VAT Registration in UAE & Dubai: A Complete Guide

Updated: November 2025. Verified for compliance with the latest FTA and EmaraTax guidelines.

“Over the past eight years working with international businesses in the UAE, I’ve seen a clear pattern: companies that understand VAT registration from the start avoid costly penalties and unlock smoother growth. The key isn’t just meeting thresholds-it’s building compliant infrastructure from day one.”

– Daniel Zhao, Head of International Legal Department, ITA Business Consultants

VAT Registration in UAE: A Complete Guide for Businesses

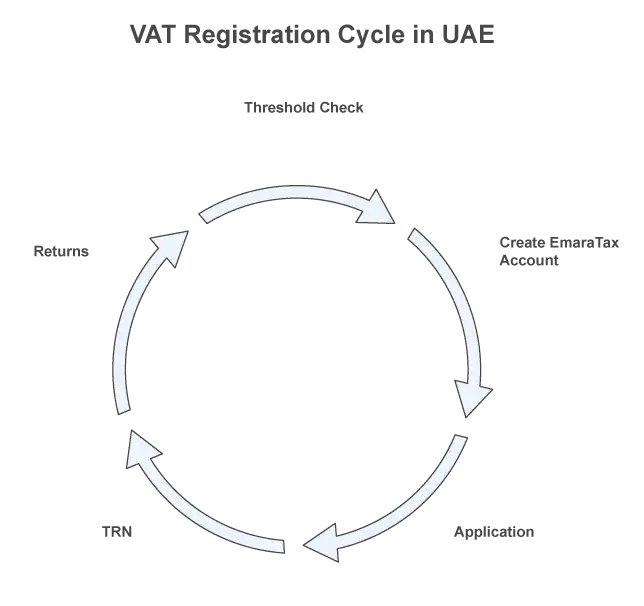

VAT registration in the UAE is a mandatory tax compliance process for any business whose taxable supplies cross specific revenue thresholds. The process is conducted entirely online via the Federal Tax Authority (FTA) EmaraTax portal and results in a Tax Registration Number (TRN) that businesses must use in all tax-related transactions.

The UAE introduced VAT on January 1, 2018, at a standard rate of 5%-one of the lowest globally. Since then, the Federal Tax Authority has processed tens of thousands of registrations through its digital platforms. The system requires businesses to charge VAT on taxable supplies, collect it from customers, and remit it to the government, while simultaneously recovering VAT paid on business purchases (input tax). This dual mechanism ensures that VAT is ultimately borne by end consumers, not by businesses themselves, provided proper compliance is maintained.

For entrepreneurs and international investors, VAT registration also demonstrates legitimacy and enhances operational credibility. VAT-registered businesses can issue compliant tax invoices, enabling B2B customers to recover input tax. Non-registered businesses cannot charge VAT, cannot issue valid tax invoices, and risk penalties if they exceed thresholds without registering.

“EmaraTax is the FTA’s online platform for registration, returns, payments, and taxpayer communication.” – Federal Tax Authority

The Federal Tax Authority publishes all regulations, guides, and public clarifications at https://tax.gov.ae/, the primary source for VAT law updates and EmaraTax portal access.

VAT Registration Thresholds in the UAE: Mandatory vs. Voluntary

VAT registration thresholds determine when a business must register based on the value of taxable supplies and imports. Understanding these thresholds is critical because crossing the mandatory threshold without timely registration triggers an automatic AED 10,000 penalty, while voluntary registration below the mandatory threshold offers strategic input tax recovery benefits.

“Businesses must register if taxable supplies exceed AED 375,000; voluntary registration from AED 187,500.” – Federal Tax Authority

Mandatory Registration Threshold

Mandatory VAT registration applies if your business’s taxable supplies and imports exceed AED 375,000 within the previous 12 months, or if you expect to exceed this threshold in the next 30 days.

“Thresholds are assessed on a rolling 12 months and on expectations for the next 30 days.” – Federal Tax Authority

This dual measurement-retrospective (past 12 months) and prospective (next 30 days)-ensures that rapidly growing businesses cannot delay registration by claiming they haven’t yet crossed the threshold historically.

The AED 375,000 threshold calculation includes all taxable supplies, meaning both standard-rated supplies (5% VAT) and zero-rated supplies (0% VAT). For example, an exporter selling AED 300,000 of standard-rated goods and AED 100,000 of zero-rated exports has AED 400,000 in total taxable supplies and must register.

“Zero‑rated supplies are taxable supplies and count toward VAT registration thresholds.”

Crucially, exempt supplies-such as financial services or residential property rentals-do not count toward the threshold.

Non-resident suppliers face an entirely different regime:

“Non‑resident suppliers must register if they make taxable supplies in the UAE, unless the recipient must account for VAT.” – Federal Tax Authority.

This rule prevents foreign businesses from avoiding UAE VAT by operating remotely. Non-residents making taxable supplies to customers who are not VAT-registered in the UAE must register regardless of turnover amount. The requirement for appointing a fiscal representative depends on the specific circumstances and should be verified with the FTA for each business structure.

In one of our recent projects, a European software-as-a-service (SaaS) company selling subscriptions to UAE customers assumed they were exempt from VAT registration because they had no physical presence in the UAE. After we reviewed their contracts and invoicing, we discovered they were making taxable supplies to non-VAT-registered UAE customers, triggering immediate mandatory registration. We completed their registration within 18 days, appointed a UAE-based tax agent, and restructured their invoicing to include reverse charge notations for VAT-registered clients. This proactive intervention avoided a late registration penalty and clarified their ongoing compliance obligations.

Voluntary Registration Threshold

Businesses may opt for voluntary registration if their taxable supplies, imports, or taxable expenses exceed AED 187,500 in the past 12 months or are expected to exceed this amount in the next 30 days. Voluntary registration is particularly beneficial for new businesses with substantial setup costs-office rent, equipment, technology, professional services-because it enables input tax recovery before generating significant sales.

The strategic advantage of voluntary registration is clear: if you incur AED 200,000 in business expenses subject to 5% VAT (AED 10,000 in input tax), voluntary registration allows you to reclaim that AED 10,000 from the government. Without registration, the AED 10,000 becomes a permanent cost. However, voluntary registration also obligates you to charge VAT on all taxable sales, which may reduce competitiveness in B2C markets where customers cannot recover VAT.

Consider the case of a Dubai-based e-commerce startup importing inventory and marketing services. In their first six months, they incurred AED 220,000 in taxable expenses but generated only AED 80,000 in sales. By registering voluntarily, they recovered AED 11,000 in input tax that would otherwise have been lost. However, they also had to raise their prices by 5% on consumer sales, which initially reduced conversion rates. Over 12 months, the input tax recovery more than offset the price impact, but the decision required careful cash flow modeling.

“Voluntary VAT registration can be rejected if applicants cannot evidence genuine business intent.”

The Federal Tax Authority scrutinizes voluntary registration applications to verify “genuine business intent.” Applications lacking credible evidence of imminent taxable supplies-such as customer contracts, market research, or sales projections-may be rejected.

| Type | Threshold (AED) | Basis | Assessment Window | Special Conditions |

|---|---|---|---|---|

| Mandatory | 375,000 | Taxable supplies + imports | Past 12 months OR next 30 days | Non-residents: must register for taxable supplies if recipient not obligated to account for VAT |

| Voluntary | 187,500 | Taxable supplies, imports, OR taxable expenses | Past 12 months OR next 30 days | FTA may reject if insufficient business intent demonstrated |

How to Register for VAT Online: A Step-by-Step Process

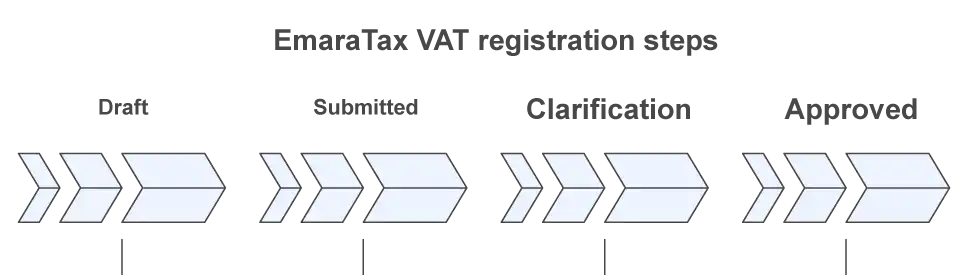

VAT registration in the UAE is conducted exclusively through the EmaraTax digital portal. The process requires creating an account, submitting a detailed application, uploading supporting documents, and tracking approval status.

“Typical VAT registration timelines range around 20–30 business days, depending on completeness.”

Businesses that prepare documents in advance and understand each step can complete registration applications in 15–20 minutes of active engagement time.

Step 1: Create an EmaraTax Account

Navigate to the FTA e-Services portal at https://eservices.tax.gov.ae/ and select the account registration option. Enter your email address and mobile number; the FTA will send a verification email and SMS code. Activate your account by clicking the verification link within 24 hours. You may authenticate using a traditional username/password or via UAE Pass, a government-wide single sign-on platform that provides faster, more secure access.

Step 2: Add Your Business Profile

Once logged in, create a “Taxable Person Profile” by entering your legal business name, trade name (if different), business address, nature of activities as described in your trade license, contact person details, and communication preferences. The profile must match your official trade license exactly-any discrepancies may delay or reject your application. Include the profile name in Arabic as required by the FTA system.

Step 3: Choose VAT Registration Application

From your EmaraTax dashboard, select “VAT” → “Registration” and open the VAT registration form. Indicate whether you are applying for mandatory or voluntary registration. For mandatory applications, specify whether you exceeded AED 375,000 in the past 12 months or expect to exceed it in the next 30 days.

Step 4: Complete Business Details Section

Provide your trade license number, free zone designation (if applicable), Memorandum of Association (MOA) or Articles of Association (AOA), ownership structure, and business activities. Ensure the Date of Incorporation matches the Date of Issue of the Trade License. For free zone companies, include customs details and free zone authority documentation. Describe your primary business activities, customer base (B2B vs. B2C), and whether you make exempt or zero-rated supplies.

Step 5: Identify Authorized Signatory

Upload passport and Emirates ID copies for all owners, managers, and authorized signatories. Attach a Power of Attorney, Memorandum of Association, or board resolution proving that designated individuals have authority to represent the business in VAT matters. The FTA pre-populates these signatories in the system; subsequent VAT returns must bear their digital signatures.

Step 6: Supply Tax Information

Declare your expected annual turnover to enable the FTA to assign the appropriate filing frequency (monthly for turnover above AED 150 million; quarterly below). Provide historical turnover data if available, along with projections for the next 12 months. Include sales figures as per the Declaration Letter and upload sample invoices. Disclose whether you anticipate making imports, exports, reverse charge supplies, or zero-rated supplies.

Step 7: Provide Bank Details

Enter your UAE IBAN and upload a bank validation letter confirming your business maintains an active account. While bank details are critical for VAT refunds and verification of your banking relationship, they are typically required at the registration stage but become essential when claiming refunds.

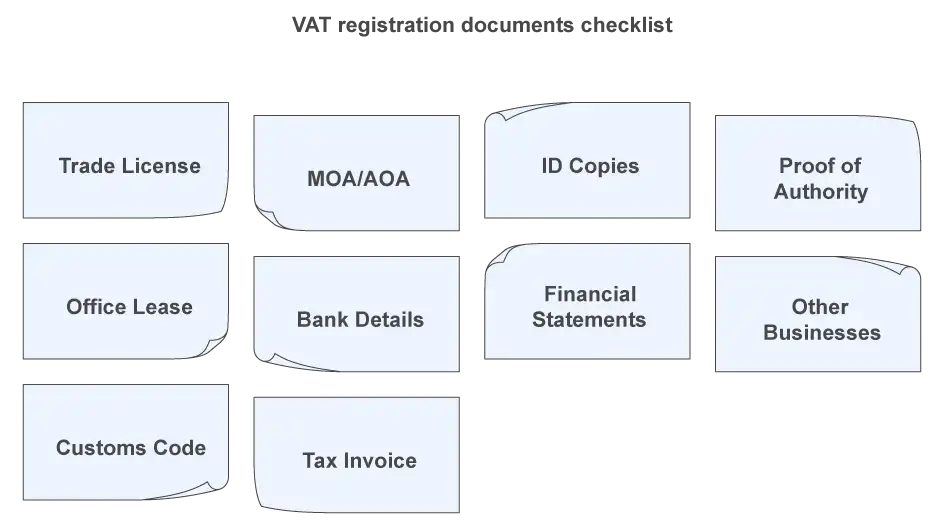

Step 8: Upload Documents

“Core documents include trade license, MOA/AOA, IDs for owners and signatories, bank IBAN letter, and financials.”

Attach clear, legible PDF copies of all required documents:

- Trade License and Certificate of Incorporation

- Memorandum/Articles of Association

- Passport and Emirates ID copies

- Bank IBAN letter

- List of other businesses of directors/partners in UAE (last 5 years with trade license copies)

- Declaration letter for turnover from Date of Issue of License

- Sample invoices

Name files descriptively (e.g., “Trade-License.pdf,” “MOA.pdf”) to facilitate FTA review. Documents in languages other than English or Arabic must include certified translations.

Step 9: Review and Submit

Validate all entries for accuracy and completeness. The EmaraTax system highlights missing or incomplete fields. Sign the declaration confirming that all information is accurate and that you understand VAT compliance obligations. Submit the application electronically.

Step 10: Track Application and Respond to FTA Requests

Monitor your application status via the EmaraTax dashboard. The FTA may request clarifications or additional documents-typically within 10–20 business days of submission. Respond promptly to avoid delays.

In a recent engagement with an international holding company establishing operations in Dubai, we managed the entire registration process from document gathering through certificate issuance in 22 business days. The client provided all required documents at the outset-audited financials, ownership structure charts, and bank letters-which eliminated FTA clarification requests. We uploaded documents in a standardized format with clear naming conventions, and the FTA approved the application on first review. This disciplined approach saved the client 15–20 additional days compared to typical processing times.

Required Documents for VAT Registration

Preparing complete, accurate documentation before starting your application accelerates FTA review and reduces the likelihood of rejection or clarification requests. The following documents are required for most business types; certain structures (e.g., free zone entities, partnerships, non-residents) may require additional materials.

- Trade license and incorporation certificate: Current, valid license showing authorized business activities.

- Memorandum of Association (MOA) or Articles of Association (AOA): For LLCs, partnerships, and shareholding companies. Sole proprietors submit business ownership documents.

- Passport and Emirates ID copies: For all owners, authorized signatories, and senior management personnel.

- Proof of authority: Power of Attorney, board resolution, or similar document establishing signatory authority.

- Office lease or tenancy contract: Recent utility bill (water, electricity) or lease agreement verifying business address.

- Bank account details: UAE IBAN and bank validation letter confirming account ownership.

- Financial documentation: Audited or non-audited financial statements, turnover calculation sheets, sample invoices, contracts, or purchase orders demonstrating taxable supplies for the past 12 months and projections for the next 30 days.

- List of other UAE businesses: Trade licenses for other businesses of directors or partners in UAE in the last five years.

- Declaration letter for turnover: From the Date of Issue of License, signed and stamped.

- Customs code and free zone certificate: If operating in a free zone or importing goods.

- Sample tax invoice template: Optional but recommended to demonstrate readiness for compliance.

For voluntary registration applications, the FTA requires robust evidence of genuine business intent. Provide customer contracts, letters of intent, market research, revenue forecasts, or other documentation showing that taxable supplies will commence in the near term. Applications lacking this evidence face higher rejection risk.

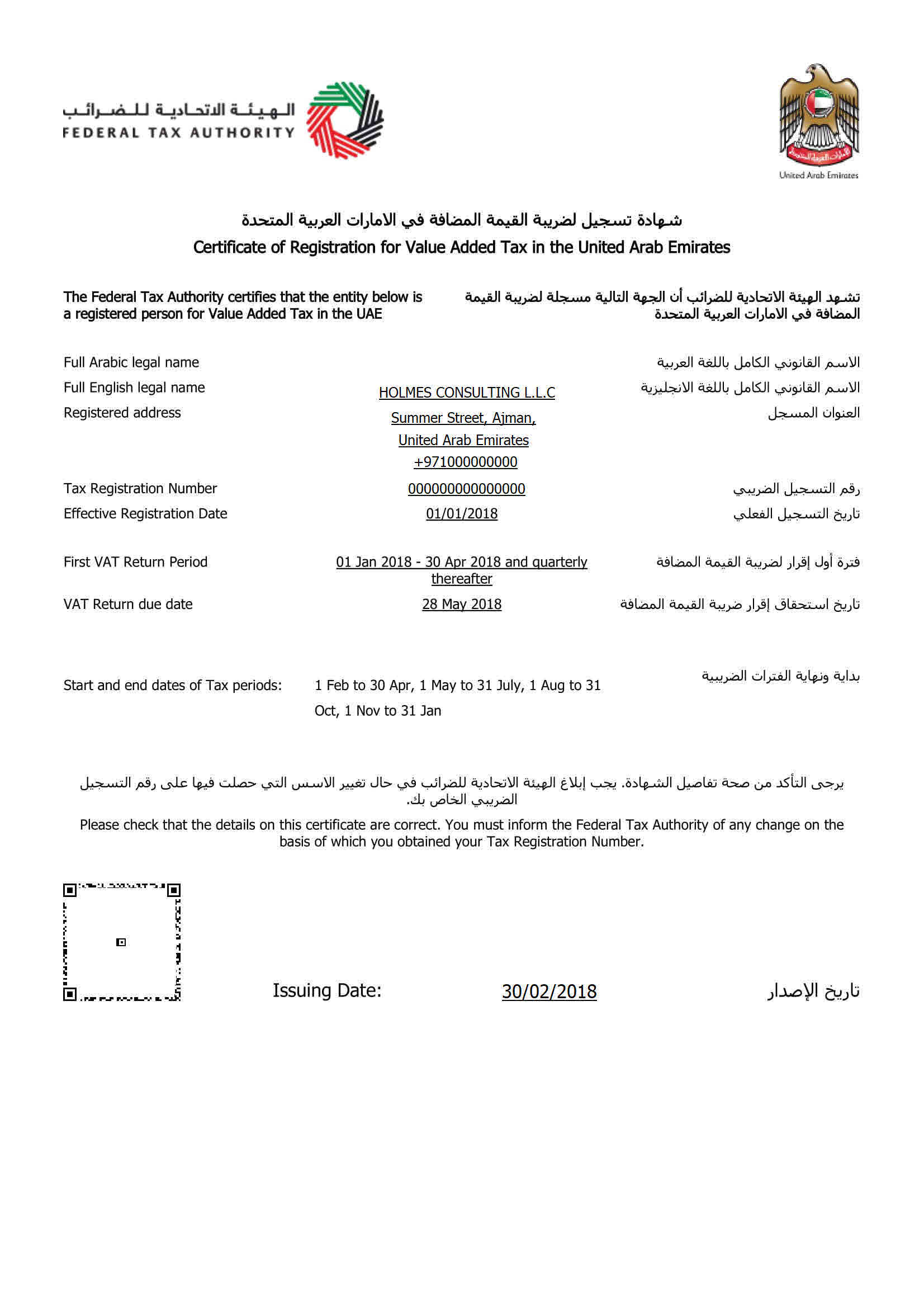

Receiving Your VAT Registration Number (TRN) and Certificate

Upon FTA approval, you receive a unique Tax Registration Number (TRN), a 15-digit identifier used in all VAT filings, tax invoices, and FTA communications. The TRN appears in your EmaraTax dashboard, and a VAT Registration Certificate is available for download.

The VAT certificate includes your legal name (in English and Arabic), TRN, registration date, assigned tax period (monthly or quarterly), and any special conditions. You must display the TRN prominently on all tax invoices, credit notes, and VAT returns. The certificate serves as official proof of registration status for banks, suppliers, government procurement processes, and other regulatory interactions.

If your business previously registered for Excise Tax, note that the Excise TRN and VAT TRN are separate and distinct. Use the correct TRN for each tax type to avoid processing errors.

Downloading Your VAT Registration Certificate

Once your registration is approved, you can download your VAT certificate directly from your EmaraTax account:

For existing taxpayers:

- Log in to the EmaraTax Platform with your Emirates ID, UAE Pass, or taxpayer account.

- Navigate to “My Correspondences” in the Taxable Person account’s Dashboard.

- Locate the VAT Registration Certificate and click to download as a PDF.

For new certificates or replacements:

If you need a replacement or physically certified copy of the certificate, you can submit a request using the FTA VAT Certificate service.

“The initial VAT Registration Certificate is issued digitally and free of charge upon the FTA’s approval of the registration application. The AED 250 fee is typically only applicable when requesting a replacement or a physically certified copy.”

The certificate can be downloaded immediately as a PDF document from your EmaraTax account. Physical copies are usually only provided upon request and for a fee.

VAT Registration Fee and Associated Costs

The Federal Tax Authority does not charge a government fee for VAT registration. The process is free when completed independently through the EmaraTax portal. However, many businesses engage tax consultants in Dubai or accounting firms to manage the application, document preparation, and FTA liaison. Professional fees vary based on scope and complexity but typically range from USD 500 to USD 1,500 for standard registrations.

Consultant services may include:

- Eligibility assessment and threshold calculation

- Document preparation and formatting

- Application review and error correction

- EmaraTax submission and tracking

- Response to FTA clarification requests

- Post-registration compliance setup (accounting systems, invoice templates, first return support)

| Approach | Cost | Error Risk | Timeline | Post-Registration Support |

|---|---|---|---|---|

| In-House | AED 0 (FTA fee) | High without VAT expertise | 20–40 business days (if errors occur) | None; business handles all filings |

| Consultant | USD 500–1,500+ | Low; professional review | 20–30 business days | Ongoing advisory, first return support |

In one recent engagement, a client attempted self-registration but received three separate FTA clarification requests due to incomplete financial documentation and inconsistent turnover calculations. After six weeks without approval, they engaged our team. We re-audited their application, corrected discrepancies, and submitted a comprehensive response within 48 hours. The FTA approved the registration within 10 business days. The client’s total delay exceeded 50 days-far longer than if they had used professional support from the outset.

Post-Registration: Your VAT Obligations and Responsibilities

Filing VAT Returns

“Businesses below AED 150 million turnover usually file quarterly; above that, monthly.” – UAE Government portal

Once registered, you must file a VAT return for each tax period via the EmaraTax portal. Returns summarize:

- Output VAT: VAT charged on taxable supplies to customers

- Input VAT: VAT paid on business purchases and imports

- Adjustments: Credit notes, bad debt relief, prior period corrections

- Net VAT position: Output VAT minus input VAT equals net liability (payment due) or net refund (recovery due)

“The VAT return must be submitted within 28 days from the end of the tax period.” – Federal Tax Authority

For example, a quarterly filer with a tax period ending March 31 must file by April 28. Late filing triggers penalties: AED 1,000 for the first offense, AED 2,000 for subsequent violations within 24 months.

Record Keeping

“Maintain VAT records for at least five years; up to fifteen for real estate.”

Maintain comprehensive records supporting all VAT positions: tax invoices, credit notes, contracts, import/export documents, customs declarations, purchase orders, and general ledgers. The FTA requires businesses to retain these records for at least 5 years following the end of the tax period (15 years for real estate transactions). Records may be maintained in physical, electronic, or cloud-based formats, provided they remain readily accessible for FTA audits.

Strong records underpin compliance, facilitate input tax recovery, and enable efficient responses to FTA inquiries. For detailed procedural guidance and support in setting up corporate services in the UAE, consult the FTA’s official resources.

Penalties for Late VAT Registration and Non-Compliance

The Federal Tax Authority enforces VAT compliance through substantial administrative penalties designed to deter late registration, improper documentation, and filing failures. Understanding these penalties is critical for risk management.

Late VAT registration: AED 10 000 (fixed penalty, regardless of delay duration).

Late VAT return filing: AED 1 000 (first violation); AED 2 000 (subsequent violations within 24 months).

Late VAT payment:

- 2% immediately after due date

- 4% monthly thereafter

- 1% daily after one month (up to 300%)

From 14 April 2026 this system will replaced with a flat 14% per annum rate (Cabinet Decision No. 129 of 2025).

Incorrect VAT declaration:AED 1,000 (first offense); AED 2,000 (repeat offense)

From 14 April 2026 – AED 500, unless the Registrant takes one of the following actions:

1. Corrects his Tax Return within the deadline specified for submitting the Tax Return pursuant to the Tax Law.

2. Submits a Voluntary Disclosure to correct the Tax Return without resulting in a difference in the amount of Due Tax.

Tax evasion: Up to 300% of the tax evaded.

These penalties compound quickly. Missing the registration deadline and failing to file returns on time can result in combined penalties exceeding AED 12,000 before any tax liability is assessed. Track your registration date, tax period, and filing deadlines rigorously to avoid these consequences.

| Violation | Penalty (AED) | Reference/Notes |

|---|---|---|

| Late VAT registration | 10 000 | Fixed penalty |

| Late VAT return filing | 1 000 (first); 2 000 (repeat) | Within 24 months of prior violation |

| Late VAT payment | 2% + 4% + 1% daily (max 300%) | Escalating structure; accrues rapidly |

| Missing tax invoices | 5 000 per document | Applies to each deficient invoice |

| Incorrect declaration | 1 000 (first); 2 000 (repeat) | Within 24 months |

VAT Group Registration for Related Companies

VAT group registration allows two or more related legal entities established in the UAE to register as a single taxable entity under one TRN. This simplifies compliance, eliminates VAT on intra-group transactions, and enables consolidated return filing.

Eligibility Criteria

All members must:

- Be legal entities (not natural persons or sole proprietors) actively conducting business

- Have a fixed establishment in the UAE

- Be related parties through common ownership or control (at least 50% voting rights, ownership interest, or decision-making authority)

- Satisfy standard VAT registration criteria (taxable supplies above AED 375,000, or voluntary eligibility)

Government bodies may only form groups with other government bodies; non-government entities form groups under standard rules.

Benefits

- No VAT on intra-group supplies: Transactions between group members are out of scope for VAT, improving cash flow and reducing administrative burden.

- Consolidated returns: One VAT return for the entire group, rather than separate returns for each member.

- Simplified input tax apportionment: Group-wide methodologies may enable better input tax recovery.

Obligations and Risks

“All VAT group members are jointly and severally liable for the group’s VAT debts.”

- Joint and several liability: All members are fully liable for the group’s VAT debts and penalties. If one member defaults, the FTA may pursue any member for the entire liability.

- Representative Member responsibility: One member (designated as Representative) files returns, makes payments, and responds to FTA inquiries. Administrative failures expose all members to penalties.

Application Process

Submit a specialized application to the FTA including:

- Written authorization from all members appointing the Representative Member

- Group structure chart demonstrating common control

- Consolidated turnover declaration

- Financial documentation for each member

The FTA reviews applications within 20 business days. Upon approval, a new group TRN is issued, and individual member TRNs are suspended. Group returns are filed under the group TRN thereafter.

Key VAT Concepts Explained

Input Tax

VAT paid on purchases and expenses used to make taxable supplies. Generally recoverable via VAT returns, subject to apportionment rules if you also make exempt supplies.

Output Tax

VAT charged on taxable supplies to customers. Net VAT payable equals output tax minus input tax (plus adjustments).

VAT Rate

The UAE standard rate is 5% for most taxable supplies.

Zero-Rated Supplies

“Zero‑rated categories include exports, international transport, investment precious metals, first supply of new residential buildings.”

Taxable at 0%. You charge no VAT, but you can reclaim input tax on related purchases. Examples: exports outside the GCC, international transportation, investment precious metals, first supply of newly constructed residential buildings, certain healthcare and education services, crude oil and natural gas.

Exempt Supplies

No VAT charged, and no input tax recovery. Examples: most financial services, residential property rentals (except first supply of new buildings), bare land, local passenger transportation.

VAT Refund

Process to reclaim excess input tax when input tax exceeds output tax, or specific refunds (e.g., for UAE nationals purchasing new residences, tourists via approved schemes, net credit positions).

Tax Credit (Input Tax Credit)

The right to offset input tax against output tax if expenses relate to taxable supplies. Requires compliant tax invoices and proper records.

VAT Calculation

Compute output VAT on sales, deduct eligible input VAT on purchases, apply adjustments (credit notes, bad-debt relief, prior period corrections), and report the net position in your VAT return.

Reverse Charge Mechanism and Import VAT Treatment

The reverse charge mechanism primarily applies to VAT-registered businesses in the UAE for transactions where goods or services are imported from outside the GCC to the UAE. In such cases, the responsibility for reporting the VAT transaction shifts from the seller to the buyer.

Documentation and Compliance

“VATP044 allows using the foreign supplier’s invoice as evidence for reverse‑charged concerned services.”

Under the reverse charge mechanism, the recipient must report the reverse charge VAT liability in their VAT return. Public Clarification VATP044 simplifies documentation requirements by allowing taxpayers to use the foreign supplier’s invoice as evidence for reverse-charged services, rather than requiring self-issued invoices.

“Report reverse‑charged supplies in VAT return Form 201, Box 3.”

Businesses must accurately report reverse charge transactions in Box 3 of VAT return Form 201 and maintain proper documentation of all cross-border service transactions.

Special Cases: Free Zones, Non-Residents, and E-commerce

Free Zones vs. Designated Zones

“Designated Zones are treated as outside the UAE for VAT on goods until they enter the mainland.” – IFZA

Most free zones in the UAE are subject to standard VAT rules: businesses operating in free zones must register if they exceed thresholds, charge 5% VAT on taxable supplies, and comply with all FTA requirements. Designated Zones, however, are specific fenced free zones with customs controls where goods remain outside UAE VAT scope until they enter the mainland. Goods moved between Designated Zones or imported into them are VAT-exempt, but VAT applies when goods enter the mainland (typically via reverse charge mechanism).

Important: Services supplied within Designated Zones are subject to standard VAT rules and should be evaluated based on the nature of the service and the parties involved.

For the official list of Designated Zones, consult the FTA’s Designated Zones List (updated September 21, 2021).

Non-Residents

Non-resident businesses making taxable supplies in the UAE must evaluate their registration obligations based on the specific circumstances of their supplies. The requirement to appoint a fiscal representative or tax agent depends on the business structure and nature of operations. We recommend consulting with the FTA or qualified tax advisors to determine the appropriate compliance approach for your specific situation.

E-commerce and Marketplaces

E-commerce platforms and marketplace sellers follow standard VAT rules: VAT must be charged on taxable supplies to UAE customers, registration is mandatory if turnover exceeds thresholds, and reverse charge mechanisms apply to certain import scenarios. Some platforms may have VAT collection obligations; sellers must independently assess their registration and reporting duties.

| Scenario | Registration Considerations | Key Notes |

|---|---|---|

| Free Zone (standard) | Yes, if turnover exceeds thresholds | Standard 5% VAT rules apply |

| Designated Zone (goods) | Depends; VAT applies when goods enter mainland | Use reverse charge mechanism |

| Non-resident supplier | Evaluate based on supply nature | Consult FTA for specific requirements |

| Marketplace seller | Yes, if turnover exceeds thresholds | Platform may have collection obligations; seller remains responsible for compliance |

VAT Registration Services in the UAE

At ITA Business Consultants, we provide comprehensive VAT registration and compliance support for businesses operating across more than 70 jurisdictions. Our team manages the entire registration workflow-from eligibility assessment and document preparation through EmaraTax submission, FTA liaison, and post-registration compliance setup. Whether you're a startup launching in Dubai, an international company expanding to the UAE, or a non-resident supplier, we ensure your registration is accurate, timely, and penalty-free.

For businesses requiring comprehensive tax planning and residency support, we also offer Tax Residency Certificate services to complement your VAT registration and ensure full compliance with UAE tax obligations.

Disclaimer: Information provided is general in nature and does not replace professional advice. For specific guidance on VAT registration, compliance, and obligations, consult with qualified tax professionals or the Federal Tax Authority directly.

Yes, unless your activities are entirely out of scope. Most free zones follow standard VAT rules. Check whether your zone is a Designated Zone for goods; if so, VAT applies when goods enter the mainland.

Typically 20–30 business days if documents are complete. The timeline reflects FTA processing standards and may vary based on application completeness. Applications requiring clarifications may take longer.

Yes, if they meet thresholds or choose voluntary registration. Freelancers must hold a valid trade license or freelance permit.

After approval, download it from your EmaraTax dashboard using your TRN login.

You may remain registered or apply for deregistration if conditions are met. Deregistration must be requested within 20 business days of no longer meeting registration criteria.

AED 10,000 (fixed penalty).