Dubai Freezone Company Formation

In the modern economic world, the United Arab Emirates is one of the most attractive regions for incorporation of a company and business setup in Dubai free zones.

Just like in all main business processes, it is of utmost importance that selection of type of the company and corporate structure be determined after taking into account a comprehensive analysis of the requirements of business and plans to conduct activity.

Key Advantages of UAE Free Zone Company Formation:

Once you decide to establish your company in the UAE, the number of possible solutions may seem discouraging. Such variety is not only determined by the diversity of types of legal entity but also by the fact that, depending on the actual location of incorporation, i.e. Emirate or free zone, features of the same type of companies may change drastically.

Main Features of Free Zone Companies

A free zone itself is a geographically defined area where a number of restrictions of financial nature do not apply. For instance, there is no corporate tax or import and export restrictions, 100% foreign ownership is allowed and much more.

There are around 50 free zones in the UAE. Some of them have all-in-one specialization (i.e. they offer solutions for all kinds of business), and some have narrow specialization and only work with one sector of business, for example, IT, jewelry business, logistics business, etc.

Companies incorporated in free zones are allowed to:

- Conduct business both inside the free zone and outside the UAE (some activities require additional permission of regulating authorities);

- Work with legal entities from other free zones and with local companies if it provides services in its office (for example, consulting, website development, app development, online marketing, branding services, etc.);

- Hire employees, obtain resident visas for them and take on lease an office;

- Obtain a tax resident certificate.

This type of companies is prohibited from:

- Taking on lease an office outside the free zone where the company is incorporated;

- Working outside the free zone if the services are required to be provided in the client’s territory outside the free zone (for example, premises repairs (as you have to leave the free zone area), equipment installation, delivery service);

- Trading and distributing products outside the free zone where the company is incorporated (the company may only trade within the free zone or throughout the whole emirate but through a local distributor);

- Participating in government tenders.

Doing business with companies outside the free zone is only allowed through registered distributors. Therefore, if you are planning to do business in the mainland UAE, you will need an intermediary (local distributor) that holds a license issued by the Department of Economic Development (DED). As an alternative, one can open a branch of a free zone company in the free zone where commercial interest has arisen.

Criteria for the Right Choice of a Free Zone

When choosing a free zone, the following criteria should be taken into account first:

| Criterion | Comment |

| Types of licenses / specialization of the free zone | If the business implies narrow specialization (financial technology, IT, science development, jewelry production and trade, etc.), the right decision will be choosing a free zone with the respective specialization and developed system of regulations. |

| Corporate structure requirements | As a general rule, a company must have a director (no residency requirement, over 21 years), manager (only one and only an individual, no residency requirement) and members (both individuals and legal entities, no residency requirement). Some free zones also require a secretary. The same person may simultaneously be a shareholder, director, secretary, manager and authorized representative of a company. |

| Requirements as to minimum amount of the authorized capital and depositing it in a company’s bank account upon incorporation | Free zones used to strictly regulate the issue of the minimum amount of the authorized capital for incorporation and the timeframe for depositing it in a bank account and providing confirmation thereof. In particular, until the receipt of a bank’s letter confirming that the authorized capital has been deposited in the company’s account, the free zone either issued no license at all, or issued a temporary limited license, which could only be used to open a bank account and deposit the authorized capital. Nowadays, most free zones keep such requirements, however a number of new free zones refused to apply them, which made the company incorporation procedure significantly easier and faster. |

| Officers’ residency requirements | A number of free zones require an employee (in particular, it may be a director) to have a valid UAE resident visa. Some free zones go further and also require an employee to constantly stay in the UAE and provide residence confirming documents (lease contract, utility bills). However, most free zones are quite favorably disposed towards this issue and do not link the validity of the company’s license to the fact of having a resident visa. |

| Infrastructure offered by the free zone | If it comes to a trading company and goods enter the territory of the UAE, it is necessary to select a free zone that offers warehouse options; if it comes to a service license and business is to be conducted in the territory of the UAE, it is necessary to select a free zone that offers suitable office premises options. Companies with industrial licenses (i.e. licenses to produce) will require a free zone that offers production departments. |

| Budget for the formation of a company | When forming the budget for the incorporation of a company, a number of factors should be taken into account: 1) Reputation of the Emirate: for example, the cost of incorporation in free zones of Dubai or Abu Dhabi is higher than in other Emirates. 2) Requirement for payment of the authorized capital and its amount: in some free zones, the cost of incorporation is relatively low, but the minimum required authorized capital is high. Other free zones may have no authorized capital requirement at all, but the amount of the authorized capital must be sufficient for the activity for which the company obtained the license. 3) Field of proposed activity: depending on the field of the proposed business activity, the following may change: a) requirements as to the amount of the authorized capital, b) state authorities whose consent is necessary to conduct the proposed activity (and accordingly the amount and number of fees payable). |

| Requirements as to filing audited accounts with state authorities | In general, a free zone company must keep accounting records sufficient to confirm its financial position and containing up-to-date information on the assets and liabilities of the company. It is also necessary to annually prepare the company’s financial statements and undergo audit. However, some free zones have no requirement to file accounts with state authorities; reporting period dates will also vary depending on the free zone. |

The list of criteria to consider is not exhaustive and should be determined depending on the particular situation.

Overview of Licenses Issued by Free Zones of the UAE

The following Dubai freezone licenses are among the most common ones:

- Service license allows the holder to provide the type of services stated in the license. Examples of service licenses: business consulting, marketing consulting, project consulting, IT consulting and others.

- Trading license allows the holder to import, export, sell, distribute and store goods stated in the license.

- General trading license allows the holder to trade in goods, including import, storage, warehousing, supply and export of permitted goods of different categories.

- Industrial license allows the holder to import raw material for production, processing and/or assembly of stated products. Finished products may be exported from the UAE.

- Commercial license allows the holder to import, export, sell, distribute and store goods stated in the license. Examples of commercial licenses: general trade, e-commerce, and trade in certain type of goods: 3 to 5 kinds.

- E-commerce license allows the holder to trade in goods and services by electronic means.

- Education license allows the holder to provide educational services (organize educational institutions or consulting companies), including professional training or management training services.

- Media license allows the holder to engage in television and radio broadcasting, newspaper and magazine publishing and organization of events.

- Individual/Professional license is issued to a company with one shareholder and allows it to conduct one activity within a narrow specialization.

The list of licenses described above is not exhaustive and varies depending on the free zone.

Company Registration in UAE Free Zone

Dubai Internet City

from 6000 AED

Dubai Internet City

from 6000 AED

0% taxes;

Proximity to major markets;

State-of-the-art facilities;

Business-friendly regulations;

Residence visa;

Supportive ecosystem;

Dubai Multi Commodities Centre

from 6000 AED

Dubai Multi Commodities Centre

from 6000 AED

0% taxes;

No need in a local sponsor;

Range of visa options;

Access to international markets;

Range of activities;

Quick company formation;

Dubai South

from 6000 AED

Dubai South

from 6000 AED

Tax-free environment;

Major logistics and aviation hub;

Flexible leasing options;

Full repatriation of capital and profits;

Diverse business activities;

Quick company formation;

International Free Zone Authority

from 6000 AED

International Free Zone Authority

from 6000 AED

Stable banking system;

Ability to work with US dollars;

Quick company setup;

Residence visa for companies;

Strategic Dubai location;

Full profit repatriation;

Jebel Ali Free Zone

from 6000 AED

Jebel Ali Free Zone

from 6000 AED

100% foreign ownership;

Long-term tax exemptions;

Prime logistics location;

Access to extensive business support;

Full profit repatriation;

Fast, streamlined setup;

Ajman Free Zone

from 6000 AED

Ajman Free Zone

from 6000 AED

100% foreign ownership;

Freelance licenses and visas;

Wide range of activities;

Quick company incorporation;

Proximity to market hubs;

Flexible office leasing;

Fujairah Creative City

from 6000 AED

Fujairah Creative City

from 6000 AED

100% foreign ownership;

Focus on creative industries;

Tax-free environment;

Full repatriation of capital and profits;

Fast setup process;

Strategic Fujairah location;

Khalifa Industrial Zone

from 6000 AED

Khalifa Industrial Zone

from 6000 AED

100% foreign ownership;

Access to Khalifa Port and Etihad Rail;

Dual license option;

Flexible office and warehouse leasing;

Simplified visa processing;

Wide range of activities;

Ras Al Khaimah Economic Zone

from 6000 AED

Ras Al Khaimah Economic Zone

from 6000 AED

100% foreign ownership;

State-of-the-art infrastructure;

Diverse business activities;

0% corporate and personal income tax;

Low operational costs;

Access to global markets;

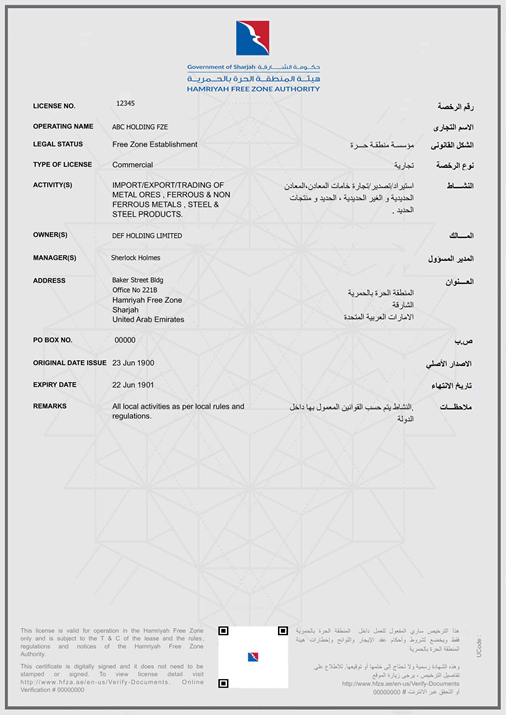

Hamriyah Free Zone Authority

from 6000 AED

Hamriyah Free Zone Authority

from 6000 AED

Deep-water port access;

Quick company setup period;

Various office packages;

Multiple business activities;

Long-term land leases;

SME-friendly environment;

Sharjah International Airport

from 6000 AED

Sharjah International Airport

from 6000 AED

No minimum capital;

Manufacturing and trading support;

Strategic Sharjah location;

Wide business activity range;

Simplified visa process;

Fast license issuance;

Sharjah Media City

from 6000 AED

Sharjah Media City

from 6000 AED

100% foreign ownership;

No physical presence required;

Easy visa procedures;

No capital or audit requirements;

Tech-enabled workspaces;

Media and tech focus;

UAQ Free Zone

from 6000 AED

UAQ Free Zone

from 6000 AED

100% foreign ownership;

Quick business setup;

Minimal documentation;

Wide business activities;

Strategic northern location;

TOP 6 Leading Free Zones of the UAE: General Review

We would single out the following main free zones, which are the most popular ones and have high ratings in and outside the UAE:

1. Khalifa Industrial Zone in Abu Dhabi (KIZAD)

The free zone of the Khalifa Port (KIZAD) is one of the fast growing logistics and manufacture hubs in the UAE. Due to its world-class infrastructure and port infrastructure, it has become investors’ favorite choice for opening business in the UAE. Currently, over 600 companies are incorporated there.

KIZAD consists of a free zone and a zone where investors can take on lease land and objects for a fixed period. The KIZAD free zone offers investors world famous industrial facilities as part of specialized light industry enterprises and warehouses. Moreover, the flexible land lease policy also encourages long-term investments and is aimed at ensuring sustainability of business. Therefore, having incorporated a company in KIZAD, investors can profit from different individual solutions based on their business requirements.

2. Dubai South Free Zone

Dubai South was founded in 2006 and today it is one of the fastest developing free zones of Dubai.

Dubai South consists of eight districts that differ in types of business:

- Aviation District – Located near the Al Maktoum International Airport, the district is 6.7 square kilometers in area and aspires to become an aviation and aerospace industry hub in the region.

- Business Park – Eleven modern buildings are integrated office premises for start-ups and transnational corporations located in the territory of the Business Park Free Zone.

- Commercial District – An area of 14 square kilometers comprising over 850 towers 1 to 45 floors in height and 25 three to five-star hotels.

- Residential District – An idyllic town made to increase wellbeing and happiness of the local community; it features exceptional architectural design and the world’s best comforts.

- Logistics District – Having the total area of 21 square kilometers, this district services enterprises of any size on the local and international levels providing them with key logistics services.

- Humanitarian District – A center for humanitarian response and relief operations in the region; it also provides opportunities of staff training for aid agencies, including the UN.

- Exhibition District – Some of the world’s most important trade events and conferences take place here.

- Golf District – A world-class gold course designed in an exclusive residential complex with golf lawns, driving ranges, a club, training facilities and much more.

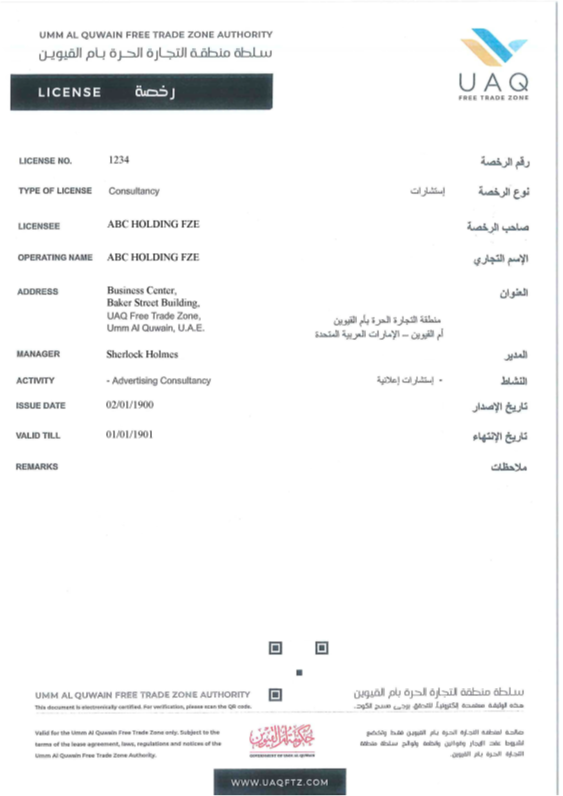

3. Umm Al Quwain Free Trade Zone (UAQ FTZ)

The Umm Al Quwain Free Trade Zone was founded in 1987 but became known to the public only after 2014 when it was restructured and started to actively sell its services. UAQ FTZ is located near the Port of Umm Al Quwain and is one hour away from the international airport of Dubai and Sharjah by car. Being located in the smallest emirate of the UAE, UAQ FTZ offers all comforts that big free zones offer.

UAQ FTZ takes advantage of experience of older free zones. The management of the free zone have decided to give their clients an opportunity to obtain any kind of license, including a freelance license. Clients can take on lease a flexi desk, office or workplace in a business center or take on lease a warehouse or plot of land.

Each license may have up to 3 kinds of business activity if they are unrelated or 10 related activities. The consulting sector allows 2 activities in one license. Some licenses require consent of the respective regulator.

4. Hamriyah Free Zone (HFZA)

The Hamriyah Free Zone is under the jurisdiction of the Emirate of Sharjah and is second largest free zone of the UAE after JAFZA. It was founded in 1987 and is growing fast increasing its size and number of companies.

Currently over 6.500 companies from 160+ countries are registered in HFZA. It is one of the few zones that have their own sea port, internal harbor, large area of 26 million square meters, warehouses and office premises.

The free zone is a preferred place of incorporation for many industrial companies due to its optimal infrastructure, including low electricity tariffs and rent.

5. Ras Al Khaimah Economic Zone (RAKEZ)

The Ras Al Khaimah Economic Zone (RAKEZ) was established in 2017 by consolidation of the Ras Al Khaimah Free Trade Zone (RAK FTZ) and the Ras Al Khaimah Investment Authority (RAKIA). Currently, RAKEZ is one of the largest economic zones in the region covering about 33 million square meters of land and numbering over 14,500 companies from more than 100 countries that service different markets throughout the world.

RAKEZ includes 6 zones that differ in types of business, namely:

- Business Zone – Trading, service and consulting business

- Al Hamra Industrial Zone – Production, industrial projects, trade, assembly and logistics (light and heavy industry)

- Al Ghail Industrial Zone – Production, industrial projects, trade, assembly and logistics (large-scale industrial enterprises)

- Al Hulaila Industrial Zone – Production, industrial projects, trade, assembly and logistics (industrial manufacturing)

- Academic Zone – Schools, universities, institutes, scientific consultations and services

- Media Zone – Radio, television, magazines, broadcasting, movie production, event organization, etc.

Some kinds of activity require a company’s manager to have relevant education confirmed by a certificate endorsed by the UAE embassy in the country of origin. Typically, such business is connected with provision of professional services requiring certain qualifications, for example, accounting, architectural design, aviation consulting, etc.

6. Jebel Ali Free Zone (JAFZA)

The Jebel Ali Free Zone (JAFZA) is located in the Emirate of Dubai and is the oldest free zone of the UAE (active since 1985). JAFZA has a strategic location. It is in close proximity to the world’s largest port and is situated a few minutes from the eighth largest cargo airport, Dubai International Airport and the new Al Maktoum International Airport.

Incorporation of a free zone company in the UAE is a complex solution for subsequent conduct of business and a much more attractive option in terms of organization and reputation compared to offshore companies in the territory of the UAE as well as in classic offshore jurisdictions. However, first of all, when choosing a free zone you should think through the proposed business model and having considered all details select the optimal free zone for your project. To receive comprehensive qualified assistance, contact our consultants with decades of experience and we will pick the option that suits you most.

Top UAE Freezone Business Setup Experts

Choosing the right partner is crucial when establishing your business in the UAE’s dynamic free zones. At ITA Business Consultants, we combine deep market knowledge with proven expertise to deliver solutions tailored to your unique business needs.

Guidance through every step—from initial consultation to operational setup and compliance;

More than 1,500 successful client projects across various free zones;

Customized advice based on your business model, and growth plans;

More than 1,500 successful client projects across various free zones in the UAE;

Over 200 dedicated professionals specializing in UAE freezone business setup and licensing;

Partner with ITA to unlock Dubai’s business potential with confidence and efficiency. Fill out the form below to start building your future today.

Trusted Team

With over a decade of experience and more than 1,500 successful company formations, ITA Business Consultants is your trusted partner for setting up your business in Dubai freezones. Our expert team works closely with Dubai’s freezone authorities and regulatory bodies to ensure a smooth, compliant, and efficient company registration process, customized to meet your specific business goals.

We guide you through every step—from selecting the ideal freezone and preparing all necessary documents to obtaining your business license and visas.

Fill out the form to connect with our specialists and discover how we can simplify your Dubai freezone company formation. Let us help you establish your business quickly and confidently, so you can focus on growth and success.

UAE Freezone Business Setup FAQs

Free zone companies primarily trade within the zone or internationally. Selling directly in the UAE mainland usually needs additional licenses or partnerships with local entities.

Industry-focused zones offer tailored licenses, infrastructure, and regulatory support, making them ideal for specialized businesses seeking sector-specific advantages.

Financial reporting requirements vary; some free zones require annual audits and filings, while others have minimal reporting, impacting your administrative workload.

Zones with logistics and production facilities optimize supply chains and reduce costs, benefiting companies involved in manufacturing, import-export, or distribution.