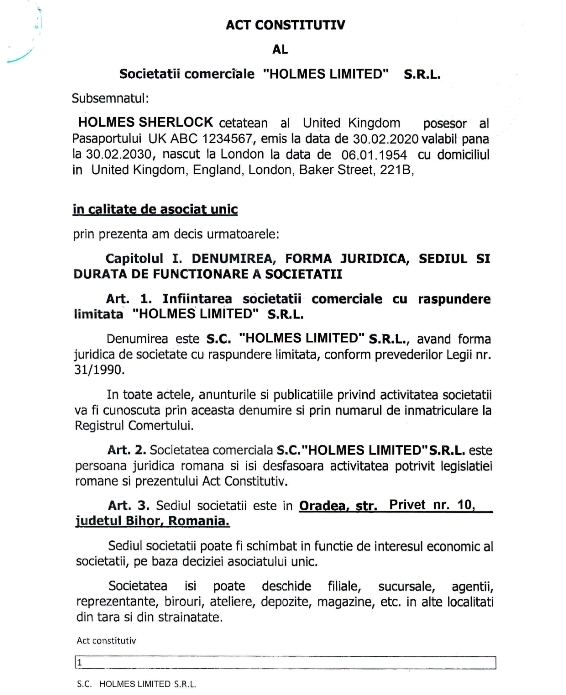

In Romania, the documents issued by the Trade Register upon the registration of a company are:

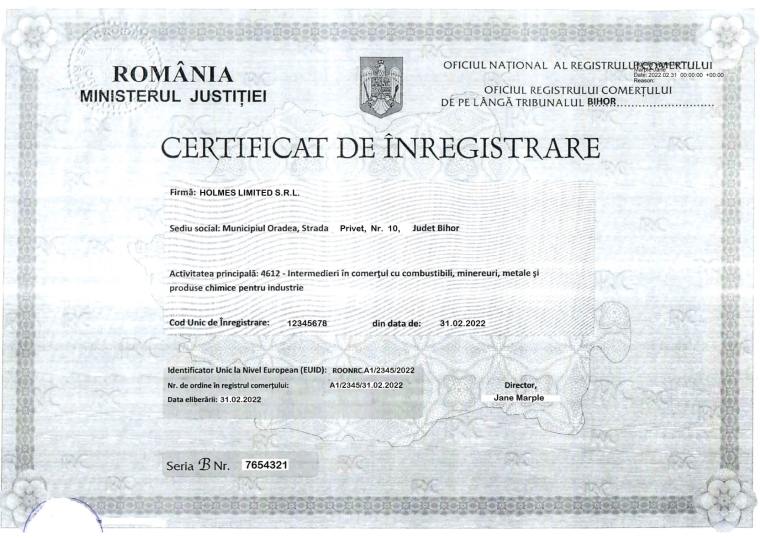

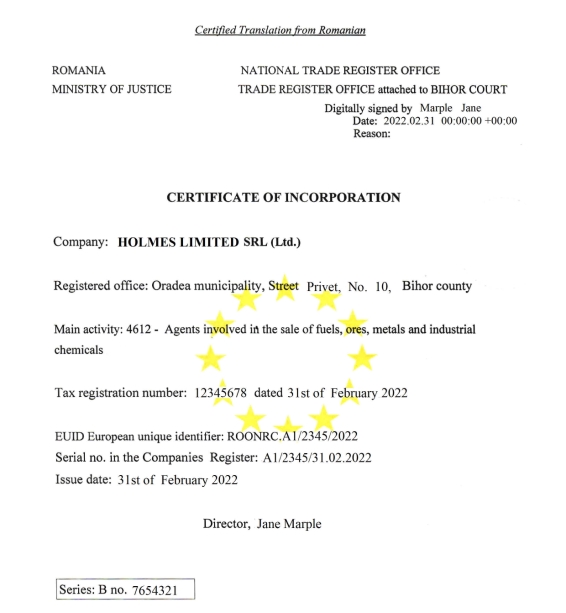

- Certificate of Company Incorporation in Romania (“Certificat de Inregistrare”);

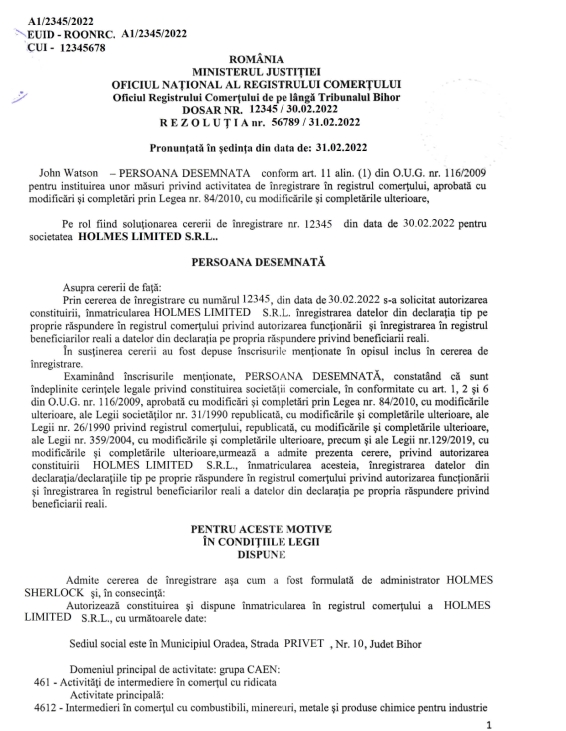

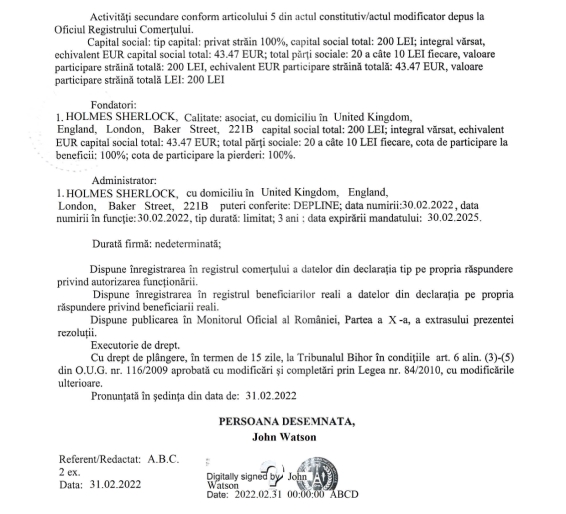

- Resolution of the Trade Register approving the registration of the company (“Rezolutia de admitere a dosarului”);

- Certificate (“Certificat constatatare”) confirming the company’s details where it is specified which activities the company has enabled from the CAEN list codes;

- Articles of Association (“Act Constitutiv”) signed by the members during the registration of the company – it is verified by the Register.

Depending on the form in which the documents are initially filed with the register, they are issued either in original or in electronic form. According to Ordinance No. 38/2020, documents issued by the Trade Register in electronic form and containing the electronic signature of a judge of the Trade Register have the legal effect of originals.

A seal is not required under Romanian law.

Disclosure and Transparency of Corporate Records

In Romania, as in most European jurisdictions, the details of administrators and members are filed with the Trade Register and thus are available to third parties and are public. On 18 July 2019, Romania adopted a law introducing a unified centralized register of beneficial owners, thereby fulfilling the requirements of the European Union to bring domestic legislation in line with the 4th and 5th Anti-Money Laundering Directives. Access to the beneficial ownership information was available not only to tax and judicial authorities, individuals and entities that carry out due diligence in relation to money laundering or terrorist financing but also to anyone interested. Now due to the decision of the European Court of Justice (CJUE) stated that general public access to information on beneficial ownership constitutes a serious interference with the rights guaranteed in Articles 7 and 8 of the Charter of Fundamental Rights of the European Union, all EU members work under some restrictions to the access to the beneficial ownership information (most likely, for individuals the access to such an information will be restricted with proof of the legitimate interest).

Ongoing Corporate Governance and Support

Yearly Annual Renewal Procedure

Each company should be renewed on an annual basis (starting from the second year) before the date of each anniversary of its incorporation. The renewal includes the provision of a registered address / making of an office lease agreement for a new period.

Filing of Mandatory Annual Reports

In Romania, there is no requirement to file Annual Return to the Register.

Tax Framework Overview

Corporate Earnings Tax Policies

The standard rate of corporate income tax is 16%.

Tax Benefits for Micro-Businesses

Romania has the most attractive tax regime for small businesses in the EU. A company is regarded a micro-enterprise if its revenue in the past years did not exceed EUR 500.000. The corporate tax rate will be:

- 1% for micro enterprises with annual proceeds not exceeding EUR 60.000 that do not conduct business in the below fields;

- 3% for micro enterprises that have annual proceeds of over EUR 60.000 or conduct business in the following fields: software development, IT services, hotel and restaurant business, medical and some other services.

Starting on 1 January 2024, micro enterprises are enterprises that meet the following criteria:

- have at least 1 staff member;

- have turnover of < EUR 500.000;

- have shareholders that hold over 25% of the total share capital or voting rights, and the company is the only micro enterprise established by these shareholders (earlier shareholders could own 3 micro enterprises at most);

- have other sources of income, besides management and consulting, that make up over 80% of the total income.

In all other cases the company automatically switches to Romania’s standard taxation regime, with a corporate income tax rate of 16%.

Regulations on Tax Withholding

Tax is withheld at a rate of 8% on dividends paid (before 1 January 2023 – 5%).

Payments of royalties and interest are taxed at source of payment at a rate of 16%. Payments for legal and consulting services provided to a Romanian company, irrespective of where the services are provided, are also subject to a 16% withholding tax.

VAT Compliance Requirements

A Romanian company is subject to mandatory VAT registration. The current VAT rate is 19%. Depending on the turnover and profit of the company, VAT returns must be filed:

- Monthly, if the annual turnover exceeds EUR 100.000 or if the goods are purchased within the EU;

- Quarterly, if the annual turnover is below EUR 100.000 or if no goods were purchased within the EU;

- Twice a year / annually – if granted a special permission from the tax authority.

Preparation of Audited Reports and Tax Filings

Businesses in Romania are required by law to submit annual financial statements, a process typically managed by a Romanian accountant.

In addition to the annual report, micro-enterprises must also confirm their status quarterly and submit the necessary declarations to the tax office with the assistance of their Romanian accountant.

The annual financial statements of legal entities that exceed at least 2 of the following criteria are subject to a compulsory independent audit:

- total assets: EUR 3.650.000;

- net turnover: EUR 7.300.000;

- average number of employees during the financial year: 50.

Our Services Prices

| Services | Fees (EUR)[1] |

| Company incorporation with one shareholder and standard Articles of Association | 3.465 |

| Registered address for the first year: physical office lease (without physical placement of employees) | 3.565 |

| Local bank account opening | 945 |

| Preparation and submission of financial accounts, and conduct of an audit | 100 – 400 per hour of work |

| Courier delivery | 250 |

| Compliance fee

Payable in the cases of:

|

350 (standard rate, includes the check of 1 individual)

+ 150 for each additional individual (administrator / member) or legal entity (member) if such legal entity is administered by ITA + 200 for each additional legal entity (member) if such legal entity is not administered by ITA 450 (rate for a High-Risk company, includes the check of 1 individual) 100 (signing of documents) |

[1] The fees do not include 19% VAT, which may arise under certain conditions. Please refer to the ITA consultants for details.